New requirements set to tighten control over online bank lending risks

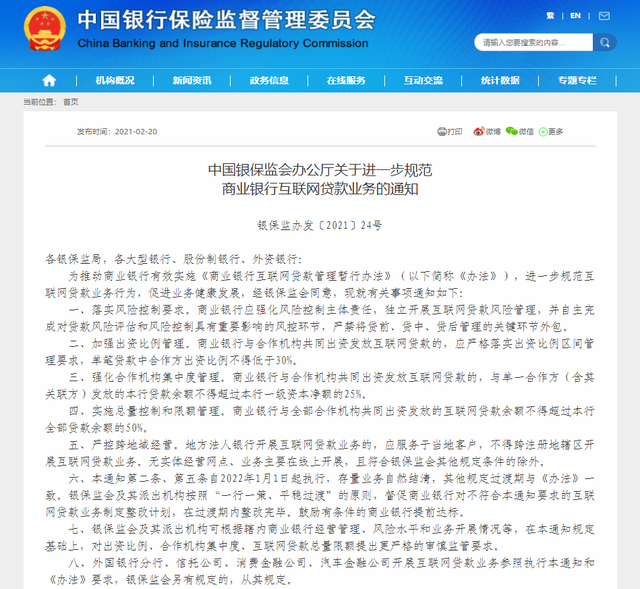

China unveiled detailed requirements and quantitative indicators to further tighten control over risks in relation to commercial banks' online lending business facilitated by their partners, the country's top banking and insurance regulator announced on Saturday.

According to the new requirements, for a single online loan jointly offered by a commercial bank and a partner, the partner must provide no less than 30 percent of the loan fund. Currently, the partners are usually large internet platforms like Ant Group, an affiliate fintech company of China's e-commerce giant Alibaba.

In addition, the China Banking and Insurance Regulatory Commission set the upper limit for the balance of online loans jointly offered by a commercial bank and a single partner at 25 percent of the bank's net tier 1 capital. The regulator also capped the balance of online loans jointly offered by a bank and all of its partners at 50 percent of the bank's outstanding loan balance.

"By setting quantitative requirements for loan concentration, the regulator is aiming at controlling risks associated with banks' joint lending with internet platforms," said Mo Xiugen, head of research at the Chinese Academy of Financial Inclusion at Renmin University of China.

"For some banks, their lending facilitated by third parties, including fintech companies, has grown rapidly in recent years. If such loans are excessively concentrated on a few internet platforms, once risks occur at one of those platforms, the entire financial system will be in danger. Therefore, from the perspective of risk management, we think it is necessary for the regulator to encourage more internet platforms and more financial institutions to participate in this type of business. In this way, the regulator also will promote market competition," Mo said.

According to the recently issued regulatory notice, the commission forbade a regional bank from conducting online lending business facilitated by its partners outside the region where the bank is registered. On the contrary, regional banks that carry out such business should serve local customers, the regulator emphasized.

"The purpose of this requirement is to prevent small and medium-sized regional banks from using third-party facilitated online lending business as a way of circumventing regional regulation and capturing profit opportunities created by different regulations," said Zeng Gang, deputy director-general of the National Institution for Finance and Development.

"For a regional bank, if a number of its clients are in other regions, the bank can do nothing substantive about risk control but rely heavily on their partners. Under the circumstances, if the bank relies too much on one partner or its joint lending business grow too big, its risk exposure may become too high. That's one of the reasons why the regulator issued quantitative indicators to control the concentration risk level," Zeng said.

Secondly, the regulator aims to force smaller banks to focus on their primary business and better serve the real economy, the part of the economy that produces goods and services. If regional banks offer loans to businesses and individuals in other provinces, their support for the economy in their own regions will become inadequate, he said.