In China, when photovoltaic enterprises are frozen in an economic cold winter, we can see more information for the industry. The enterprises, which were originally textile producers, now cluster together and have entered the profitable photovoltaic industry. When crisis comes, large photovoltaic enterprises, which were originally the Commander Ones, now work to produce edible oil. As the industry bellwethers the enterprises that once enjoyed a leading status are now waiting for bankruptcy.

Why would an industry which was extremely prosperous and profitable wither overnight?

According to statistics, in 2008, there were fewer than 100 photovoltaic enterprises. However, after several years of rapid development, there are presently more than 500 photovoltaic enterprises. Therefore, they have to face the harsh reality of competition in importing raw materials from foreign countries, lacking core technical equipment and product export. Compared with those fully developed countries in photovoltaic industry, the photovoltaic industry in China lacks powerful patent technology and R&D investments, which are the root of its plight of foreign dependence.

Winter Has Just Begun

Shen Fuxin, Secretary General of Zhejiang Photovoltaic Association, once said frankly in an interview: “In 2011, nearly one-third of the photovoltaic enterprises were not running in Zhejiang. On the one hand, some major countries in Europe adjusted their policies, which caused a sharp decrease in the photovoltaic products market. To make matters worse, photovoltaic investments were too hot in 2010 and a large number of enterprises made investments and built plants, and blindly enlarged their capacity. That’s why people have been forced into the impasse at present.”

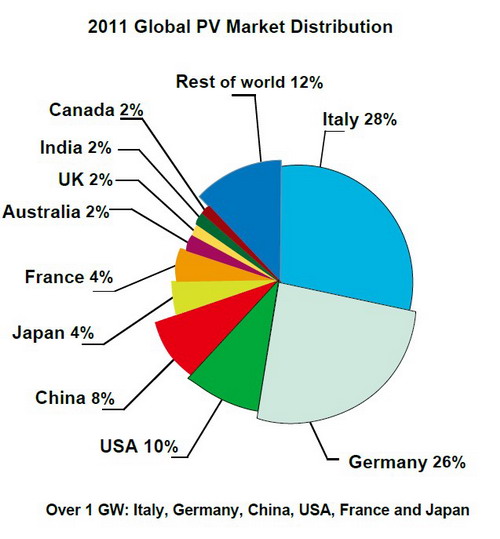

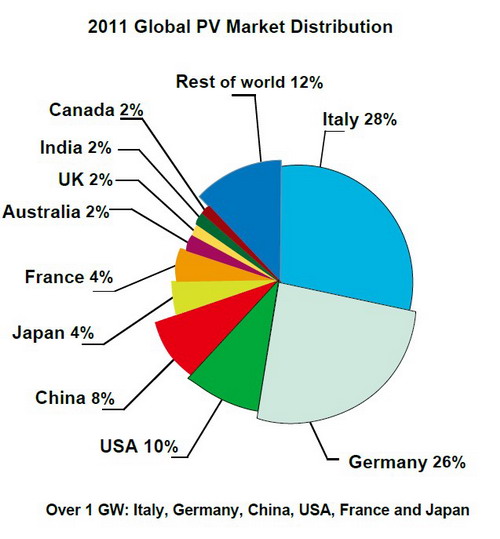

“Rising industry, clean energy, high profit, financial legend in the capital market” were all the halos of the photovoltaic industry. Because of the temptations of prospect and benefit, many enterprises in the traditional industries, such as textile and clothing, have turned to the photovoltaic industry. When most people were optimistic about the photovoltaic industry and tried to enter with their money in hand, the inevitable excess capacity broke their dreams of wealth. Seeing from the installation of photovoltaic generators around the globe, the demand for photovoltaic modules around the world in China is 11.7 GW, which is much lower than the 30 GW capacity of China.

In 2011 the cold current of the European financial crisis added snow to the frozen photovoltaic industry. Since the beginning of 2012, the European countries have been cutting photovoltaic subsidies one after another and the demand from the European market has greatly decreased. This market accounted for more than 70% of the installation of photovoltaic generators worldwide and 80% of the photovoltaic cells came from China. According to the latest research report by international consultation company HIS iSuppli, in 2010, photovoltaic installations were increasing at a rate of 153%. Now the forecast of increase in 2011 is only 20%. The sharp decrease in demand has caused the quick downturn of the price of the photovoltaic products. In 2011, the price of polysilicon, silicon chips, component elements and cell plates decreased respectively by about 45%, 52%, 53% and 42%.

The worst is yet to come. The “cold wind” from the US has brought the photovoltaic industry in China into severe winter.

On October 19th, 2011, seven major photovoltaic enterprises in the US filed an anti-dumping and anti-subsidy appeal with the US Department of Commerce and the United States International Trade Commission (USITC), requiring that the US Federal Government charge an import tariff of “more than 100%” on Chinese solar batteries. The US Department of Commerce and the USITC approved the proposal on October 19th and November 18th.

When the message came, guided by the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME), 14 Chinese photovoltaic enterprises, including Yingli Solar, Suntech, Trina Solar and Canadian Solar, held a press conference together in Beijing in order to clarify the facts and define their positions. The Ministry of Finance has given a boost to the heart of the Chinese photovoltaic industry: the Notice on the Organization and Implementation of the Application Demonstration for Solar Energy Photovoltaic Architecture in 2012 (Notice).

The Notice states that eligible facilities which are reliant on photovoltaic products will receive subsides. The subsidy standard will be based on changing conditions, such as the market prices of photovoltaic products. The Notice places emphasis on the following two specific photovoltaic reliant facilities: public and civil facilities in green ecological city areas and other facilities with a high level of integration, such as museums, science museums, gymnasiums, conference and exhibition centers, airport terminals and stations.

In an interview with China IP, Shen Hongwen, a researcher on the industry of new energy at CIConsulting, said that the main function of the Notice for the photovoltaic industry is to promote the development of photovoltaic modules. It has sped up the launching of the application market for domestic solar energy photovoltaic architecture and has further raised the application level of such architecture. In order to achieve this goal, the government has raised the subsidy standard for photovoltaic integration projects.

In fact, the core impetus of the development of the photovoltaic industry is from the market, not the policies. The policies can only promote and speed up the development of the photovoltaic industry to a certain extent. At present, the dismal situation in the international market is the cause of the bottleneck in the development of domestic photovoltaic enterprises which depend upon exports. At this time, the government has taken a series of measures that are good for the industry’s development, which will not only enlarge the scale of the domestic photovoltaic market, but are also good for guiding the photovoltaic enterprises out of their plight. However, if the photovoltaic enterprises depend too much on the support of policies and neglect the research and development of their own techniques, their competitive force might be weakened. Policies cannot promote the development of the industry forever.

Being “Trapped” in the Dilemmas

In recent years the photovoltaic industry has earned large amounts of money. But we have to admit that the Chinese photovoltaic industry is still an original equipment manufacturer (OEM) within the new energy industry.

Presently, the Chinese photovoltaic industry is “trapped” in a dilemma: the Chinese market is not open yet and the foreign market is closed. Shi Zhengrong, CEO of Suntech Power, told the media: “The solar energy industry should prepare for (an economic) winter in the latter half of the year. The toughest time will be the latter half of 2012. In the western countries, the solar energy is a market that depends on government subsidies. But there is no such a market in China now. If there is no market, how can there be plants? I have repeated this point many times in the past five years, but few listened to my words. Therefore, we again emphasize that China should develop not only the industry, but also the market.”

The domestic market cannot be developed with one stroke. And that’s also the reason why the measures of the US have such a big influence. For the Chinese enterprises, once the measures of the US take effect, the most painful impact will be the chain reaction that follows. After the US, the EU might also take some measures against the same Chinese products. As the largest photovoltaic production country, 10% of the Chinese photovoltaic cells are exported to the US and 80% are exported to Europe. If a “chain reaction” occurs, it will be a fatal crisis for the industry. Nearly 95% of the photovoltaic products of China depend on exports, especially to European countries such as German and Italy, which have always been the main export destination countries for domestic photovoltaic enterprises. Take Germany as an example. In 2009 their newly increased installation capacity reached 3.8 GW, half of which was from products imported from China.

An enterprise that depends on the “customer” to feed, especially a “foreign customer,” is mostly afraid of the changes in the “customer’s” attitude. The Chinese enterprises are facing this exact situation. Looking at Germany again, the 2009 financial crisis made the government realize the problem and began to control the speed of development of the photovoltaic industry. Through decreasing subsidies for the photovoltaic industry, they reduced financial expenditures. In the beginning of 2010 they cut the photovoltaic subsidy by 10%. In the third quarter 13% and in the fourth quarter they cut 3% more based on the third quarter. Then in 2011 their government revised the Renewable Energy Act. Two months later they passed the Photovoltaic Network Electrovalence Reduction Program. This program provided that in the middle of 2011 the reduction scale should be adjusted according to the estimation of photovoltaic installation during the whole year. The price remains the same only when the newly increased installation is lower than 3.5 GW annually. Otherwise, whenever the installation increases 1 GW, the photovoltaic subsidy is reduced by 3%. Due to the adjustments made by this policy, installations in Germany decreased significantly from January to May in 2011. The decrease was about 1.08 GW, which was a 37.4% decrease compared with the previous year.

Unfortunately, Germany is only the beginning. Afterwards, other countries such as Italy and Spain issued similar policies. What’s more, the economic crisis in the EU and the measures of the US are taking their toll. The “exit” for the Chinese photovoltaic industry is blocked.

When we turn back to see the “entrance,” the result is not optimistic either. On January 5th, 2012, Shi Lishan, Deputy Director of the New Energy and Renewable Energy Department of the National Energy Administration, made his judgment upon the Chinese photovoltaic industry: “The Chinese photovoltaic industry is an industry where production is repurchased.” As we all know, the Chinese industry is only the processing factory of the world. What’s worse, the Chinese enterprises are at the lower level of the processing.

As to the raw materials, though China is the largest raw silicon exporter, the key technology of the purification of polysilicon is mainly held by the seven large enterprises. They have almost monopolized the supply of raw polysilicon in the world. Therefore, China has to import raw materials such as polysilicon that are worth nearly 2 billion dollars from the US. The products that are processed in China are mainly sold in foreign countries. Though the volume of Chinese photovoltaic products has remained the largest for several years, the installation volume for photovoltaic power generation has been scarce.

When interviewing Mr. Shen Hongwen, he told journalists from China IP that the biggest advantage for the scale of the Chinese photovoltaic industry is the cheap labor force. However, with the development of the economy, the advantage of the cost of labor force is disappearing gradually. The photovoltaic enterprises cannot produce the cheap photovoltaic modules depending on the cheap labor force forever. Changing from production to research and development and from manufacture to creation is the inevitable route for the long-term development for the domestic photovoltaic industry. Without R&D and innovation, the domestic photovoltaic industry will have no way out.

The Achilles’ Heel

No doubt, the Chinese photovoltaic industry is playing the role of a processing factory. But the number of patent application shows that China is not last in line. The public patent index from 1990 to 2009 shows that Chinese enterprises are among the world’s top in the photovoltaic industry. Chinese photovoltaic patents account for 13% of the world’s patents, which is second only to Japan. China is 1% and 5% higher than the US and Germany, respectively. So why is China in such a situation?

Though the number of patents is advantageous, the hard power is not satisfactory. Presently, most domestic photovoltaic enterprises apply for utility models and there are fewer invention patents, especially the thin-film battery enterprises, which have a large number of low-quality patents and face slow development at the core technology. It’s not difficult to find the reason: if a photovoltaic enterprise wants to apply to become a high-tech enterprise, it must have one invention patent and six utility models. When it has become a high-tech enterprise, after the ratification of the tax authorities, the business income tax can be reduced from 25% to the preferential rate of 15%.

Although it seems as if the cold current that the Chinese photovoltaic industry encounters is from external causes, the lack of inner power is the key to its plight. Among the international photovoltaic great powers, Japan is worth mentioning. In 2009, among the top 11 photovoltaic patent holding companies in the world, 5 were Japanese companies. At present, the Japanese photovoltaic enterprises are not satisfied with the accumulation and the development of the traditional photovoltaic technology, and they are paying more attention to the new generation of photovoltaic technology such as light-gathering power generation technology in order to keep their technologically leading status in the market. More than half of the patents of these photovoltaic strong powers are in the area of photovoltaic materials, for which China has to depend on imports.

Ethylene-vinyl acetate (EVA), coating target material and special gases are indispensible among the upstream materials, but if we look at foreign technology, we may discover why the Chinese photovoltaic industry can’t survive alone. According to some reports, the American DuPont Company holds 50% of the EVA market. In 2010, the sales of its photovoltaic products were over 1 billion dollar. They have more than 5,000 scientists, and a patent project is born nearly every two days. The German Heraeus, which is the leading enterprise in photovoltaic coating target material, has more than 5,500 patents. At present, the amount of patent applications of the US, Japan, Germany, Korea and some other countries in thin-film batteries are increasing annually. In the area of photovoltaic materials, the patent applications have increased by only 1/3 in China. Among the patent applications in China, Japan is the major force.

According to the statistics provided by the SIPO, 1/3 of the several thousands of domestic patents concerning domestic solar cells and their components are domestic invention patents and the rest are from foreign enterprises. As to the application of utility models, the Chinese enterprises have taken up more than 95%. Japanese companies have far more patents in the area of photovoltaic core technology than any other country in the world.

Shen Hongwen believes that lack of intellectual property is indeed a weakness of the Chinese photovoltaic industry. In the world, the Chinese photovoltaic enterprises are advantageous in cost, volume of production and market share, but most enterprises are at the lower end of the industry chain, which makes it difficult for them to receive a higher added value. This is also the cause for the insufficient storage of intellectual property and the lack of core competitiveness for Chinese photovoltaic enterprises. In the long run the lack of intellectual property will inevitably become the “Achilles’ Heel” of the Chinese photovoltaic industry.

(Translated by Snow Li)