Where the iPhone work went

Updated: 2012-01-29 07:58

By Charles Duhigg and Keith Bradsher (The New York Times)

|

|||||||||

|

Foxconn Technology, which assembles iPhones in China, was flooded with applicants at a 2010 job fair. Below, employees live in dormitories. Donald Chan / Reuters |

Tech firms use a global network to get products made

Not long ago, Apple boasted that its products were made in America. Today, almost all of the 70 million iPhones, 30 million iPads and 59 million other products Apple sold last year were manufactured in other countries.

Why can't that work come home, President Obama asked Apple's Steven P. Jobs at a dinner in California last February.

"Those jobs aren't coming back," Mr. Jobs reportedly said.

It is not just a matter of wages being lower outside the United States. Rather, Apple's executives believe the vast scale of overseas factories as well as the flexibility, diligence and industrial skills of foreign workers have so outpaced their American counterparts that "Made in the U.S.A." is no longer a viable option for most Apple products.

One former executive described how Apple relied upon a Chinese factory to revamp iPhone manufacturing just weeks before the device was due on shelves. Apple had redesigned the iPhone's screen at the last minute, forcing an assembly line overhaul. New screens began arriving at the plant near midnight.

A foreman roused 8,000 workers inside the company's dormitories, according to the executive. Each employee was given a biscuit and a cup of tea and within half an hour started a 12-hour shift fitting glass screens into beveled frames.

"There's no American plant that can match that," the executive said.

Apple employs 43,000 people in the United States and 20,000 in other countries. Many more people work for Apple's contractors: an additional 700,000 people engineer, build and assemble iPads, iPhones and Apple's other products. But almost all of them work for companies in Asia, Europe and elsewhere, at factories that almost all electronics designers rely upon to build their wares.

"Apple's an example of why it's so hard to create middle-class jobs in the U.S. now," said Jared Bernstein, who until last year was an economic adviser to the White House. "If it's the pinnacle of capitalism, we should be worried."

Similar stories could be told about other companies in the United States, Europe and elsewhere. Outsourcing has become common in hundreds of industries, including accounting, legal services, banking, textiles, auto manufacturing and pharmaceuticals. But while Apple is far from alone, it offers a window into why the success of some prominent companies has not translated into large numbers of domestic jobs.

"Companies once felt an obligation to support American workers, even when it wasn't the best financial choice," said Betsey Stevenson, the chief economist at the United States Labor Department until last September. "That's disappeared. Profits and efficiency have trumped generosity."

Apple executives say it is a mistake to measure a company's contribution simply by tallying its employees - though they note that Apple employs more workers in the United States than ever before. They say Apple's success has benefited the economy by empowering entrepreneurs and creating jobs at companies like cellular providers and businesses shipping Apple products.

"We don't have an obligation to solve America's problems," a current Apple executive said. "Our only obligation is making the best product possible."

Getting the jobs

YM Yik / European PresspHoto Agency

A few years after Apple began building the Macintosh in 1983, Mr. Jobs bragged that it was "a machine that is made in America." But, by 2004, Apple had largely turned to foreign manufacturing.

Asia was attractive because the semiskilled workers there were cheaper. But that wasn't driving Apple. For technology companies, the cost of labor is minimal compared with the expense of buying parts and managing supply chains that bring together components and services from hundreds of companies.

The focus on Asia "came down to two things," said one former high-ranking Apple executive. Factories in Asia "can scale up and down faster" and "Asian supply chains have surpassed what's in the U.S."

The impact of such advantages became obvious as soon as Mr. Jobs, dissatisfied with how easily scratched the iPhone's plastic screens were, demanded glass screens in 2007. For years, cellphone makers had avoided using glass because it required precision in cutting and grinding that was extremely difficult to achieve. Apple had already selected an American company, Corning Inc., to manufacture strengthened glass. But figuring out how to cut those panes into millions of iPhone screens required finding an empty cutting plant, hundreds of pieces of glass to use in experiments and an army of midlevel engineers. Then a bid for the work arrived from a Chinese factory.

When an Apple team visited, the Chinese plant's owners were already constructing a new wing. "This is in case you give us the contract," the manager said, according to a former Apple executive. The Chinese government had agreed to underwrite costs for numerous industries, and those subsidies had trickled down to the glass-cutting factory. It had a warehouse filled with glass samples available to Apple, free of charge. The owners made engineers available at almost no cost. They had built on-site dormitories so employees would be available 24 hours a day.

The Chinese plant got the job.

Chinese advantages

An eight-hour drive from that glass factory is a complex, known informally as Foxconn City, where the iPhone is assembled. The facility has 230,000 employees, many working six days a week, often spending up to 12 hours a day at the plant. Over a quarter of Foxconn's work force lives in company barracks and many workers earn less than $17 a day.

In mid-2007, after Apple's engineers perfected a method for cutting strengthened glass so it could be used in the iPhone's screen, the first truckloads arrived at Foxconn City in the dead of night, according to the former Apple executive. That's when managers woke thousands of workers, who lined up to assemble, by hand, the phones.

Foxconn Technology, in statements, disputed the former executive's account, and wrote that a midnight shift was impossible "because we have strict regulations regarding the working hours of our employees." The company said that all shifts began at either 7 a.m. or 7 p.m., and that employees receive at least 12 hours' notice of any schedule changes. Foxconn employees, in interviews, have challenged those assertions. Foxconn has dozens of facilities in Asia and Eastern Europe, and in Mexico and Brazil. It assembles an estimated 40 percent of the world's consumer electronics for customers like Amazon, Dell, Hewlett-Packard, Motorola, Nintendo, Nokia, Samsung and Sony.

Apple also said that China provided engineers at a scale the United States could not match. Apple's executives had estimated that it needed about 8,700 industrial engineers for the iPhone project. The company's analysts had forecast it would take as long as nine months to find that many engineers in the United States. In China, it took 15 days.

It is hard to estimate how much more it would cost to build iPhones in the United States. However, various analysts estimate paying American wages would add up to $65 to each iPhone's expense. Since Apple's profits are often hundreds of dollars per phone, building domestically would still yield a big profit.

But such calculations are meaningless because building the iPhone in the United States would demand much more than hiring Americans - it would require transforming the national and global economies. Apple executives believe America simply does not have the necessary factories or workers.

Middle-class jobs fade

The first time Eric Saragoza stepped into Apple's manufacturing plant in Elk Grove, California, it was 1995, and the facility near Sacramento employed more than 1,500 workers. Mr. Saragoza, an engineer, quickly moved up the plant's ranks and joined an elite diagnostic team. His salary climbed to $50,000.

"It felt like, finally, school was paying off," he said. "I knew the world needed people who can build things."

A few years after Mr. Saragoza started his job, his bosses explained how the California plant stacked up against overseas factories: the cost, excluding the materials, of building a $1,500 computer in Elk Grove was $22 a machine. In Singapore, it was $6. In Taiwan, $4.85. Wages weren't the major reason for the disparities. Rather it was costs like inventory and how long it took workers to finish a task.

Some of Elk Grove's routine tasks were sent overseas. Then the robotics that made Apple a futuristic playground allowed executives to replace workers with machines. Some diagnostic engineering went to Singapore.

Then it was Mr. Saragoza's turn. Apparently deemed too expensive for an unskilled position, and insufficiently credentialed for upper management, he was called into a small office in 2002 after a night shift, laid off and then escorted from the plant.

There were employment prospects in Silicon Valley, but none of them panned out. "What they really want are 30-year-olds without children," said Mr. Saragoza, who today is 48, and whose family now includes five of his own.

After a few months of looking for work, he started feeling desperate. So he took a job checking returned iPhones and iPads. Every day, Mr. Saragoza would drive to the building where he had once worked as an engineer, and for $10 an hour with no benefits, wipe thousands of glass screens and test audio ports. After two months, he quit. The pay was so low that he was better off, he figured, spending those hours applying for other jobs.

On a recent October evening, while Mr. Saragoza sat at his MacBook and submitted another round of resumes online, halfway around the world a woman arrived at her office.

The worker, Lina Lin, is a project manager in Shenzhen, China, at PCH International, which contracts with Apple and other electronics companies to coordinate production of accessories, like the cases that protect the iPad's glass screens.

Mrs. Lin earns a bit less than what Mr. Saragoza was paid by Apple. She and her husband put a quarter of their salaries in the bank every month.

"There are lots of jobs," Mrs. Lin said. "Especially in Shenzhen."

Innovation's losers

Economists note that a struggling economy is sometimes transformed by unexpected developments. The last time analysts wrung their hands about prolonged American unemployment, for instance, in the early 1980s, the Internet hardly existed.

What remains unknown, however, is whether the United States will be able to leverage tomorrow's innovations into millions of jobs.

In the last decade, technological leaps in solar and wind energy, semiconductor fabrication and display technologies have created thousands of jobs. But while many of those industries started in America, much of the employment has occurred abroad. Companies have closed major facilities in the United States to reopen in China. By way of explanation, executives say they are competing with Apple for shareholders. If they cannot rival Apple's growth and profit margins, they won't survive.

"New middle-class jobs will eventually emerge," said Lawrence Katz, a Harvard University economist. "But will someone in his 40s have the skills for them? Or will he be bypassed for a new graduate and never find his way back into the middle class?"

The New York Times

|

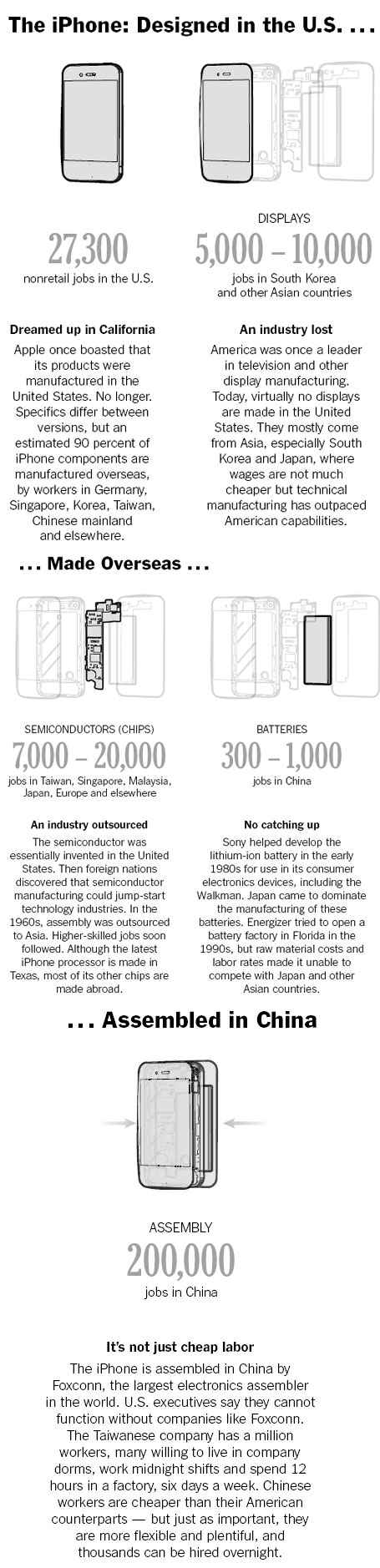

Sources: Paul Semenza, senior vice president, Analyst Services, DisplaySearch, an NPD Group Company; Linley Gwennap, founder and principal analyst, the Linley Group; Ron Turi, owner, Element 3 Battery Venture; Wayne Lam, IHS iSuppli. The New York Times |

Hot Topics

Kim Jong-il, Mengniu, train crash probe, Vaclav Havel, New Year, coast guard death, Internet security, Mekong River, Strait of Hormuz, economic work conference

Editor's Picks

|

|

|

|

|

|