Oliver Barron, head of the Beijing branch of North Square Blue Oak, a United Kingdom-based investment bank, said rising alternative investment by entrepreneurs is a natural part of China's evolution.

"High net worth individuals around the world have long recognized the benefits of asset diversification in terms of wealth preservation," he said. "As large-scale overseas investments are more difficult owing to capital controls, the next best option for diversification is investment in new emerging sectors in China."

Hoogewerf said investment is the third-largest source of wealth after real estate and manufacturing, which is a good sign for the Chinese economy.

"It is another form of finance. One of the big troubles that these entrepreneurs had in the earlier days is that they couldn't get access to the capital from bank loans if they didn't have land or assets.

"But alternative sources of financing such as private equity, venture capital or even angel capital are very good ways to get a lot of potentially strong businesses off the ground and help speed up the growth of your companies.

"Potentially this will do good to the economy as a whole."

Barron agreed, saying that Chinese banks' inability to price risk has restricted their lending to smaller companies, which remain starved for credit.

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

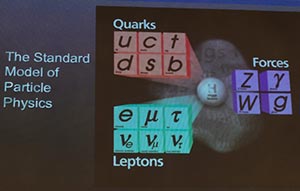

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists

Tibet expected to witness bumper harvest

Tibet expected to witness bumper harvest

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone