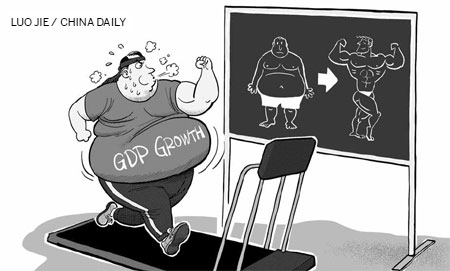

Like it or not, it will affect China's economic future with long-term gain

Many Chinese observers have been talking about Likonomics ,which aims to characterize the way Premier Li Keqiang is expected to manage the economy. There are three pillars of Likonomics often quoted: no stimulus, structural reform (short-term pain, long-term gain) and deleveraging. We believe these characterizations are misleading. The priority is not reform "instead" of growth, but reform "and" growth, as we believe it should be. Stimulus is already being implemented, although the size is likely to be small. And the concern for growth implies that the objective is not direct "deleveraging" but a controlled pace of ongoing "leveraging".

These factors imply some growth supporting policy stimulus and some structural reforms going forward but it is unlikely that either will be extremely aggressive. This more balanced approach promises to generate a growth path which is modestly lower than in past years but potentially more sustainable.

While it is true that the premier and the new administration have put a lot of emphasis on reform, slowing economic growth is clearly a growing concern. Data has mostly surprised on the downside and there is a growing amount of anecdotal evidence of stress in the economy, forcing the risk of further growth deceleration into the spotlight.

The first clear sign of this came from the policy announcement on June 26 on the redevelopment of less developed urban areas. While the policy announcement could be viewed as a social welfare measure instead of a stimulus measure, we believe it was clearly motivated by the government's growth concerns. Specifically, the announcement stated that "many areas including the urban redevelopment plan can become new growth drivers".

As a result, we have viewed this as the possible start of a series of policy measures which may seem unrelated but all have the tendency to support economic growth.

The subsequent announcements focused on information consumption (especially with regard to fourth-generation mobile technology) as well as on environmental and energy conservation policies, all came on July 12.

Domestic media also reported further policy measures to include support for railway construction and urban infrastructure (indeed urban redevelopment already had an element of this because it emphasized the need to build infrastructure to serve the newly built social housing). The wording of this was very vague so it can include almost all infrastructure including the more broadly defined areas of education and healthcare.

Apart from these announcements on the demand/expenditure side, there have been a number of announcements on the financial supply side as well.

The State Council's announcement on urban redevelopment very closely followed a dovish announcement by the normally hawkish People's Bank of China on the day before June 25 on liquidity conditions. Interbank liquidity had been extremely tight until then and has since been loosened dramatically (although still not fully back to the level before the initial round of tightening in mid-May).

The government has since announced its intention to better utilize existing monetary and fiscal stock, as opposed to being dependent on new flows. Early last week, the Ministry of Finance directed various government agencies to speed up the pace of fiscal expenditure.

The PBOC also followed up with some changes to the interest rate setting mechanism, especially the abolition of the floor on bank lending interest rates.