|

|

|

An international information technology exhibition in Beijing. Intel Capital, the venture capital arm of Intel Corp, has invested about $650 million in more than 100 Chinese technology companies since 1998. [Photo/China Daily] |

Intel executive says voice commands are the future of computing

Arvind Sodhani has been hosting journalists in a small meeting room in a resort hotel in Huntington Beach, California, for two hours.

Despite the lure of a 14-kilometer sandy beach famous for its surf just outside, the executive vice-president of Intel Corp and president of Intel Capital decided to spend most of his time with investors and the media.

Looking tired when the last group of Chinese reporters entered the room, the 57-year-old was still able to save some of his energy to discuss Chinese information technology startups.

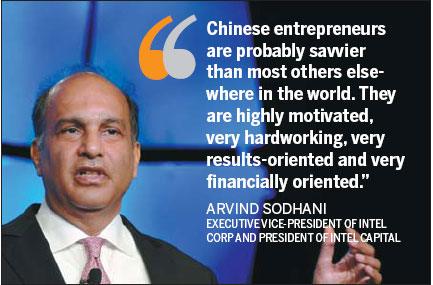

"Chinese entrepreneurs are probably savvier than most others elsewhere in the world," he said. "They are highly motivated, very hardworking, very results-oriented and very financially oriented."

As the head of Intel Capital, the strategic investor and merger and acquisition arm of multinational semiconductor chip maker Intel Corp, Sodhani's job is to help Intel find potential partners or technology providers.

Intel Capital's investment scope includes hardware, software and services targeting enterprise, digital media, mobility, consumer Internet, semiconductor manufacturing and clean-tech sectors.

The company has invested about $650 million in more than 100 Chinese technology companies since 1998.

Sodhani said Intel Capital was the first venture capital investor in China and it helped the Chinese government to "modify many laws" to facilitate the concept of investing. Early entry helped Intel Capital build a brand name very well known to Chinese companies.

He said he believes that China is big enough to establish a standalone ecosystem in the IT industry. For startup IT companies in China, success means deep localization in the country.

"In computer and telecommunications areas, China is the largest market, so the need to go overseas is not as strong as other emerging markets," he explained.

"A startup company in the Czech Republic or Israel has to go overseas to look for a bigger market but, for Chinese companies, the domestic market is big enough for them to cultivate. Even when China is slowing down, its GDP growth is still 7 or 8 percent, so the need to go overseas is very low," Sodhani added.

On Oct 3, Intel Capital announced about $40 million of investment in 10 companies. The investment included two Chinese mainland startups: Transmension Technology Ltd, a television-focused gaming service provider, and UUCun Information Technology (Beijing) Co Ltd, a mobile advertising agency.

"Although China's TV gaming industry remains young, I believe the user base will expand rapidly as more Chinese families start to watch digital cable TVs," said Joey Pan, CEO of Transmension.

A total of 50 million TVs were sold in China last year, creating a turnover of 200 billion yuan ($32 billion), industry insiders said.

"The Internet is an ever-changing industry which requires every company to keep its products updated," said Liang Hancheng, co-founder and CEO of Fashion Republic, China's first fashion product search engine.

In January, Intel Capital announced it was investing in Liang's website along with local venture capital company, Taishan Venture Capital Co Ltd. The exact investment amount was unclear.

Liang said it does not matter who invests in his business. However, to Richard Hsu, managing director of Intel Capital China, all that matters is which companies to invest in.

"With the rapid evolution of the digital media landscape, it is critical for healthy ecosystems to be developed to support these new consumption models and enhance the consumer experience," said Hsu.

Currently, Hsu and his six-man team are in charge of a $500 million fund for the Chinese mainland and Hong Kong. The fund was put into use in April 2008.

Intel Capital's strategy gave Hsu and his team more freedom in selecting companies in which to invest.

"Our team is familiar with the landscape and understands Chinese entrepreneurs. All our investors in China are Chinese, Chinese speaking. They know China, they have been around in China, so we are not foreign investors," he said.

Every investor hopes to keep the valuation of a target company as low as possible. Intel Capital is no exception.

Sodhani and his China team came to a consensus earlier this year that most Chinese tech companies were overvalued. A moveable valuation is not good for anybody, he said.

"It is not good for the investors and not good for the companies because most of the time high valuations lead to down runs," he said.

"Over-valuations are dangerous. We try not to invest in companies with excessively high valuations."

Starting this year, Intel Capital has slowed its pace in investing in Chinese companies because of increasing risks and "irrational" company valuations.