|

|

|||||||||||

|

|||||||||||

|

|

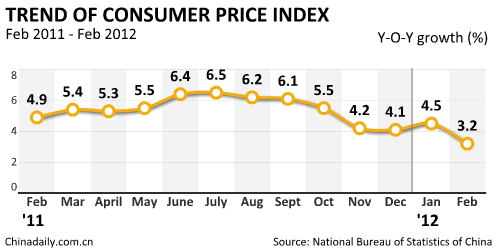

CPI growth falls to 3.2% China's inflation rose in February at its lowest pace in 20 months, providing more room for the government to stimulate growth in the world's second-largest economy. The consumer price index (CPI), a main gauge of inflation, increased 3.2 percent year-on-year last month, the National Bureau of Statistics said. [Full story] |

||||||||||

|

|

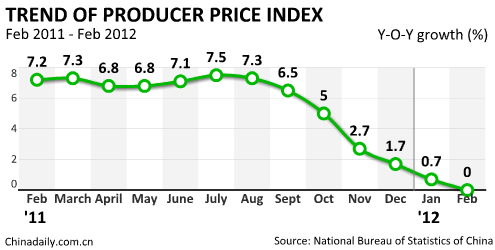

PPI stays flat in Feb China's Producer Price Index (PPI), a main gauge of inflation at the wholesale level, remained unchanged in February from a year earlier, the National Bureau of Statistics (NBS) said. The zero-growth reading, the lowest since December 2009, further eased from 0.7 percent in January, after hitting a 31-month high of 7.5 percent in July last year, NBS data showed. [Full story] |

||||||||||

|

|

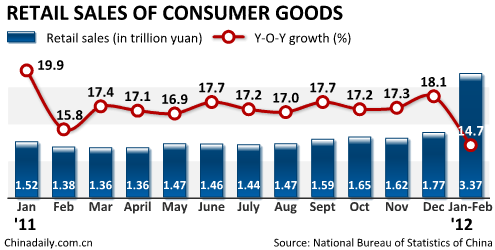

Retail sales up 14.7% China's retail sales rose 14.7 percent year-on-year to 3.37 trillion yuan ($533.8 billion) in the first two months of this year, the National Bureau of Statistics (NBS) announced. After adjusting for inflation, the real growth rate came in at 10.8 percent, the NBS said. [Full story] |

||||||||||

|

Industrial value-added output up 11.4% China's industrial value-added output grew 11.4 percent year on year in the first two months of this year, easing from 12.8 percent in December last year, the National Bureau of Statistics said. The NBS ascribed the ease in growth to shrinking market demand. [Full story] |

||||||||||

|

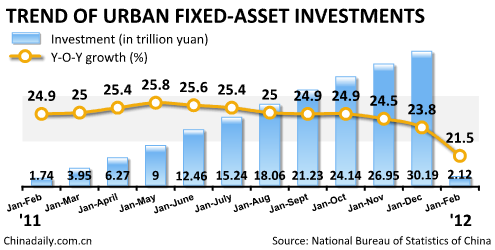

Urban fixed-asset investment up 21.5% China's urban fixed asset investment climbed 21.5 percent to 2.1189 trillion yuan ($336 billion) in the first two months of 2012 from a year earlier, the National Bureau of Statistics (NBS) said. The growth rate, down 2.3 percentage points year-on-year, dropped to its lowest level since 17.4 percent in 2002, the official data showed. [Full story] |

||||||||||

|

Fiscal revenue up 13% in first 2 months China's national fiscal revenue rose 13.1 percent year-on-year to 2.09 trillion yuan ($330.27 billion) in the first two months, the Ministry of Finance said. The annual growth rate decelerated from 24.8 percent recorded last year, but higher than 10 percent recorded in the fourth quarter of last year. [Full story] |

||||||||||

|

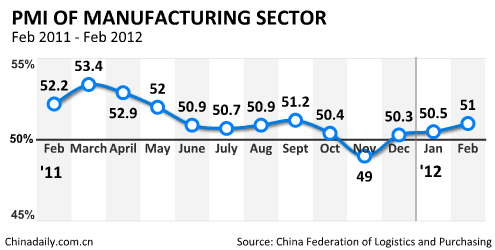

PMI rises to 51% in Feb China's Purchasing Managers Index (PMI), a preliminary readout of the country's manufacturing activity, rose to 51 percent in February of 2012, the highest level since October, the China Federation of Logistics and Purchasing (CFLP) said. [Full story] |

||||||||||

|

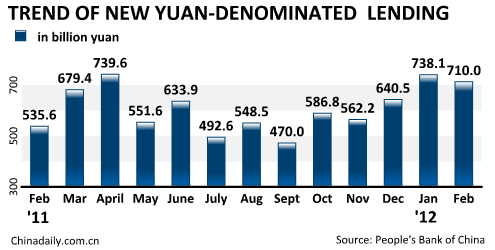

China issues more than 710b yuan in loans China's new yuan-denominated loans hit 710.7 billion yuan ($112.81 billion) in February, up 173 billion yuan year-on-year, the central bank said. By the end of February, the outstanding broad money supply (M2), which covers cash in circulation and all deposits, rose 13 percent year-on-year to 86.72 trillion yuan. [Full story]

|

||||||||||

|

China posts vast trade deficit For the first time in a year, China recorded a trade deficit of $31.48 billion in February, the largest in a decade, as import growth far outpaced exports. Exports rose by a six-month-high of 18.4 percent from a year earlier to $114.47 billion in February, while imports were up 39.6 percent, the highest growth in 13 months, to $145.96 billion, customs data showed. [Full story] |

||||||||||

|

|

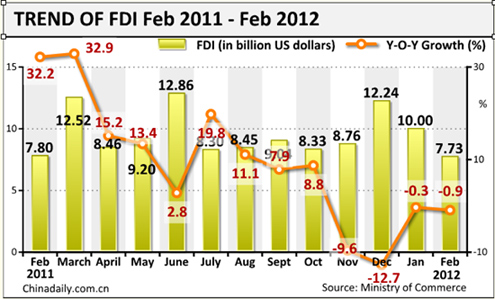

China's FDI down 0.9% in Feb China attracted $7.73 billion in foreign direct investment (FDI) in February, down 0.9 percent year-on-year, the Ministry of Commerce said Thursday. It marks the fourth consecutive month of drops in FDI in the wake of a lingering global economic recovery, MOC data shows. FDI fell 0.3 percent year-on-year in January, 12.73 percent in December, and 9.76 percent in November. [Full story] |

||||||||||

|

|||||||||||

|

Lower GDP target is healthier In response to Premier Wen Jiabao's announcement in his government work report delivered to the ongoing session of the National People's Congress that China will set its GDP growth for 2012 at 7.5 percent, stock markets, especially the Hong Kong stock market, fell drastically amid concerns about China abandoning its years-long efforts to maintain an 8 percent economic growth rate. However, the markets should not over-interpret China's lowered economic growth target. By decelerating its GDP growth to 7.5 percent, the slowest since 2005, the Chinese government aims to promote the quality of its economic growth. [Full story] |

|||||||||||

|

In pursuit of quality growth Moderate rate of development will be more sustainable, help protect environment and improve people's lives. The slowest GDP growth expectation since 2005 does not mean the country is incapable of sustaining faster growth. After decades of rapid development, China's economic aggregate has reached more than 47 trillion yuan ($7.45 trillion), the world's second largest. In this context, to continue maintaining its past development momentum would undoubtedly make the country pay greater environmental and social costs. With its per capita income rising steadily, what the country should do is to promote fairer distribution while trying to make a bigger cake. [Full story] |

|||||||||||

|

Innovation-driven growth, which is essential to sustain longer-term growth and avoid the middle-income trap, would benefit from greater private sector participation because private companies, in particular small and medium-sized ones, generate the largest share of GDP growth, employment, and innovative products in the market. In this process, further liberalizing the financial sector will improve the allocation of capital in support of the transition to an innovation-based economy while lowering the cost of finance. [Full story] |

|||||||||||

|

|||||||||||