Home prices slide again in October

Updated: 2011-11-02 09:31

By Hu Yuanyuan (China Daily)

|

|||||||||||

|

Early property buyers seek refunds from developers in Shanghai on Oct 26, after prices were cut. Home prices in major cities dropped for a second month in October, a new report shows. [Photo/ China Daily] |

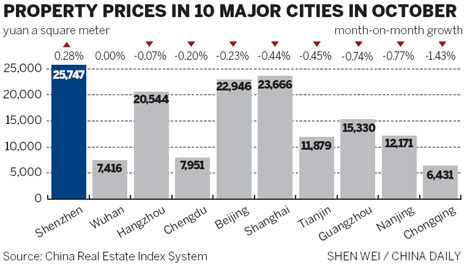

BEIJING - Home prices in major Chinese cities fell for a second month in October, with more developers cutting prices as government property curbs crimped their cash flow.

According to SouFun Holdings Ltd, owner of the country's biggest real estate website, prices dropped in 58 of 100 sample cities, with the pace of decline quickening to 0.23 percent from 0.03 percent in September.

The number of cities experiencing month-on-month falls reached a record for this year in October, SouFun said in an e-mailed report on Tuesday.

The report attributed the declines to continued government tightening measures and a credit crunch. Those factors led large developers, such as Vanke Co Ltd and Longfor Group, to start cutting prices to stimulate sales in first- and second-tier cities. Prices for some projects plunged more than 20 percent on a monthly basis.

Cutting deeper

"The decline in home prices is just beginning. And this price adjustment will cut deeper than was the case in 2008 to 2009," said Chen Li, head of China equity strategy at UBS Securities Co Ltd.

Vanke, the nation's biggest publicly traded developer, is cutting prices on units in Beijing and Shenzhen and planning to offer discounts in Huizhou and Dongguan in Guangdong province, the 21st Century Business Herald reported on Tuesday.

Other major developers reducing prices include Country Garden Holdings Co and China Merchants Property Development Co, according to the newspaper.

Xiao Li, executive vice-president of Vanke, said last Tuesday that the government's measures to curb property prices over the past year had affected developers severely. Xiao said conditions in the property market would worsen in the coming months with "further drops in both sales and prices".

For the 46 listed developers that released third-quarter financial statements before Oct 27, cash flow from transactions dropped 54.41 percent year-on-year to 33.68 billion yuan ($5.3 billion), according to Wind Information Co Ltd, a leading provider of financial data and information.

According to Zhang Dawei, marketing director of Centaline Group in Beijing, price cuts will spread from the suburbs into urban areas and from large apartments to small and medium-sized ones.

"Homebuyers' confidence has hit bottom," said Zhang.

Vanke predicted that even homebuyers with purchasing power would prefer to take a wait-and-see attitude, as they expect prices to drop further.

Meanwhile, the government's rigorous real estate measures are set to continue.

Premier Wen Jiabao said over the weekend the government will "firmly" maintain control over the property market even as it seeks to "fine-tune" other economic policies.

Chen Weiguang, general manager of Beijing City Development Co, a division of Yangguang Co Ltd, said the government is not likely to relax home purchase restrictions unless the world economy experiences a major setback next year.

But the chance of such a global scenario occurring is small, according to Andrew Cates, senior international economist with UBS AG.

"Europe will see a mild recession, but the US will see a moderate pickup. With the growth prospects of the emerging markets remaining strong, we expect the global economy may grow 3.1 percent next year," said Cates.

"Though we expect that the Chinese government may take some fiscal measures to fend off external economic turbulence, they are not likely to loosen monetary policies in the short term, given the inflation pressure," he added.

Zhuhai in Guangdong province is the latest city to impose restrictions on home purchases and prices, the Zhuhai Daily reported on Tuesday, citing the local government.

Chen Keyu contributed to this story.