Home price increases slowing

Updated: 2011-10-19 09:17

By Hu Yuanyuan (China Daily)

|

|||||||||||

|

Apartment buildings in Foshan, Guangdong province. More Chinese cities saw property price increases slow down in September year-on-year. [Photo/China Daily] |

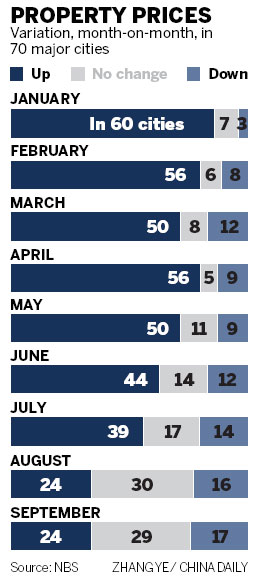

59 of 70 major cities see cooling trend as tightening measures kick in

BEIJING - More Chinese cities saw property price increases slow down in September year-on-year as the government's tightening measures to cool the market kicked in, the National Bureau of Statistics (NBS) said on Tuesday.

Last month, 59 of the statistical pool of 70 major cities saw new-home prices increase more slowly from a year earlier, compared with 40 cities in August, according to the NBS.

On a monthly basis, 17 cities saw new-home prices decline in September, up from 16 in August. Meanwhile, prices in 29 cities remained unchanged, NBS statistics showed.

Chongqing, one of only two cities to impose property taxes this year - the other was Shanghai - posted the steepest decline as prices dropped 0.4 percent from August. Changsha, Kunming, Yinchuan and Luoyang had the largest gain, 0.3 percent, according to the NBS.

|

|

"Residential prices will see a bigger drop in the fourth quarter of this year as the government's tightening credit policy toward property developers and individual buyers continues and even strengthens," said Joan Wang, head of research at Savills (Beijing).

On Oct 13, the Beijing branch of China Construction BankCorp raised the mortgage rate for first-home buyers to be 1.05 times the benchmark interest rate. It used to offer first-home buyers 30 percent off the benchmark rate.

So far, some banks in 14 cities, including Guangzhou, Shenzhen and Shanghai, have raised the mortgage rate by 5 percent to 30 percent, a move experts said will slam owner-occupiers and thus hurt the property market.

Li Min, a 28-year-old company executive, intended to buy an apartment around the end of the year but is now postponing his plan.

"The price drop has almost been offset by the growing mortgage cost," Li sighed.

According to Wang, the property price in Beijing fell about 3 percent in the third quarter.

"Given the government's rigorous measures to curb speculative home purchases, first-home buyers or owner-occupiers have been the major customer group in the market," said Wang. "Such a measure will definitely hurt demand and thus help to further lower property prices."

China's property sales rose 23 percent to 3.9 trillion yuan ($611 billion) in the first nine months, while development investments gained 32 percent to 4.4 trillion yuan, according to the NBS.

"The increase in China's property investment is largely due to social housing," said Wang.

Related Stories

Policy about-turn in Foshan home limits 2011-10-12 11:07

Rural home appliance sales jump in Sept 2011-10-11 10:14

Excess inventories expected to pare home prices 2011-10-09 16:32

Beijing's 2nd-hand home sales drop to 3-yr low 2011-09-26 09:30

- China Eastern cancels order for Boeing 787s

- Economic slowdown won't mean easing

- SASAC: SOEs' profits surge in 2010

- China Sept steel output lowest since Feb

- Sinohydro shares rise on debut

- Overseas companies set to boost cruise travel

- Siemens to build Chengdu plant, R&D base

- Vale lowers Q4 iron ore price