New payment program set to boost HK's financial role

The milestone Payment Connect program launched in China on Sunday offers a more convenient and cost-effective solution for cross-boundary transactions, said experts and residents, who highlighted its significance in boosting connections, promoting the internationalization of the renminbi and reinforcing Hong Kong's position as a financial hub.

Payment Connect was jointly launched by the People's Bank of China and the Hong Kong Monetary Authority to strengthen efficiency in cross-boundary payments. The first group of institutions participating in the program includes 12 banks, six of which are on the mainland and six in Hong Kong.

According to the Hong Kong Monetary Authority, the Payment Connect program recorded 25,900 transactions on its first day of operation on Sunday. Some 19,000 transactions, with an average value of 3,100 yuan ($430), had flowed south from the mainland to the Hong Kong Special Administrative Region as of 6 pm on Sunday.

By using Payment Connect through mobile banking or online banking channels, residents can easily make cross-boundary remittances by simply entering the recipient's mobile number or account number. They can choose to use either the RMB or the Hong Kong dollar as the receiving currency.

For remittances from Hong Kong to the mainland via Payment Connect, senders need a Hong Kong identity card, and they face a daily limit of HK$10,000 ($1,275) and an annual cap of HK$200,000. For transfers from the mainland to Hong Kong, senders must have a mainland identity card, and the annual limit is $50,000.

The Bank of Communications, which is one of the six Chinese mainland banks participating in the program, said that Payment Connect has addressed the problems of traditional cross-boundary payments such as complicated procedures, high costs and long settlement terms.

Wang Pengbo, a senior analyst at market consultancy Botong Analysys, said a major step forward in the Payment Connect program is not having to set up a separate account or rely on a third-party institution.

Payment and clearance systems in both places can be used directly, which will lower the usage threshold and transaction cost to a great extent, Wang said.

As the program supports the flow of the renminbi and the Hong Kong dollar, the recognition and use of both currencies will be promoted in retail scenarios, which will also pave the way for connectivity and mutual recognition between the Chinese currency and other currencies, he added.

Xiao Feifei, chief banking analyst at CITIC Securities, said that such a payment mechanism is likely to be expanded to Macao, and even in member economies of the Association of Southeast Asian Nations and the Middle East, after it takes hold. Such a proliferation would help to create a cross-regional, real-time payment network, facilitate the cross-border use of the RMB and promote regional economic and financial integration, she said.

HSBC is among the first banks in Hong Kong to participate in Payment Connect. According to Luanne Lim, the bank's CEO for Hong Kong, the demand for seamless cross-boundary solutions has never been greater, as mobility between Hong Kong and the Chinese mainland increases.

Today's Top News

- Japan's PM seen as playing to right wing

- Mainland increases entry points for Taiwan compatriots

- China notifies Japan of import ban on aquatic products

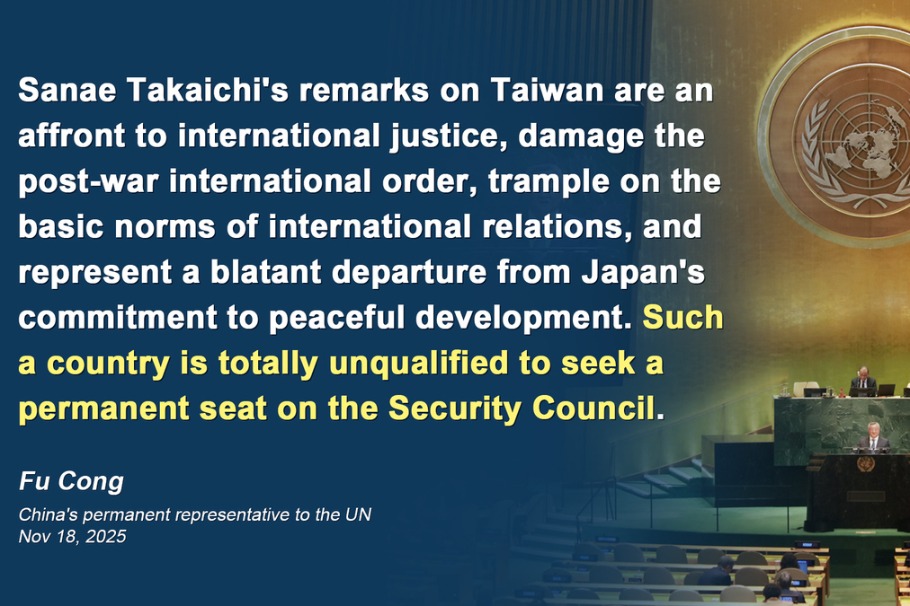

- Envoy: Japan not qualified to bid for UN seat

- Deforestation is climate action's blind spot

- Japan unqualified for UN Security Council: Chinese envoy