Briefly

Shanxi's coal output up in Jan-Sept

Shanxi province, China's largest coal-producing region, raised coal output by 10.5 percent year-on-year in the first three quarters of 2022 as it strives to guarantee energy supply. In the January-September period, coal mining enterprises in Shanxi produced 977.91 million metric tons of raw coal, an increase of 93 million tons from the same period a year ago, according to the Shanxi provincial bureau of statistics. Major power plants in the province transmitted 105.35 billion kilowatt-hours of electricity to other regions during the period, up 14.6 percent year-on-year, the bureau said.

Chongqing reports foreign trade growth

Chongqing municipality saw foreign trade grow by 8.5 percent year-on-year to reach 625.95 billion yuan ($86.4 billion) in the first nine months of 2022, according to Customs authorities in the city. In the period, exports rose by 11.5 percent year-on-year to 407.45 billion yuan, while imports gained 3.3 percent to hit 218.5 billion yuan, said Chongqing Customs. From January to September, imports and exports of foreign-invested enterprises in Chongqing reached 294.24 billion yuan, up 8.2 percent year-on-year. Imports and exports of private enterprises hit 283.5 billion yuan, up 12.7 percent year-on-year.

Central bank conducts reverse repos

China's central bank on Friday conducted a total of 90 billion yuan ($12.42 billion) of reverse repos to maintain liquidity in the banking system. The interest rate for the seven-day reverse repos was set at 2 percent, according to the People's Bank of China. The move aims to keep month-end liquidity in the banking system stable, it said.

Microcredit loans outstanding at $125b

Outstanding loans extended by China's microcredit companies came in at 907.6 billion yuan ($125.3 billion) by the end of September, official data showed. In the first three quarters, the total fell by 34.7 billion yuan, the People's Bank of China said in a statement. By the end of last month, there were 6,054 microcredit companies nationwide, the central bank said. Microlenders largely target small companies and low-income groups in need of capital.

Xinhua - China Daily

Today's Top News

- Xi chairs CPC leadership meeting to review report on work of state institutions, secretariat of Party Central Committee

- China's transport sector sees growth in 2025

- Politicizing business cooperation undermines shared interests

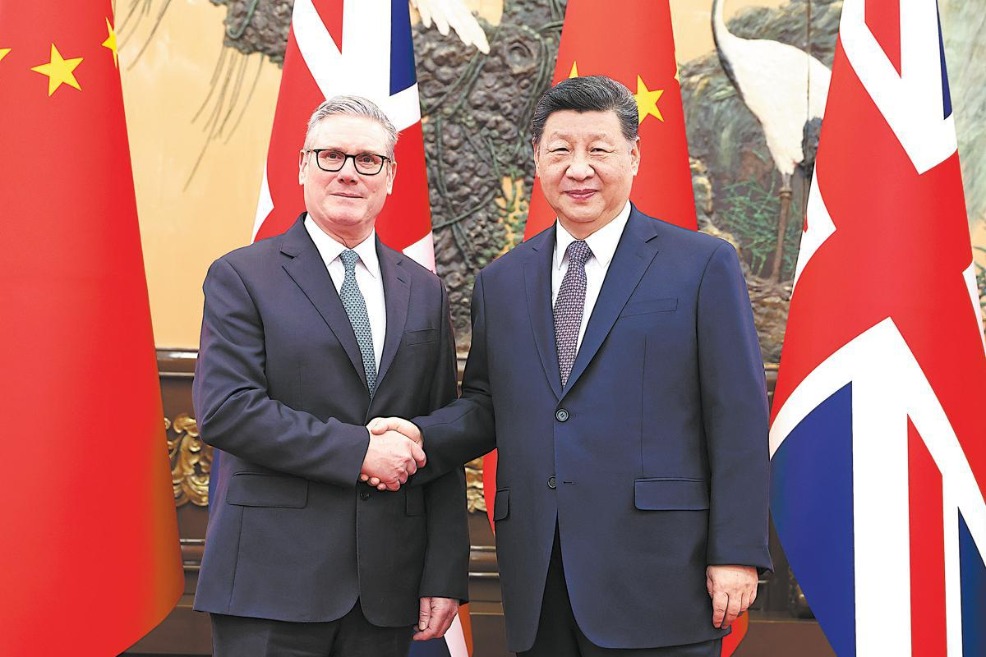

- High-profile visits signal pivot by EU

- Nation gears up for Spring Festival rush

- Premier calls for stronger economic cooperation