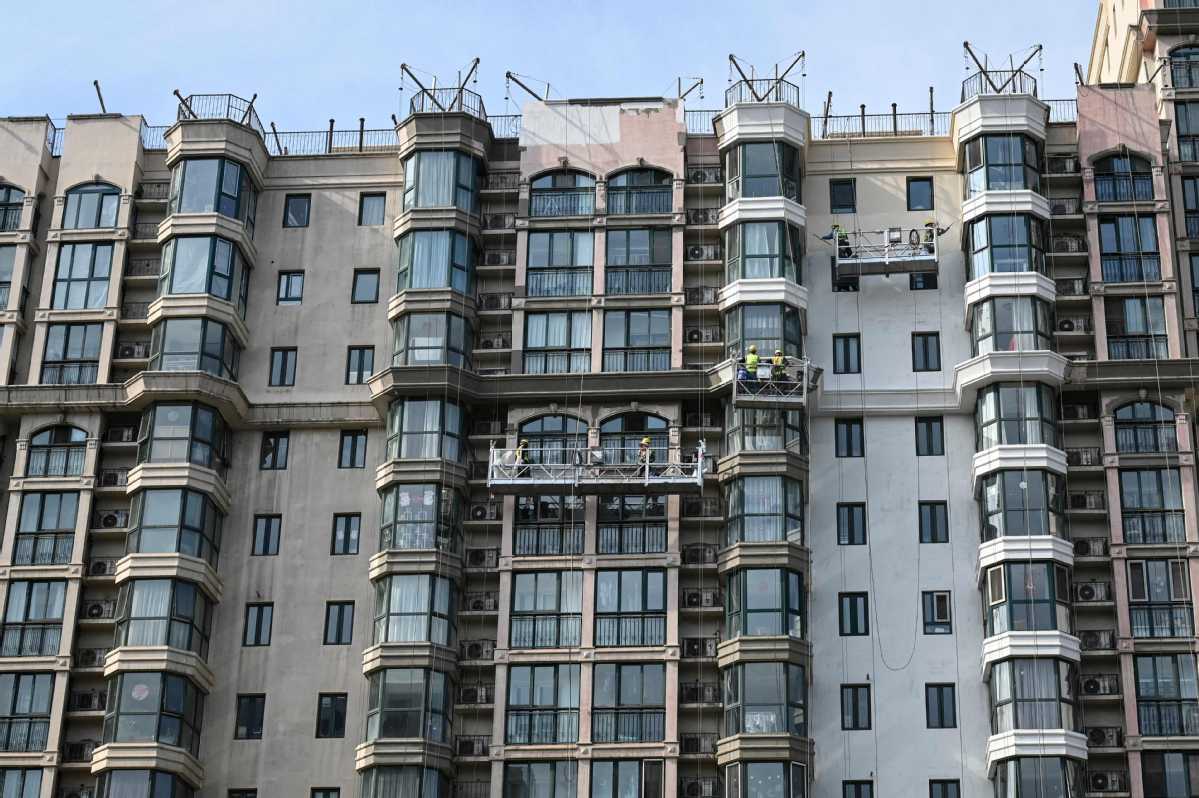

Beijing to see property rebound in H2

Beijing's commercial property market is expected to see a rebound in the second half of 2022, according to reports from international real estate service providers.

"With economic factors gradually improving, the capital's property market will probably see a recovery and rebound in the second half," said Anthony McQuade, managing director of Savills North China.

The office market in the first half was flat compared with the same period last year, but the market will be more active in the second half, according to a Savills report.

"Beijing is under short-term pressure due to the recent Omicron outbreak, but the market fundamentals have not been substantially impacted," said Julien Zhang, China chief strategy officer and managing director for North China, JLL.

In the second quarter of 2022, the decline of overall vacancy rates narrowed compared with the previous quarter. Sizable transactions were limited, as uncertainties due to COVID-19 affected potential tenants' decision-making processes. The decrease in vacant space was largely supported by transactions of less than 2,000 square meters, which accounted for nearly 70 percent of total transaction volume. Overall rents returned to negative growth in the second quarter, down 0.2 percent quarter-on-quarter, but were up slightly 0.5 percent year-on-year, mainly due to strict controls which obstructed the normal functioning of the leasing market, according to JLL's report.

"Landlords are actively adjusting their leasing strategies to maintain rental stability of projects and the market will not see a huge drop in rents in the short term," said Michael Zhang, senior director of office leasing advisory for JLL Beijing.

Jin Siying contributed to this story