New bourse can invigorate innovative SMEs: China Daily editorial

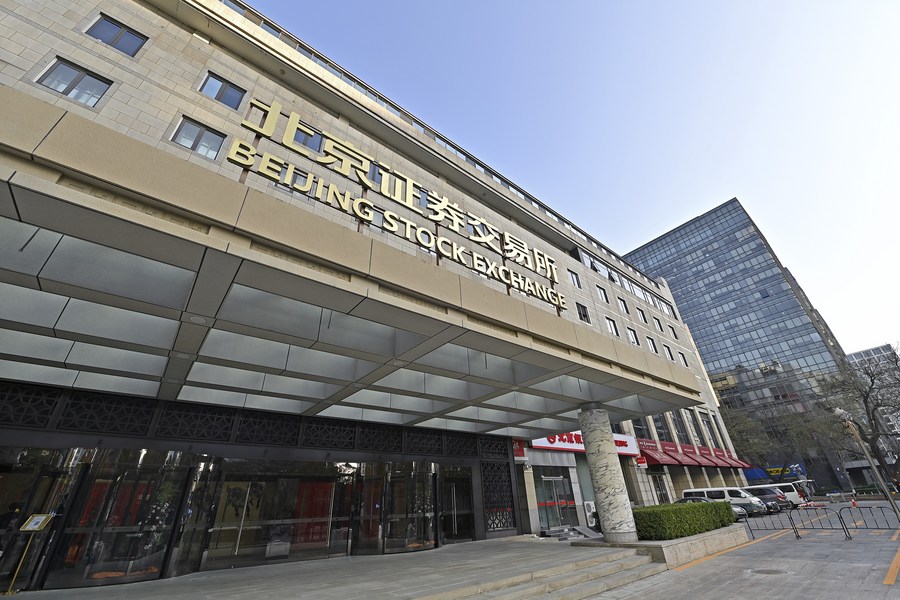

The Beijing Stock Exchange started trading on Monday, a new landmark in the reform and development of China's capital market. It has been launched just a little more than two months after President Xi Jinping announced on Sept 2 that the country would establish the bourse to better serve its innovative small and medium-sized enterprises.

To complete the process, including conducting rounds of technical tests, establishing the bourse's self-regulation system and enacting rules covering issuance, supervision and trading — within such a short time — underscores that the central authority regards "creating a multi-level capital market, improving financial support for SMEs, as well as promoting innovation-driven development, and economic transformation and upgrading" to be a matter of urgency, as Yi Huiman, chairman of the China Securities Regulatory Commission, said at the launch ceremony.

A total of 81 SMEs — 10 that recently conducted initial public offerings and 71 which were transferred from the "select tier" of Beijing's over-the-counter New Third Board — saw their shares traded on the new platform, with prices surging as high as 500 percent at one point, reflecting investors' enthusiasm for such stocks.

The country's tens of millions of SMEs have long served as the backbone of the Chinese economy, accounting for over 50 percent of the country's tax revenues, no less than 60 percent of its gross domestic product, over 70 percent of technological innovation and more than 80 percent of the urban employment.

But despite their contributions, they have long faced difficulty getting funding from State-owned banks either because of rigid lending criteria or the fact that most SMEs are vulnerable to adverse business environments because of their relatively small scale. The financing bottleneck has greatly restrained the SMEs' healthy development.

The launch of the BSE will not only provide more financing support to innovative SMEs, but also enrich the Chinese capital market, helping to boost the development of the real economy, especially in the northern parts of the country.

Currently, the country's two major stock markets are based in Shanghai and Shenzhen, both in the south. The launch of the new bourse in Beijing, home to most of China's high-tech startups, will inject new vitality into the development of the innovation sector in the north with better distribution of capital resources.

For the BSE to succeed in the long run, more work needs to be done to make sure that only the best of the country's SMEs get listed, with market supervision and oversight continuously strengthened and investors' interests well protected. This will help the country to ride the wave of innovation in the days to come.