Going's getting tough, but the undaunted Huawei gets going

Amid such mounting pressure, Huawei has worked as hard as it can to maintain its leading position on its home turf.

Zhang Mengmeng, research analyst at market research company Counterpoint, said: "Huawei continued to lead the (China smartphone) market with 45 percent share in the third quarter of this year."

In comparison, the distant-second Vivo only has a 17 percent market share.

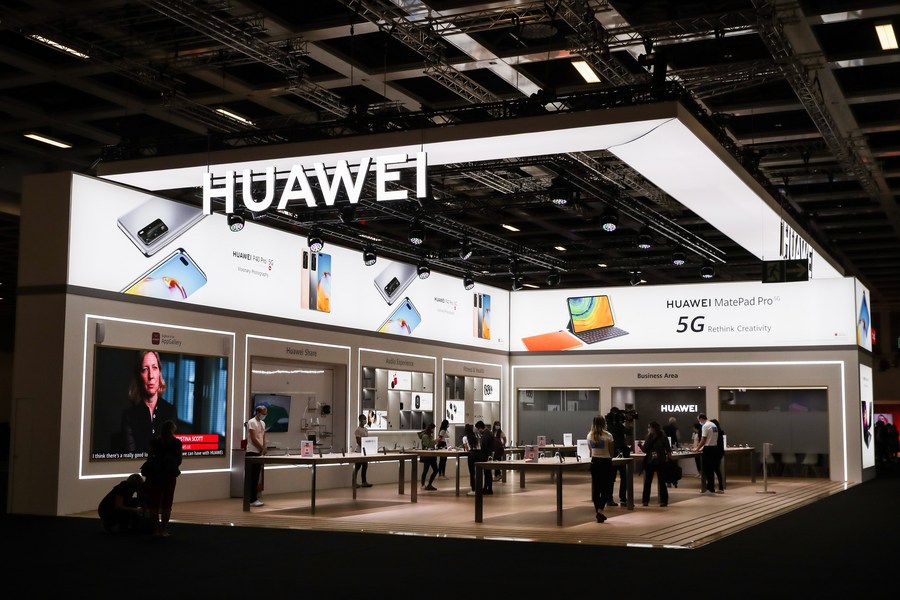

"Various Huawei 5G smartphones, including the premium P40 and P40 Pro 5G series, the Mate 30 5G series and the affordable premium Nova 7 5G series, received positive market feedback to dominate China's top 10 best-selling models list," Zhang said.

As Huawei is still struggling with the shortage of key 5G components, the company is striving to increase sales of its non-smartphone products. It is devoting more resources to selling personal computers, tablets, TVs and other consumer electronics that are not subject to supply issues.

Fu Liang, an independent telecom analyst who has been following the sector for more than a decade, said the growing sales of non-smartphone products can help Huawei's consumer business group to stay afloat for a longer time and await possible changes in Washington's restrictions on the company in the future.

"Huawei is a strong brand in China that has millions of loyal users. Such consumers are willing to pay for Huawei's non-smartphone products," Fu said.

Meanwhile, Huawei wants to increase software revenues it can derive from its large size of existing smartphone users. It is partnering with more internet companies such as NetEase and Sohu to experiment with mobile advertising and other services.

For a long-term solution, Huawei is partnering with domestic semiconductor companies to strengthen their research and development capabilities to reduce reliance on US chip technologies.

Liu Chang, an employee at Huawei, said: "The road ahead is tougher, but my colleagues and I are determined to hold our heads up to meet the challenges."