Relief and stimulus measures essential to stave off recession

As confirmed COVID-19 cases around the world keep rising, the economic impact has exceeded that seen during the 2008 global financial crisis. Although another Great Depression may not be on the horizon, temporary shocks might lead to a significant downturn.

In the face of disruptions caused by the novel coronavirus pandemic, relief measures and economic stimulus policies are both important.

To offset external shocks, China should utilize relief and stimulus measures of no less than 10 trillion yuan ($1.4 trillion).

We should consider some factors: investment is no longer the main driving force of China's economy; "new infrastructure" is not strong enough to be the key growth engine; building metropolitan regions is constrained by slower urbanization, and construction of "old infrastructure" like railways, roads and airports has been running close to full capacity.

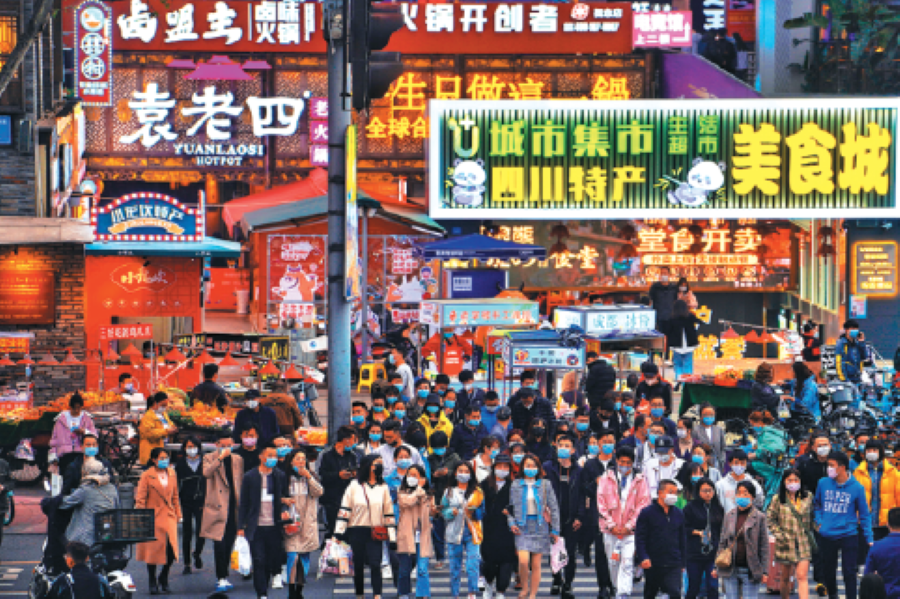

At the same time, consumption has been the main force boosting China's economic growth. Small and medium-sized private enterprises and the service sector are the main creators of new jobs. Thus, economic relief measures should focus on micro, small and medium-sized private enterprises, exporters and traditional manufacturing industries, while the direction of economic stimulus should focus on consumption and service sector industries as well as the "new economy".

The impact of the current pandemic has far exceeded that of the severe acute respiratory syndrome in 2003. Affected by the contagion, enterprises are facing shocks not only in terms of labor shortages and supply chain disruptions, but also due to shrinking consumer demand for goods and services. Some enterprises are also facing risks in terms of cash flow, high debt and even bankruptcy.

The pandemic may lead to economic recession this year, even worse than that seen in 2008. Economic growth in the United States is expected to slow to -2.8 percent for the full year. The growth rate of the eurozone may be -4.5 percent. China's GDP retreated by 6.8 percent in the first quarter, year-on-year. Without any new stimulus from the government, full-year growth estimates have been revised to 1 to 2 percent by some institutions, down from 6 percent at the beginning of this year.

Although the uncertainty of the pandemic may prolong a recession, the contagion has not harmed the basic economic operating mechanism or structure. For enterprises, although short-term income has declined sharply, profits have deteriorated, fund liquidity is insufficient and the supply chain has been interrupted, the core competitiveness of most enterprises will not be harmed as long as the impact does not endure for long.

Therefore, necessary relief measures and stimulus policies should be launched quickly, and sufficient measures to offset headwinds should be utilized before a large number of enterprises go bankrupt. This will help ease the economic recession and aid in a faster recovery.

In the face of the global pandemic's impact and financial turmoil, many countries provided economic relief and stimulus policies in a timely and aggressive manner. In particular, Western developed countries such as the United States and Germany have cut interest rates to zero or subzero, providing unlimited monetary liquidity, and their economic rescue plans account for 10 to 20 percent of their GDP.