Hong Kong Lawyer Looking across the Border

China Reform and Opening – Forty Years in Perspective

Hong Kong Lawyer Looking Across the Border

Editor’s note:Laurence Brahm, first came to China as a fresh university exchange student from the US in 1981 and he has spent much of the past three and a half decades living and working in the country. He has been a lawyer, a writer, and now he is Founding Director of Himalayan Consensus and a Senior International Fellow at the Center for China and Globalization.

He has captured his own story and the nation’s journey in China Reform and Opening – Forty Years in Perspective. China Daily is running a series of articles every Thursday starting from May 24 that reveal the changes that have taken place in the country in the past four decades. Keep track of the story by following us.

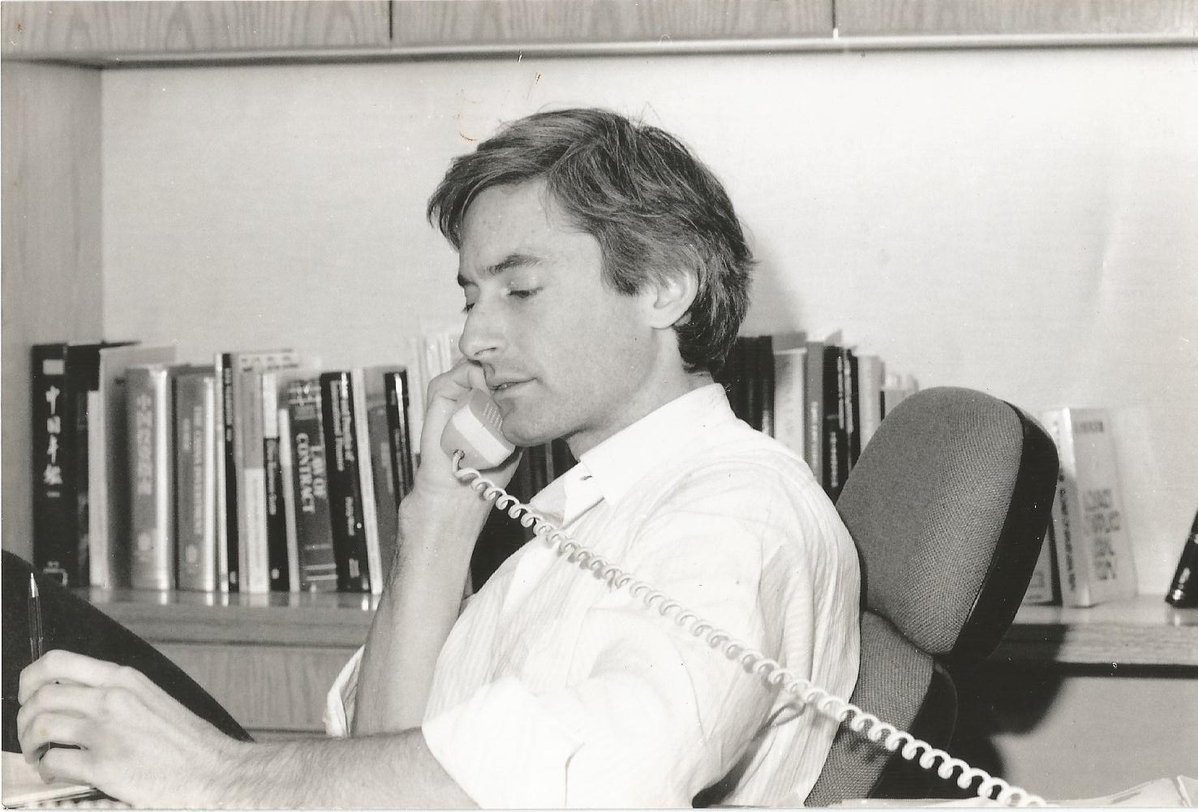

Laurence Brahm working at a law firm in Hong Kong in 1987. [Photo provided to chinadaily.com.cn]

Travelling from Beijing to Hong Kong on an evening flight in the 1980s, I looked out the window and saw the entire coast was pitch black. A major landmass with a population of 1.3 billion where public lights in every major city were shut off after 7:00 pm. China clocked out after hours.

The glow of city lights was not visible until the plane finally approached Hong Kong. Suddenly after all that darkness lights appeared in the distance. It seemed thrilling to fly over neon-lit narrow streets approaching Hong Kong’s old Kai Tak airport that stretched as a runway into Hong Kong’s harbor extending right out from crammed residential areas with shop, restaurants and clubs open all night. There was a sense of leaving one world and entering another.

The truth is, before 1987 few businessmen and professionals in Hong Kong could really see business opportunity in China. Hong Kong’s real estate and stock markets were booming. In 1987 the three stock markets of Hong Kong, Kowloon and the New Territories had been merged into one. There was too much money to be made there on daily trades to even bother looking at the rice paddies and rusted factories across the border.

I was part of a just a small circle of American lawyers in Hong Kong betting careers on China’s future. We believed that China would open up, reform its economic systems, and as an opportunity that the sky would be limitless. There was such a buzz of enthusiasm among us young lawyers working in the mere handful of American firms that had offices in Hong Kong with sights focused intently on China and its slow yet obvious changes. British and Hong Kong lawyers considered us at best wishful visionaries or naïve idealists -- just daydreamers fascinated by China’s past culture which seemed overshadowed by the business buzz and modernizing changes happening all at once across the region at once.

With business opportunity booming across the rest of Asia, China seemed like sleepy giant that had not awakened yet. Instead everyone talked about the “Asian Economic Dragons,” countries adopting the “import substitution and export promotion” model of economic development, and it seemed to be working well for each. That is a fancy way of describing two development phases. In the first, a nation overvalues its currency to strengthen purchasing power over technology and infrastructure upgrades, so that it is able to produce cost effective exports. In the second phase, it depreciates its currency to become a competitive export economy. In East Asia “dragons” adopting this approach were: Japan, Korea, and China's Taiwan. By the 1980s, Southeast Asia’s “little dragons”: Singapore, Thailand, Malaysia, Indonesia and the Philippines, did the same thing. Clearly, the action was then in Southeast Asia, not Chinese mainland.

Nobody in the Asian business community really looked to China as a business opportunity. If anything most saw China as a looming challenge in the decade ahead. Control of Hong Kong would revert from Britain to China in 1997. The question everyone asked: how to merge a purely capitalist economy with a communist system? It left everyone perplexed, and even a little depressed when they talked about it. The future seemed so uncertain then.

The pragmatism of Hong Kong people always rises against adversity. I have witnessed this again and again. Soon young entrepreneurs opened a 1997 bar, a 1997 restaurant, and a 1997 disco club in a slum area with daipaidang street food sellers near the financial district that would soon become known around the world as Lan Kwai Fung, one of the hottest night life centers with the priciest real estate. The 1997 venues were all vogue up to the night of the handover, after which they lost their marketing edge, to be replaced with new themes. Hong Kong people are so practical. Even amidst uncertainty they find creative ways to leverage profit while pushing up real estate prices.

Then, as today, most analysis from Western “China experts” was just guesswork based on patched rumors. When China’s Communist Party or National People’s Congress held a meeting, the experts observed and analyzed the clothes of the leadership, looking for some sign of their thinking. Some cadres dumped the traditional four pocket cadre jackets for business suits. Others wore the traditional four pocket cadre jackets one day changing to suits the next, and back again when the wind shifted. Some still hung onto their old cadre clothes nostalgically.

Few imagined that the convoluted debate over socialism vs. capitalism would soon abruptly end, and China’s economy would takeoff. Most people could not foresee this in the 1980s. Within a mere decade China transformed itself from what was technically an economy of scarcity into one of surplus. From an underdeveloped backwater, to become by 2010 the world’s second largest economy.

Please click here to read the previous article.