Acquisition of trophy assets curbed

State Council clarifies outbound investment criteria

Authorities are steering outbound investment away from trophy assets like soccer clubs, hotels and Hollywood studios. Lin Wenjie finds that investments in the Belt and Road Initiative are favored, along with high-tech, energy and agriculture sectors.

As China guides its macroeconomic transition from export-driven, labor-intensive manufacturing, to a consumption-led, innovation-fueled "new economy", its private sector, encouraged to globalize, has been hyperactive in overseas acquisitions.

Investment frenzy

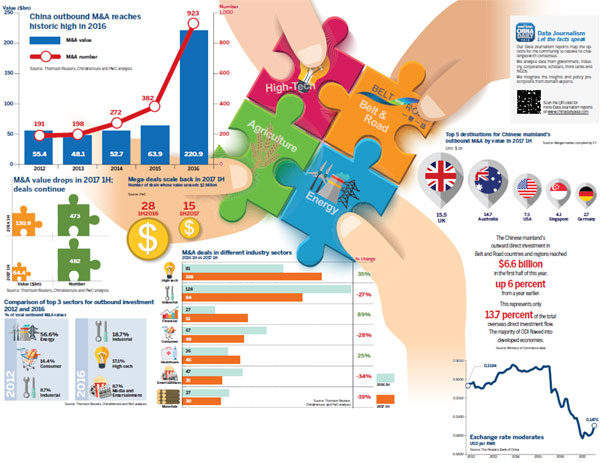

In 2016, the outbound mergers and acquisitions (M&A) value grew 246 percent over 2015, to $221 billion, according to accounting firm PwC's M&A Mid-Year Review & Outlook 2017. Some of the high-profile foreign acquisitions seemed, in retrospect, hasty and over-valued. Regulators suspect the acquisition conduit may have been used to move surplus cash out, bypassing domestic restrictions.

These companies took on massive debt to overbid for assets, destabilizing the financial system and putting pressure on the mainland currency. Regulators reined in the most aggressive deal-makers - Anbang Insurance Group, Fosun International, Dalian Wanda Group and HNA Group. Their deals are being scrutinized for proper due-diligence and valuation assessment.

Xinhua News Agency quoted Guo Guangchang, chairman of Fosun International, in a report on Aug 20, as saying competition between Chinese companies led some firms to overbid. Guo said he supports the government's stringent supervision of outbound investment to prevent such unproductive counterbidding.

Brand appeal

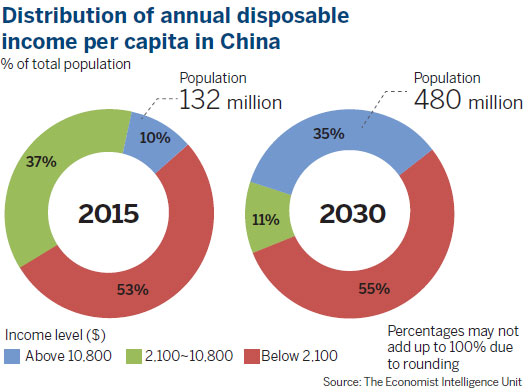

Chinese companies also want to acquire high quality assets with strong brand reputations to meet the rising middle-class consumer demands. The Economist Intelligence Unit reports that about 35 percent of China's population in China will have in excess of $10,000 in annual disposable income by 2030, compared to about 10 percent in 2015. The emergence of this large population will increase demand for higher quality consumer goods and services. Acquisition of well-known international brands was also a factor in the outbound investment drive.

Clear directives

The State Council issued specific guidelines in August, discouraging outbound investment in property, hotels, entertainment and sports clubs. It outlaws investment in gambling and sex industries. It encourages investment in high-tech, energy and agricultural sectors. There is blessing for direct investments in the nation's Belt and Road Initiative which covers 65 countries and regions.

The greater accountability imposed by the new regulations has refocused the private sector on more thorough internal governance, a broader spectrum of due diligence, and strategy to integrate the acquisition target into the enterprise. "Companies should do their homework at the very start to nip problems in the bud, instead of seeking a remedy when they encounter obstacles," said Wu Jianyong, the Beijing-based partner of accounting firm Grant Thornton.

Private companies are also seeking tie-ups with State-owned Enterprises (SOEs) on outbound acquisitions, in the belief that co-opting them would ensure smoother regulatory approval. "We expect to see more of these tie-ups in the future, provided the private companies can prove that their acquisitions make strategic sense and are not just an attempt to get money out of China," said Hamilton Matthews, CEO of business intelligence provider Acuris.

Mega deals shrink

Statistics indicate 28 mega-transactions (valued at more than $1 billion each) for the first half of 2016, but the figure dropped to 15 for the first half this year. The upcoming 19th National Congress of the Communist Party of China in October could also have caused a "wait and see" attitude, for policy direction on outbound investment.

"The absence of high-profile mega-deals has affected the overall value of M&A activities in 2017," says David Brown, transaction services leader for PwC in the Chinese mainland and Hong Kong. "Deals with a sound strategic rationale are still encouraged, and technology was the leading sector," he added.

Since late last year, the People's Bank of China (PBoC), the State Administration of Foreign Exchange, State-owned Assets Supervision and Administration Commission of the State Council, have all issued guidelines to standardize investment criteria to avoid "irrational" outbound deals that "didn't bring much benefit to China and caused some complaints overseas", said Zhou Xiaochuan, the PBoC governor, at a press conference on March 10, 2017.

As a consequence, outbound M&A value in the first half of this year fell 50.8 percent to $64.4 billion from $130.9 billion in the first six months of last year. However, the number of deals grew by nine to a record 482 for the first half this year. More Belt and Road deals were signed.

Hong Kong advantage

Overseas-listed companies or firms with overseas financing channels will have an advantage over investors with only renminbi funding sources, for international investments. "There are various ways to raise money in Hong Kong, from securities companies, banks, and some family offices," said Chen Zhiping, founder of RJ Capital, emphasizing Hong Kong's excellent facilitation of investment capital.

Fan Shengyan, head of M&A at China Everbright Investment & Assets Management, said foreign companies unsure about the new regulations for business with the Chinese mainland can use Hong Kong as a safe buffer. Hong Kong has traditionally played that two-way role for Chinese companies globalizing and foreign investors seeking entry into the mainland economy.

Cross-border contracts, arbitration, fund-raising, due-diligence, auditing, construction, engineering, project management and global financial trade are well-established and trusted in Hong Kong. All of this expertise and the professionals to execute it are available for both mainland corporations and international investors.

Belt and Road opportunity

"Getting back on a rational track, we can expect more domestic companies to have their eyes on the Belt and Road route for an investment growth engine," said Yang Feng, founding partner and CEO of Shenzhen-based Blue Ocean Capital Group.

Ministry of Commerce data showed that the mainland's outward direct investment in Belt and Road countries and regions reached $6.6 billion in the first half of this year, up 6 percent from a year earlier. But this represents only 13.7 percent of the total overseas direct investment (ODI) flow. The majority of ODI flowed into developed economies.

M&A deals in Asia increased by nine to 133 in the first half, compared to the same period last year, most linked to the Belt and Road, while in Europe and North America, the number of M&A deals in the first half moderated to 297 from 301.

Risk mitigation

Some companies hesitate to invest in Belt and Road countries and regions, due to their unpredictable politics and unknown cultural conflicts. Experts suggest investors should fully understand the local culture, structure of power and politics, and factor in the benefits for the communities to be impacted by the projects.

"We face various challenges in Belt and Road countries and regions, including political uncertainty, cultural conflict, and technical risks," said Wen Gang, vice-president of rail builder China Communications Construction Company. The company has more than 190 projects in the Association of Southeast Asian Nations, a trade bloc of 10 countries that play a significant role in the implementation of the Belt and Road Initiative.

"The best way to mitigate these risks is to fully understand the conditions of these countries, the people, their culture, and share profits with them," said Wen.

Frederick Ma Si-hang, chairman of Hong Kong's rail-network operator MTR Corp, is "prudent" in investing in Belt and Road countries and regions. MTR Corp hasn't invested in those countries yet. Ma is actively looking for opportunities there. MTR Corp is partnering with China Railway to bid for the Kuala Lumpur-Singapore high-speed rail project.

Contact the writer at cherrylin@chinadailyhk.com

(HK Edition 09/25/2017 page8)

Today's Top News

- Multiple satellite filings demonstrate transparency, responsibility and ambition

- Beijing responds to US tariff threat regarding Iran

- 2025 in review: Resilience amid headwinds

- Economy, ecology flow together in Yangtze Delta

- Xi: Advance rigorous Party self-governance

- Pricing deal to avoid EU tariffs on Chinese EVs