Value of top 100 brands soars to $525b

Private Chinese companies surpass state-owned enterprises in worth for the first time

The value of China's top 100 brands surged 13 percent to $525.6 billion last year despite the economic slowdown, an annual survey shows.

In addition, for the first time, market-driven brands owned by private companies contributed more than half (51 percent), of the value of the top 100, surpassing state-owned enterprises.

The results of the 2016 BrandZ Top 100 Most Valuable Chinese Brands, released on March 21 by New York research firm Millward Brown, have been seen as evidence of China's continuing transition to a market economy.

"The robust increase in brand value reflects the continued optimism of Chinese consumers, while demonstrating how resilient strong brands are in times of economic turbulence," says Doreen Wang, global head of BrandZ.

Personal care and jewelry were the fastest-growing categories in terms of brand value, followed by real estate, insurance, airlines and travel agencies, the survey shows.

This is evidence that consumers are still spending on nonessentials, luxuries and big-ticket items, as well as on personal care and health products, Wang says.

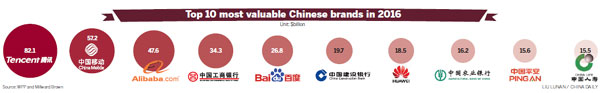

According to the survey, Tencent remains China's most valuable brand, growing its value 24 percent to $82.1 billion, followed by China Mobile at $57.2 billion, and Alibaba at $47.6 billion.

The highest new entrants were telecom brand Huawei, which ranked seventh with $18.5 billion, and online retailer JD.com, which was 15th with $9.4 billion.

Huawei has a strong global presence, and its smartphone business has been a powerful growth engine. JD, a challenger to Alibaba, has benefited from the expansion of its mobile offering, the worldwide extension of its e-commerce platforms and partnerships with premium international brands.

"China is the most dynamic market in the world in terms of mobile use, and companies that intend to build their brands there should not underestimate the speed of the digitalization and mobilization wave," Wang says.

"Despite the slowdown in economic growth and extreme stock market fluctuations, consumers feel optimistic: They still hold on to the Chinese Dream of a better life for themselves and their families."

Technology brands accounted for 27 percent of the total value of the top 100, up from 16 percent from just two years earlier, and their growth has boosted the strength of the market-driven brands.

Three tech brands also topped the rankings for those that generated the highest proportion of their revenue overseas, including Lenovo (68 percent), Huawei (62 percent) and ZTE (50 percent).

Two tech brands - content provider LeEco, which was 32nd, and gaming platform NetEase, 40th - were the highest risers, increasing in value by 81 percent and 73 percent respectively.

According to Deepender Rana, CEO of Millward Brown, Chinese brands are now as competitive as multinationals.

He says that the increasing power of domestic brands may help stem the current outflow of capital from China that is concerning economists.

zhengxin@chinadaily.com.cn

(China Daily European Weekly 03/25/2016 page29)

Today's Top News

- Crackdown on Chinese firms politically driven

- Mainland denounces Taiwan-US trade deal as 'sellout pact'

- Steering Sino-US relations in the right direction

- Retired judges lend skills to 'silver-haired mediation'

- Are you ready for robots to roam your streets?

- Good start for new five-year plan stressed