E-commerce turns the corner in Africa

While not always an easy sell, Web-based companies are blooming around the continent by overcoming some daunting obstacles

While Africa may be the land of the future when it comes to e-commerce businesses, it has not always been easy to make such businesses work.

In February 2013, online classified company Mocality announced the closure of its operations in Kenya and Nigeria.

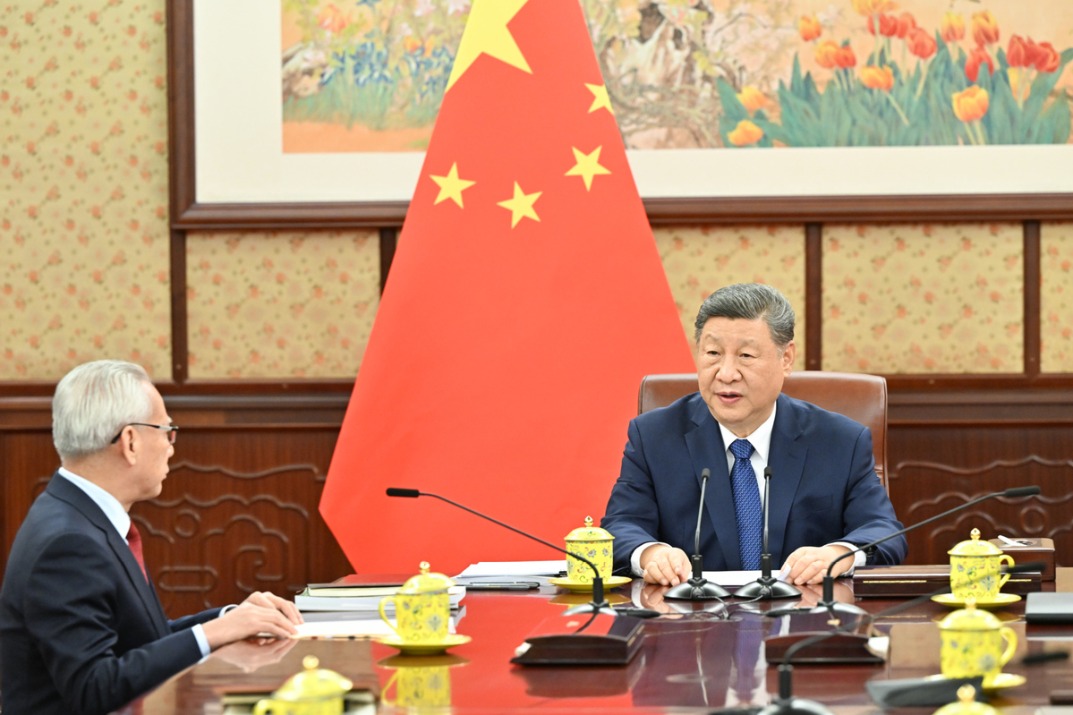

| An employee of online retailer Jumia sorts packages for delivery at the company's warehouse in Lagos. Joe Penney / Reuters |

The South African-based company owned by Naspers, a media empire, said the operation wasn't profitable.

The first casualty was the e-commerce site Kalahari.co.ke, owned by the same group. It boasted of 14 million users and over 3 million products.

Blogger Robertalai wrote on the TechMtta website at the time that a source "intimated that Kalahari never made profits while Mocality and (online classifieds marketplace) Dealfish" were "far from even breaking even".

These developments might have raised doubts in the minds of many as to the sustainability of such businesses. The landscape looked bleak, with investors finding the terrain difficult to operate in, especially for start-ups that were working to recreate successful foreign business models in the continent.

The fragmented market has been but one of the challenges. Africa's 1.1 billion people live in 54 countries, all under different laws with few of them harmonized across borders. Companies needing to capitalize on economies of scale therefore must take numerous steps in each country to accumulate a critical mass, significantly impacting efficient allocation of capital due to duplication of resources across the region.

Second, infrastructure deficits increase the cost of logistics. While Alibaba Group Holding uses over 14 key logistics partners to deliver packages to customers on its behalf in China, and Amazon.com and eBay use the postal system, these operations are costly and inefficient in Africa.

Also, the low penetration of credit cards has a direct impact on e-commerce payment systems. Few Africans are included in the formal banking system with only 34 percent of adults having an account in 2014, according to the World Bank's Financial Inclusion Database.

Several years later, however, the online landscape has changed, with many new entrants making it more vibrant and dynamic.

The big investors are African Internet Group, which operates in 23 countries and owns Jumia, the Nigerian e-commerce site started in 2012 that has been called "the Amazon of Africa".

Naspers joined with Swedish-based venture capital firm Investment AB Kinnevik to invest in Konga, a Nigeria-based electronics site also started in 2012. Groupe Casino, a French mass retailer, has popular e-commerce platforms in Cote d'Ivoire and Cameroon, and One Media Africa has built a huge classified business in the continent.

Local operators are expanding within their home turfs. In South Africa, the Competition Commission approved the merger last year of the two biggest e-commerce firms, Kalahari.com and Takealot.com. The companies said the move enables them to compete successfully against local brick and mortar retailers and foreign companies such as Alibaba and Amazon.

According to Takealot.com, the South African consumer market is approximately $49.8 billion, "of which less that 2 percent is online," adding that worldwide online retail as a percentage of total retail is growing. "China has an online retail market share of 10 percent whilst in the US and UK it is already approaching 15 percent."

E-commerce is predicted to open up a new shopping experience for Africa's growing middle class, according to a 2013 report by US-based management consulting firm McKinsey & Company entitled Lions go digital: The Internet's transformative potential in Africa. "By 2025, it could account for 10 percent of retail sales in the continent's largest economies, which will translate into some $75 billion in revenue," it says.

The report notes that the expanding middle-income bracket, with greater disposable income, growing ownership of Internet-capable devices and accessibility to 3G networks, will support the trend.

The co-CEO of the company that owns Jumia told Forbes in 2014 that in Nigeria, where the e-retailer was launched, the chief commercial city of Lagos has two malls serving 20 million people. The situation is exacerbated by high costs of building and lack of roads.

Jeremy Hodara, the co-CEO of Africa Internet Holding, said the underdeveloped condition of the retail market in general in Africa strengthens the potential for e-retailers.

"It is going to ultimately exceed bricks and mortar retail - similar to how mobile phones eclipsed landlines in Africa."

Jumia operates in five countries - Egypt, Morocco, Nigeria, Kenya and Cote d'Ivoire. Hodara has been quoted as saying that every month, the business registers double-digit growth.

To make online business sustainable in different countries, the company has localized its operations. First, in a bid to build trust, it ensures that the packages are delivered on time, company officials say. It has invested in 500 motorbikes and trucks. In addition, it has adopted a liberal return policy, they say.

Also, to bypass the traditional payment model using credit cards, customers pay in cash upon delivery. In Kenya, customers can pay using mobile-money transfers.

Chinabuy Group in Kenya has similar strategies. The Kenyan operation is a member of Chinabuy Group Ltd, a global company headquartered in Hong Kong that says it provides Kenyans with access to over a million different items directly from Chinese manufacturers.

"Chinabuy Group has introduced a 24/7 call center in local languages, different delivery methods up to express delivery of 10 days, quality control and the option to return unused products within a period of 365 days," says Joe Zhang, the founder and CEO of the company.

"The major challenge e-commerce sites faces in Kenya and Africa is the fact that customers are still not very comfortable paying online and trusting that their item will be delivered," he says, adding that the apprehension will dissipate with more people using the Internet.

Contact the writers at lucymorangi@chinadaily.com.cn and houliqiang@chinadaily.com.cn

(China Daily Africa Weekly 02/05/2016 page8)

Today's Top News

- Crossing a milestone in the journey called Sinology

- China-Russia media forum held in Beijing

- Where mobility will drive China and the West

- HK community strongly supports Lai's conviction

- Japan paying high price for PM's rhetoric

- Japan's move to mislead public firmly opposed