Economy 'poised to face increased pressure'

Gloomy outlook on imports and exports to push China to focus on stimulating domestic demand

External uncertainties will increase next year, which may further drag down Chinese exports and imports and add pressure to the economy, according to a senior researcher at the government's top think tank.

Economic growth is likely to slow to about 7 percent, says Wei Jianguo, vice-chairman and secretary-general of the China Center for International Economic Exchanges.

The world's major economies may witness a downturn and global demand will remain weak in 2015, Wei told China Daily in an exclusive interview.

He says China is unlikely to achieve its 2014 economic growth target of 7.5 percent and the global foreign trade situation will worsen in 2015.

Wei predicts that economic growth in the United States may slow next year as fiscal income growth is still at a relatively low level. The US shale gas industry will also be affected by the falling price of oil.

"The crisis in Ukraine will bring an overall recession to Europe. Interminable debates over easing and tightening policies among European leaders will delay the economic recovery," he says.

"Japan may see the sharpest slowdown in 2015, as 'Abenomics' was a mistake in theory and practice, Wei says, referring to the series of measures introduced by Japanese Prime Minister Shinzo Abe since his re-election in December 2012.

The gloomy external environment will push China to focus more on stimulating domestic demand, which is a key composition of ongoing structural reform, Wei added.

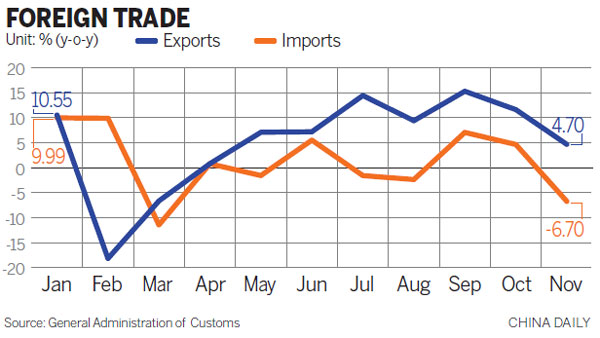

The General Administration of Customs has reported an unexpected 6.7 percent year-on-year fall in imports in November, compared with 4.6 percent growth in October. Exports growth weakened to 4.7 percent from 11.6 percent.

In the first 11 months of the year, the export-import volume rose by 3.4 percent year-on-year, much lower than the 7.5 percent annual growth target set in the Government Work Report announced by Premier Li Keqiang in March.

Economists say the November trade figures reflect softer domestic demand and the sharp drop in prices of oil and other commodities. They also indicate that global trade momentum remains sluggish, with demand from developed countries weak.

In November, the trade surplus rose to a record-high $54.5 billion, up from $45.4 billion in October. It is 60 percent higher than in November 2013.

"With such a current account surplus, fundamental pressures on the yuan remain toward appreciation against the US dollar," says Louis Kuijs, chief economist in China at the Royal Bank of Scotland.

"We expect some mild appreciation of the yuan against the dollar in 2015 to just below 6. The strength of the dollar could be a wild card, though. More pronounced global strengthening of the dollar may shift the balance and may lead to some yuan depreciation against the US currency," he says.

Liu Ligang, chief economist in China at ANZ Bank, says that weak domestic and external demand may suggest slow economic growth in the fourth quarter. "It will also be difficult to reach the 7.5 percent GDP growth target this year," Liu says.

A report by Nomura Securities Co predicts that figures for November will continue to fall, with industrial production growth dropping to 7.3 percent from 7.7 percent in October, fixed-asset investment declining to 15.6 percent from 15.9 percent and retail sales falling to 11.3 percent from 11.5 percent.

chenjia1@chinadaily.com.cn

(China Daily Africa Weekly 12/12/2014 page23)

Today's Top News

- Crackdown on Chinese firms politically driven

- Mainland denounces Taiwan-US trade deal as 'sellout pact'

- Steering Sino-US relations in the right direction

- Retired judges lend skills to 'silver-haired mediation'

- Are you ready for robots to roam your streets?

- Good start for new five-year plan stressed