Africa needs to take a new approach

Developing its partnerships with international investors key to economic growth

The Ninth African Development Forum was held in Marrakesh, Morocco, from Oct 12 to 16 to address the need for leveraging innovating financing mechanisms as effective alternatives for funding transformative development on the continent.

Through plenary sessions, high-level panel discussions and side meetings, the forum led to a consensus statement with clear recommendations on options relating to innovative financing and calls for the promotion of sustainable development financing. Key aspects were highlighted: domestic resource mobilization, illicit financial flows, private equity, new forms of partnerships and issues relating to climate financing.

Since the late 1990s, Africa has benefited from favorable economic growth, facilitated by improved macroeconomic fundamentals and an expansion of all the main components of foreign financing (export revenues, foreign direct investments, remittances and official flows).

However, investment as a share of GDP has climbed only modestly (from 17 percent in 2000 to 21 percent in 2012). Development finance is a crucial challenge for the region, particularly in view of its infrastructural and technological gaps. National data reveal that Africa's growth acceleration has been accompanied by heightened reliance on foreign savings for investment financing, which has widened the resource gap, in particular for non-oil exporting African economies.

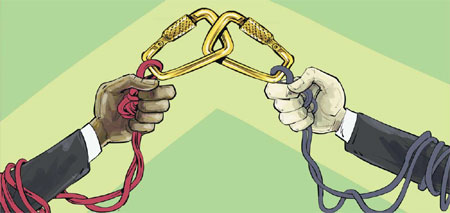

But a new approach to development finance should be sought through innovative forms of international partnerships, ensuring that the mistakes of the past are not repeated. These mistakes and goals include: the inability of the traditional donor-recipient logic to promote mutual accountability; enabling authentic ownership of the development agenda and delivery on the promises set out in the UN Millennium Development Goals, especially the 0.7 percent official development assistance target.

They also include the failure to redress the imbalances of existing multilateral trade and financial systems, and the limitations of the existing partnership in dealing with global challenges, such as climate change and financial stability, which intrinsically call for the application of the principle of common but differentiated responsibilities.

It is crucial that the new partnerships capture the nuances of the evolved global economy. First, they should be consistent with the ongoing rebalancing of geopolitical and economic weight in favor of emerging and developing countries such as Brazil, China and India. Secondly, they should pay greater attention to advancing regional integration for Africa's own transformation prospects. Thirdly, the new partnerships should cater to the complexity of the evolving development finance landscape.

China has become Africa's main foreign direct investment partner, and its FDI comes into Africa seeking resources, efficiency and markets. China has more than tripled its FDI inflows from just above $40 billion in 2000 to a record $124 billion in 2011. Although only a few countries, mostly resource-rich, account for the bulk of Chinese FDI, there is also massive market-seeking investment focusing on transport infrastructure, sports facilities, financial services, tourism, and telecoms, as well as efficiency-seeking investments in the agricultural sector.

But reports by the Office of the Special Adviser on Africa in 2009 and 2013 note that China is not the only player in trade, aid and investment to Africa. China now constitutes the so-called seven new and emerging partners (including Brazil, India, South Korea, Malaysia, Russia and Turkey). Unlike traditional Western development partners, Africa has similar operating environments to that in the new partner countries and represents a rapidly growing market for these countries.

One of the myths that UN studies are dispelling is that "resource hungry" new partner countries including China are involved in infrastructure investment in Africa purely to gain access to its commodities or to facilitate commodity exports. It is definitely not the case with China's involvement in African infrastructure, since only 6 percent of the 141 large infrastructure projects between 2000 and 2008 - examined by a UN special adviser in 2013 - are wholly linked to resource extraction and export.

A majority of Chinese projects involve a high degree of packages of aid, trade and FDI. The study notes that these bundles also involves significant synergies between economic infrastructure, social infrastructure and training in return for access to mineral deposits to repay China's investments.

Chinese involvement in Africa provides both major challenges and greater opportunities. In terms of the latter, Africa has to be very proactive in engaging with all of its investment partners. Fortunately, there is a coordinated framework that guides Africa in its engagement with investment partners as it seeks "sustainable economic growth, wealth creation and global integration using manufacturing as a driving force".

Indeed, recognition of the need to curtail and redirect illicit financial flows as an innovative source of financing for Africa's transformation has been included in the continent's position on post-2015 development goals.

Although the sources of illicit financial flows are within the continent and primary responsibility for eliminating these sources rests with African governments, the mechanisms for moving illicit financial flows out of Africa involve non-African private actors and are sometimes the result of policies and laws adopted by intergovernmental bodies and foreign governments. According to estimates by the Economic Commission for Africa and other organizations, annual illicit flows from Africa during the past decade could amount to $50 billion, exceeding official development assistance. Moreover, this estimate may very well fall short of the true situation, as there are no accurate data for all transactions.

Africa's relatively high growth since the turn of the century would have been even higher if potential investment resources were not leaving the continent illicitly. As illicit financial flows are hidden from African tax authorities, they undermine Africa's fiscal policy space. They also deny the continent additional tax revenues, which could be used to fund government programs and enhance productivity, which in turn would increase the tax base to raise more revenue and fund development requirements. Secondly, as Africa seeks to mobilize more domestic resources to fund its development, illicit financial flows deny its financial systems and governments the opportunity to use these resources. In addition, illicit financial flows severely impact the continent's savings ratios and deny local investors access to financial resources for investments, job creation, enhanced productivity and economic growth

Curbing illicit financial flows requires political will and commitment at various levels. More specifically, corruption, tax havens, financial secrecy jurisdictions and capacity constraints need to be tackled directly through dedicated investment, international cooperation and systems that provide deterrents and high penalties for perpetrators.

There is a consensus amongst African leaders that Africa has, up to now, not benefited optimally from its resources, especially in the mineral sector. Many developing countries all over the world show intricate linkages between industrialization, economic growth and prosperity. This means that for Africa to reach a status of wealth, it has to maximize the benefits of its natural resources in markets within the continent as well as export markets.

Africa needs to close its financing gap and generate the resources required to achieve an economic model based on industry and modern services, with significant employment generation and a more equitable distribution of income. The continent should focus on revamping the infrastructure value chain in order to link the entire African region not only with the outside world but to foster intra-African trade.

The Ninth Africa Development Forum identified various investment and finance options but Africa needs to unlock its potential for domestic resource mobilization, which can play a pivotal role in financing its sustainable development agenda. It also must promote private equity, as an important potential source of investment for growth and development, and maximize the benefits of South-South cooperation. It must articulate its need for infrastructural development, education and training, health, finance and other critical areas. Currently, China is supporting Africa in all these areas, but it is up to the African people and states to take advantage of this opportunity and mobilize their own national and international resources to complement this effort.

The author is deputy executive secretary of the Economic Commission for Africa. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 11/07/2014 page11)

Today's Top News

- Dialogue constructive way to rebalance trade

- AI needs to be governed wisely to ensure that it is beneficial for future of humanity: China Daily editorial

- China warns about Japan's intended military buildup

- China urges EU to halt anti-subsidy probes

- Experts: Lai not freedom fighter, but a pawn of the West

- Hainan evolves as gateway to global markets