Fed looks set to ease policy as US outlook dims

Updated: 2011-09-21 15:53

(Agencies)

|

|||||||||||

|

|

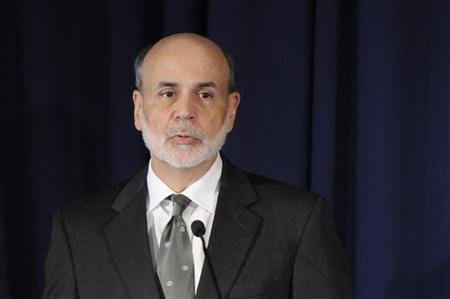

US Federal Reserve Chairman Ben Bernanke makes remarks at the start of a conference on systemic risk, at the Federal Reserve in Washington September 15, 2011.[Photo/Agencies] |

WASHINGTON - The Federal Reserve on Wednesday looks set to launch a fresh effort to invigorate the faltering US recovery, embarking on what could be the first in a series of incremental steps to foster stronger growth.

The central bank appears likely to try to push long-term borrowing costs lower by rebalancing its $2.8 trillion portfolio of bond holdings to weight it more heavily to longer-term securities.

Such a move that would fly in the face of Republican objections to Fed activism.

Top GOP congressional leaders wrote to Fed Chairman Ben Bernanke this week urging the central bank to desist from further economic interventions, echoing criticism voiced by Republican presidential candidates in recent weeks.

Fed officials, however, believe that by shifting their bond holdings they could encourage mortgage refinancing and push investors into riskier assets, such as corporate bonds and stocks, without stoking a run-up in consumer prices.

Members of the Fed's policy-setting committee are expected to announce their decision at about 2:15 pm at the conclusion of a two-day meeting.

Faced with a lofty 9.1 percent unemployment rate, consumer and business confidence sapped by a troubling US credit downgrade, and an escalating sovereign debt crisis in Europe, Fed officials have signaled they would seek to prevent already sluggish US growth from weakening further.

The economy grew at less than a 1 percent annual rate over the first half of the year and analysts have warned of a heightened risk of recession.

"The US recovery has now demonstrated a renewed loss of momentum, one now joined by a more pronounced slowdown globally," TD Securities economist Eric Green said. "In this environment the Fed will remain in crisis management mode."

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|