|

WORLD> America

|

|

FBI hands Allen Stanford fraud charges in Virginia

(Agencies)

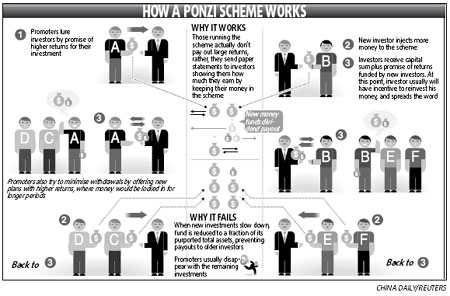

Updated: 2009-02-21 08:05 Texas billionaire Allen Stanford, accused of an $8 billion fraud that spooked investors around the world, was served with the formal complaint on Thursday by FBI agents in Virginia. FBI spokesman Richard Kolko said the Federal Bureau of Investigation had acted at the request of the US Securities and Exchange Commission (SEC), and that Stanford had not been arrested. No criminal charges have been filed against him. A law enforcement official said Stanford was making arrangements to surrender his passport. Stanford holds dual US-Antiguan citizenship, and has homes in the United States and the Caribbean. The whereabouts of Stanford, 58, had been the subject of intense speculation since he failed to respond to a subpoena from the SEC to answer questions about his company's operations. The SEC filed civil charges in Dallas, Texas, on Tuesday against Stanford, two colleagues and Stanford International Bank Ltd, Stanford Group Co and Stanford Capital Management LLC, accusing them of a "massive, ongoing fraud". A court appointed receiver has moved to add Stanford Financial Group and Stanford Financial Group Bldg Inc as relief defendants, along with the other three companies and three people already named in the case. Officials did not say how the FBI learned that Stanford was in Virginia, but they said he had not been hiding and he was not a fugitive. Stanford was found in the area of Fredericksburg, Virginia, about 80km south of Washington, DC. "We're so pleased and thankful to the lord that he's alive," said Stanford's stepmother Billie Stanford. She and his father, James, live in Mexia, Texas. Fallout spreads The SEC has accused the financier and sports entrepreneur of fraudulently selling $8 billion in certificates of deposit with impossibly high interest rates from his Antiguan affiliate, Stanford International Bank Ltd (SIB). The Wall Street Journal reported on Thursday that US federal prosecutors were investigating whether Stanford was operating a Ponzi scheme. In such a scheme, money from new investors is used to pay earlier investors. The scandal, emerging hard on the heels of allegations that Wall Street veteran Bernard Madoff carried out a $50 billion fraud, spooked international investors, and prompted investigations in Latin America and Europe as well as in the US. US federal agents raided Stanford Group Co offices in Miami, Houston and other US cities earlier in the week. Britain's Serious Fraud Office (SFO) is monitoring a possible UK link after media reports that Stanford's books were audited in Britain. Mexico's banking regulator said it was investigating a local Stanford bank unit for possible violation of banking laws. In Caracas, Venezuela, the government seized Stanford Bank Venezuela, one of the country's smallest commercial banks, to stem massive online withdrawals and said there would be an immediate sale of the bank. Another Andean nation, Ecuador, said it was seizing two local Stanford units, a brokerage house and a fiduciary firm. "We will intervene to protect the interests of investors," said Santiago Noboa, the state regulator of the stock exchange in Quito. Peru's securities regulator suspended the operations of a local Stanford unit.

|