TV panels becoming bigger to meet customers' demand

( chinadaily.com.cn )

Chinese TV panel manufacturers are investing heavily in large-size screens with high-definition and cutting-edge technologies, a move that China's display panel industry hopes will help it to make headway against overseas competitors.

Shipments of liquid crystal display (LCD) TV panels worldwide totaled 284 million last year, up 8.4 percent year-on-year, according to a report released by Beijing-based market researcher Sigmaintell Consulting.

Affected by the slowdown in the global economy, and consumers' limited purchasing power, TV panel supply has surpassed demand. Manufacturers are facing severe challenges due to falling panel prices, the report said.

BOE Technology Group Co Ltd, a leading domestic display producer, topped the global list for LCD TV panel shipments, shipping 54.3 million TV panels last year, up 27 percent year-on-year. LG Display followed with 48.6 million panels and Innolux Display Group with 45.1 million.

Sigmaintell estimated that large-screen TVs will witness explosive growth, and the proportion of 65-inch panels will increase to 7.3 percent in 2019, fuelled by the increased demand from both the consumer and commercial markets.

At the same time, super-large panels, at 75 to 86 inches, will also usher in rapid growth, injecting new vitality into the market this year, the report forecast.

Sigmaintell predicted that 276 million LCD TV panels will be shipped globally in 2019, down 2 percent from a year earlier.

After BOE's Gen 10.5 TFT-LCD production line entered operation in Hefei, Anhui province, in December 2017, the company's production capacity increased by over 40 percent in 2018 year-on-year, according to Sigmaintell. The plant produces high-definition LCD screens of 65 inches and above.

BOE's products structure has optimized, with its 75-inch TV panels ranking first in the global market last year.

"China's semiconductor display industry has taken large steps forward in the past decade, changing the display industry's global competitive landscape. China has transformed into the world's largest consumer market and manufacturing base for display terminals, with huge market potential," said BOE Vice-President Zhang Yu.

BOE announced in November it had developed China's first 55-inch 4K organic LED display using inkjet printing technology, which will break South Korea's monopoly in the field of large-sized OLED panels.

The technology not only greatly improves the utilization rate of organic materials, but also significantly reduces costs.

LG Display is currently the world's only supplier of large-sized OLED panels for televisions.

"The traditional LCD TV market is almost saturated and OLED TVs with innovative designs are in line with ongoing consumption upgrading," said Dong Min, vice-president of market consultancy All View Cloud.

Shenzhen China Star Optoelectronics Technology Co Ltd, a subsidiary of Chinese consumer electronics giant TCL Corp, said in November its Gen 11 TFT-LCD and active-matrix OLED production line had officially entered operation. The facility produces 43-inch, 65-inch and 75-inch LCD screens.

Li Dongsheng, chairman of TCL, said after the completion of the new production line the company will continue to innovate, enhance its competitiveness and ramp up efforts to build Shenzhen in Guangdong province into the world's largest semiconductor display industry base.

In addition to large screens, the company started to build a sixth-generation low-temperature polysilicon active-matrix OLED display panel production line in Wuhan, Hubei province, in 2017.

With an investment of 35 billion yuan ($5.17 billion), the facility will produce small and medium-sized high-resolution display panels that are flexible and foldable for high-end smartphones.

China is expected to replace South Korea as the world's largest flat-panel display producer this year, according to a report from the China Video Industry Association and the China Optics and Optoelectronics Manufacturers Association.

Chen Lijuan, an analyst at Sigmaintell, said panel manufacturers should not just invest in production lines, but also pay more attention to the establishment of the whole supply chain, including raw materials, equipment and technology.

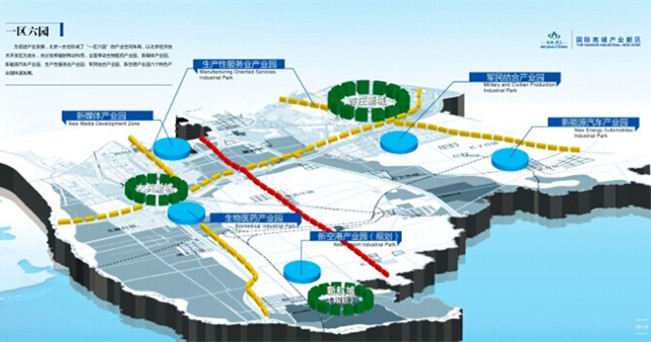

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500