Fintech reshapes finance, challenges regulation, say experts

( chinadaily.com.cn )

|

|

Andrew Chi-Chih Yao, winner of A.M. Turing Award in 2000,makes a speech on the 2nd China Fintech Conference Agenda held in Beijing on Sept 17, 2017.[Photo provided to chinadaily.com.cn] |

Andrew Chi-Chih Yao, winner of A.M. Turing Award in 2000 and dean of Institute for Interdisciplinary Information Sciences, Tsinghua University, said while Fintech in the United States is more for improving efficiency of current financial services, Fintech in China has come up with many totally new financial products.

"Comparatively speaking, Fintech is progressing in a more conservative way in the United States' matured market , but in China, it has rocketed for years, into an unknown area," said Yao.

In Zhu's opinion, the biggest shockwave from Fintech is for regulation and legislation as the entire ecosystem has been undergoing fundamental changes and this process is still unfinished.

Zhu said that when finance's role can be played internally, regulations levied on financial institutions can deal with all problems, but under the premise of Fintech, regulation has to go from an institutionally based structure to a functionally based structure. In addition, regulation has to be evolved from being static, single region-based to being cross-region or even cross-border.

"Rules-based regulation cannot give guidance to Fintech companies, while principles-based regulation cannot cover their development, so, previous regulation models seem rather helpless," Zhu added.

"Furthermore, when regulation faces such an eco-system change, laws also need to change," said Zhu.

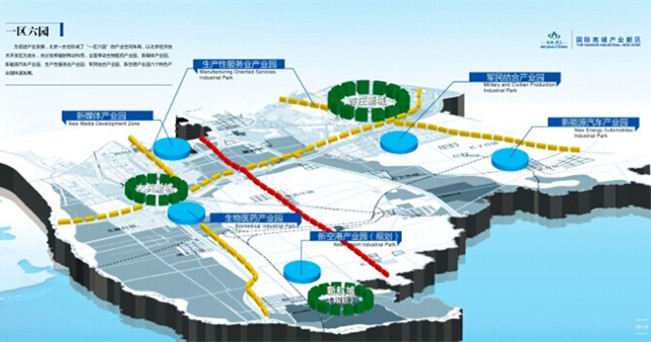

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500