|

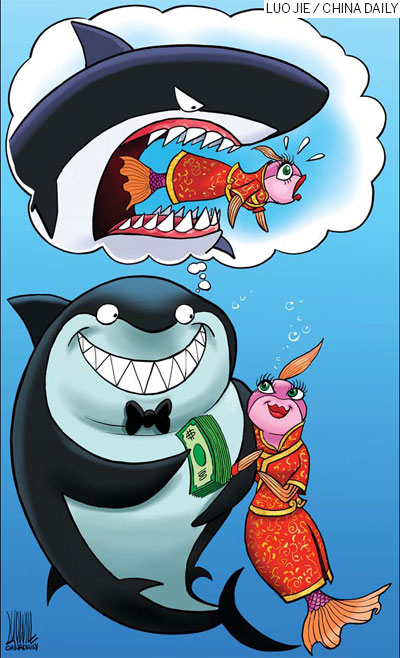

Chinese find foreign partners wanting a greater piece of the pie

To John Deere, a Fortune 200 American business, the largely untapped Chinese market might have seemed so lucrative that a joint venture with a small Chinese company might not have been enough to satisfy its appetite.

As an agricultural machinery manufacturer, John Deere is headquartered in the mid-western United States city of Moline, Illinois, which has a population of only 43,000. But, after it got a foothold in China, the world's fastest-growing economy, the multinational went looking for much more.

"What they want is total control and to put their label on our product," said Chen Gang, general manager of the Xuzhou XCG John Deere Machine Manufacturing Co, a joint venture with John Deere.

John Deere formed it with XCG, a construction equipment manufacturer in Xuzhou, Jiangsu province, owned by the Xuzhou Bohui Construction Machinery Group.

"We've been suffering from this failed marriage with John Deere," Chen said in an interview with China Daily.

"And now we're really tired."

Acquiring the Chinese partner's intellectual property rights and know-how, might have given John Deere a chance to compete with its major rival back home, Caterpillar.

As it hopes, with the joint venture as its sprint board, the American agricultural equipment producer, which doesn't own industrial excavator design and production technology, could gain a foothold to enter into China's buoyant excavator sector.

XCG was formerly known as the Xuzhou Xuwa Excavator Machinery Co, a subsidiary of Xuzhou Bohui Construction Machinery Group Co, and ranked one of China's top three excavator producers in 2007, along with the SANY Group and Liugong Machinery Co.

The year 2008 marked a turning point for the Chinese company when it sold a 50-percent stake to John Deere for 330 million yuan, establishing the 50-50 joint venture.

"At the time, we simply wanted the JV to bring advanced Western management and capital to help our company develop best in a booming market," said Chen.

The backdrop was China's boom in infrastructure spending and a growing excavator market. Between 2000 and 2010, excavator sales went from 10,000 units, a year, to 165,000. Last year alone, the number of excavators sold in China soared to 165,804, an increase of 78.25 percent from the previous year.

What the XCG partner did not expect, however, was that the new-comers did not necessarily have their Chinese counterpart's interests in mind.

Fight for control

One year after the joint venture deal was signed, John Deere said it wanted a controlling stake in September 2009. The surprised XCG turned the offer down, and after that, Deere tried various other ways to get a controlling stake.

Then, when production capacity could not meet the growing market demand, the two parties agreed on a third round of capital input at a board meeting, to expand production, in November 2009, Chen said.

Then, in the midst of the capital flow, John Deere said it wanted to put another director on the board, thereby changing the ratio of each side's board members from parity to 3:2, a structure that guarantees John Deere's boardroom control.

"Deere said that if XCG didn't allow them to control the company, they wouldn't allow the capital increase to go through," Chen said.

XCG did not like the deal, so the capital flow dried up and the production expansion plan ground to a halt.

"Over the following months, John Deere didn't give up trying all kinds of ways to take control," Chen recalled.

One way was to use the law. In December 2009, it accused XCG of breach of contract by using an improper land title for the JV factory.

According to the initial contract, if one party reneged on the deal, the other had the right to acquire that party's shares. It turned out that the deed was valid, according to the Tongshan County government.

Competing interests

The saga took a further twist this past May when John Deere announced it would put $60 million into an engine-production facility in the Tianjin Economic and Development Area. One of the production lines was for the Series 9 excavator, the technology of which was jointly developed, so it was the exclusive property of the JV, Chen explained.

Samuel R. Allen, chairman and CEO of John Deere & Company, said at the JV's first board meeting, in 2008, that his company would have only three excavator productions bases worldwide, one of them is the China JV. Then, John Deere applied for an evacuator production license for its Tianjin Subsidiary, last May.

"That means they had the scheme in mind very early and had a roadmap already when they began the JV cooperation. Now we understand what they were trying to do from day one, namely, take our technology to develop a competing business," said Fu Jian, chairman of the board of the Xuzhou Bohui Construction Machinery Group Co.

But, according to Louis Meng, a partner at the Albright Law Firm, in New York and Washington DC, "Some tactics, like setting up a new competing excavator plant in Tianjin to manufacture excavators developed by the JV, is in a legal gray area."

And, the US company deployed other iron-fisted tactics. Early last year, John Deere insisted that they would not press ahead with the technology research and development center at XCG, that they had initially promised - until they got a controlling stake.

They also threatened that they would not allow the company to go public unless they got a majority stake, said Fu.

Alternative tactics

All of these efforts turned out to be in vain, so the American giant, a multinational, turned to the Xuzhou government, which they thought was eager to attract foreign direct investment to boost the local economy, in the same way most governments in China's underdeveloped areas were doing.

The Americans said that if the government would support them in getting a controlling interest, they would inject $350 million into the JV.

Through local government mediation, John Deere offered 165 million yuan for XCG's 50-percent stake, this past March.

That 165 million yuan covered 70 million yuan the JV owed BHCM and 70 million yuan worth of BHCM assets. So the actual bid price was only 25 million yuan for the 50 percent ownership, said Fu.

The JV reported registered capital of 378 million yuan, and total assets of 650 million yuan by the end of last year.

"We can't sell our assets at such an unreasonably low price," said Fu, also the former general manager of Xugong Group Construction Machinery, who fought against an ill-fated buyout offer of Carlyle to take control of his company.

"If they thought a 50-percent stake in the company was worth only 25 million yuan, we said we'd buy their 50-percent stake for an even higher price than 25 million yuan, but John Deere declined," said Fu.

The dispute was going nowhere, so the county government proposed they break up the JV earlier this year, with the two parties keeping their own separate production unit.

"John Deere objected. What they really want is just to own the whole company," Fu said.

Because John Deere stopped the third round of capital input, the company did not have sufficient funds to finance the expansion, so sales and profits have been sluggish recently.

Back in 2007, before it became a joint venture, XCG sold 500 excavators. Sales stayed flat the next few years. In 2008, only 512 sold; in 2009, it was 440; and in 2010, only 650, after the joint venture was set up. They had missed the opportunity to cash in on the increase in sales nationwide.

During negotiations, John Deere took sole control of international marketing and promised to sell the JV's products through its global network of around 100 offices.

But, according to Chen Gang, "Not one product was sold outside China. John Deere said that, to sell JV product overseas, it would have to take control of the company."

In fact, before the JV was formed, XCG had been selling its products overseas.

Chen said that if John Deere is neither willing to go with the 50-50 split, nor show some sincerity by paying a fair price for the stake, they should go to Hong Kong for mediation.

China has become the world's largest excavator producer and market. Sales of construction machinery were worth $131 billion worldwide in 2010, with the China share exceeding 400 billion yuan, according to statistics from the China Machinery Industry Federation.

The report predicts China's construction market to more than double to $2.5trillion by 2020, accounting for 21 percent of the world's total.

|