Ready to go

By Alfred Romann ( China Daily Europe )

Updated: 2013-10-25

|

|||||||||

E

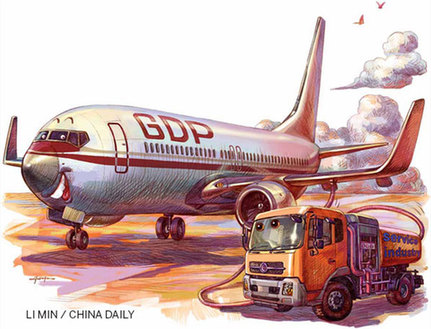

xpansion in services will see jobs market take off and give China sustained growth

Acrowd of celebrities descending on a seaside Chinese town made famous by a beer brand seems like an unusual way to mark a signifi cant economic shift but, even if it was unintentional, that is exactly what happened. The weekend of Sept 21 was a busy one in Qingdao, the seaside city in East China's Shandong province. It is there that Wang Jianlin, the richest man in China, wants to build a world-class movie town.

To mark this decision, Wang flew in some of the world's most famous movie stars. Leonardo DiCaprio and Nicole Kidman were there. Harvey Weinstein and Kate Beckinsale were there. So were Ewan McGregor, John Travolta, Zhang Ziyi, Jet Li and Tony Leung. They were essentially just co-stars because Wang was the real star of this particular show.

Wang owns Dalian Wanda Group, a conglomerate with interests in entertainment, hotels, and real estate that also happens to be the largest owner of cinemas in the world after it bought AMC Entertainment's theaters in the US.

Wang had brought all the celebrities to China for a big party to announce an $8-billion

(6 billion euros) mega studio and theme park. The tentatively named Qingdao Oriental Movie Metropolis and its 20 films studios and theme park would add significantly to the services column in China's GDP calculation.

This year is particularly signifi cant in that it is likely to mark a turning point in the development of the Chinese economy. For the first time in recent history, the service sector is expected to zoom past industry. Last year, services accounted

for 44.6 percent of gross domestic product while industry was responsible for 45.3 percent. Figures for 2013 are not out yet but services have been growing at a faster rate than industrial production.

"The service sector is not that mature compared with the industrial sector," says Zhao Hong, a researcher at the East Asian Institute of the National University of Singapore. "It is still small but has potential because China is adjusting its economic structure."

Services account for a larger portion of economic output in the more developed economies. About two-thirds of European output is services, and in the US it is about three-quarters.

In China it is less than half, and that to some extent is also why the government is so keen on expanding the service sector. More services mean less reliance on manufacturing for growth. Also, services typically generate more jobs. At the same time, higher spending on services would signal that the Chinese consumer is ready to start splashing out.

Gross domestic product is made up of the value of all goods and services produced in an

economy. In simple terms, it is measured by adding consumption, investment, government purchases and net exports. The consumption category is further divided into goods and services.

Services include products such as insurance, healthcare, tourism and others. Filming a movie would be a service, as would be editing it. A typical tourist on a trip during the week-long National Day holiday at the beginning of October could have bought airline or train tickets (both services) and hotel rooms (another service).

This push toward expanding the service sector was visible again about a week after the celebrity-heavy party in Qingdao. On Sept 29, the China (Shanghai) Pilot Free Trade Zone was officially launched in a much more subdued fashion. In an area of 29 square kilometers, the government plans to allow for full convertibility of the yuan and freer flow of capital, and banks that qualify will be allowed to do offshore business.

Companies will be allowed to import goods directly into the zone before going through customs, but it is service providers such as insurance companies and private hospitals that expect to see the most benefits. In theory, companies both domestic and foreign will be allowed to invest in banks, shipping, entertainment services, schools and more out of the zone.

Even if there are more than 1,000 sectors that still remain off-limits to investors, the zone is likely to help develop the service industry, particularly if the pilot is introduced nationwide.

A few days after the launch of the free trade zone, came the National Day holiday that helped the service portion of the economy grow further after reaching a six-month peak in September. As it turns out, the number of tourists during the period hit a record.

There were so many tourists that much of the feedback was negative, many complaining that the more popular sites around the country were overcrowded, hotels were full and that restaurants were operating beyond capacity.

On the positive side, the growing number of tourists suggests that Chinese people are willing and able to spend. It does not necessarily suggest a return to double-digit economic growth but it may be useful anecdotal evidence of continuing growth.

Promising data

And the latest numbers, both official and private, suggest China's service sector grew faster last month than it had in the previous six months even as growth in other areas remains slack due to weak demand at home and abroad.

The official purchasing managers' index for the non-manufacturing sector rose to 55.4 in September from 53.9 in August. It was the highest reading since March, according to the National Bureau of Statistic, which compiles the numbers with the China Federation of Logistics and Purchasing. A number above 50 represents growth.

"The index reflected strong growth in consumption services represented by retail, thanks to the holiday factor in September," says Cai Jin, vice -chairman of the China Federation of Logistics and Purchasing. "It also showed that restructuring policies had boosted demand in the service sector."

The HSBC/Markit Services PMI, which came out on Oct 8, painted a slightly different picture, coming in at 52.4 for September compared with 52.8 in August as both manufacturers and services providers raised their prices in response to higher costs.

The service sector continues to grow but the growth is increasingly subdued.

"Combined with the gradual improvement of the manufacturing PMI, the Chinese economy is still on the way to modest recovery," says Qu Hongbin, chief economist for China and co-head of Asian economic research. "But a more consolidated and sustainable recovery requires structural reforms."

More than underscoring a continuing rebound in economic activity, increasing non-manufacturing activity underscores the government's efforts to change the structure of the country's economy.

For the time being, the service sector remains mostly protected across the country. Foreign players that can invest with ease in most industrial sectors have a more difficult time investing in services such as accounting, banking or legal services. The new Shanghai free trade zone could mark the beginning of a change and the opening of the sector to international competition but details of what exactly the zone would do are sparse.

"The government is aware that they need to reform. They are losing capacity in the traditional industries," says Stuart Allsopp, head of Asia country risk and financial markets at Business Monitor International, a market intelligence firm. The free trade zone is a move in the right direction, even if details remain sketchy. For example, Allsopp says, foreigners will be able to invest in things like schools.

The current 12th Five-Year Plan (2011-15) calls for services to contribute about 47 percent of GDP by the end of 2015. That would represent a gain of about 2 percent from current levels but would cement services as the biggest single contributor to the country's GDP. Zhao of the East Asian Institute says the target is attainable. Within three to five years, he says, services could account for as much as half of the economy.

China's GDP last year was $8.227 trillion. Services accounted for just under 45 percent of that, a little less than $3.7 trillion, according to official figures.

But these measurements can be subjective. Measuring GDP can be a difficult thing and determining what is a service and what is a good requires myriad small decisions. Somebody has to make a decision about what is a service and what is a good, something that is not always clear-cut. And because avoiding double counting is key to calculating GDP, somebody has to make a decision about what to count. For example, if a tourist buys a plane ticket, is the fuel that the airline buys for that trip counted as a good, or is it only the purchase of the ticket that is counted?

Allsopp from Business Monitor International prefers to look at private consumption to track the growth of services in the economy and private consumption accounts for about 30 percent of GDP, much less than the services tab.

"We think the private consumption data is probably more accurate," Allsopp says. "The service sector is quite underdeveloped. It's not that it is not growing but, relative to the broader economy, it is slowing."

Despite the growth and the emergence of services as the largest single contributor to the country's GDP, services remain relatively underdeveloped in China, which has long focused on manufacturing as an engine of growth.

But this is changing both at home and abroad. China's overseas investments are increasingly focused on the service sector. This push matches both China's interest to invest more and more abroad but also helps countries in places like Asia and Africa develop their own service sectors.

More and more countries in Asia are likely to emphasize services, but it will be a little bit like paddling against the current, Allsopp says.

"It is not something that Asia has a comparative advantage in," Allsopp says. Nevertheless, "as economies do develop, people tend to spend more on services".

ASEAN advantage

The services sector accounts for between 40 and 50 percent of the GDP of most ASEAN countries, according to a paper published in July by the ASEAN Secretariat. The service sector is the fastest growing in the region.

Expanding the trade in services among the 10 members of ASEAN - Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam- is one of the key points of the upcoming ASEAN Economic Community, due to come into being in 2015.

By 2008, about half of ASEAN FDI flows, about $33.5 billion, went to services. Conversely, the export of services out of ASEAN to the world market has grown steadily, rising from just $68 billion in 2000 to $153 billion in 2007.

By 2010, ASEAN countries removed most of the restrictions for investment in four priority service sectors of air transport, e-commerce, healthcare and tourism. By the end of this year, restrictions on the trade of logistics services should be lifted and all other services should be mostly open by 2015.

Increasing integration between ASEAN and more advanced economies such as China, Japan and South Korea will help this process along. China, in particular, is undergoing this shift toward more demand-led production of services at the same time as most ASEAN economies.

On the positive side, this will mean that economies in the region will continue to benefit from continuing growth and reform in China. The creation of the Shanghai free trade zone, which puts emphasis on the trade in services, should help this process.

On the negative side, a slowdown in China would probably spread to economies across ASEAN almost instantaneously.

"The prospects of the APEC region are increasingly linked to China's outlook," ratings agency Moody's Investors Service said in a recent report. Any slowdown in China has an immediate impact on economies in the region, particularly those in ASEAN that are increasingly integrated.

"In recent years, China's impact on the regional economy has been deeply profound and the stabilization in the country's growth cycle could help cushion domestic demand weakness across Asia," says Rahul Ghosh, of Business Monitor International in Singapore.

Even though services account for most employment in China and that growth is visible, the service sector remains relatively underdeveloped compared with the sector in economies such as the US or Europe, where services account for about 75 percent and 60 percent of GDP.

Chinese Premier Li Keqiang has been vocal in advocating the growth of services. Speaking in May, he said increasing the availability and quality of the country's service industries "will help unleash huge potential in domestic demand, and thus offer firm support for stable economic growth and structural optimization".

"China will further open up the service industry and pilot free trade experimental zones to tap development," he said.

For China Daily