World Economy in the Era of Dynamic Adjustment

By Long Guoqiang 2015-08-18

After the outbreak of the international financial crisis, the world economy entered an era of dynamic adjustment and transformation. In the next five years, the world economy will present some different development trends and features. Economic growth will drop back and the world economy will enter a stage of low growth; emerging economies will become the new engine of world economic growth; developed countries will strive to rejuvenate manufacturing industry while developing countries will accelerate foreign investment, both of which will become two new major driving forces to promote the division of global value chain; "innovative development" will attract great attention, emerging industries will gather momentum for development, and competition for possessing a leading position in terms of industrial and technological development will become fiercer; global energy structure and the supply-demand pattern will witness profound changes; the easy monetary policy adopted by developed countries to respond to the crisis will cause worldwide liquidity surplus and intensify financial fluctuation and inflation; global economic governance mechanism reform will be further promoted; and regional integration will become a major form to propel liberalization of trade and investment. Such dynamic adjustments of world economy would bring about a number of changes related to the, external environment for China’s development, and connotations of opportunities and challenges would be different from before. China should adhere to the basic national policy of further opening up and make innovations to the strategy and mode of opening up so as to build up new advantages while avoiding disadvantages and get better prepared to participate in global competition and cooperation in the course of dynamic adjustments of world economy.

I. Major Trend of World Economic Performance

1. World economy enters the stage of low growth

Prior to 2007, the world economy experienced an over-one-decade phase of high growth and prosperity, especially the period from 2004 to 2007, during which the average annual growth rate reached 3.9%, up nearly one percentage point higher than the average growth in the past 30 years. Developed countries headed by the United States played as the locomotive for global economic growth. The high growth was attributed to four major factors: first, technological revolution represented by information and communication technologies and Internet; second, dividend of economic globalization; third, peace dividend brought by disintegration of the former Soviet Union and end of the Cold War; fourth, system dividend resulting from system adjustment and opening up of various countries since 1980s.

The international financial crisis triggered by the American sub-prime mortgage crisis in 2008 put an end to the world economic prosperity. At the end of 2009, as the European sovereign debt crisis broke out, center of the financial storm was shifted from the United States to Europe. Since the top three developed economies, the United States, Europe and Japan, all plunged into depression, overall growth of developed economies in the past two years was only slightly higher than 1%, which also dragged the world economy down a low growth. According to predictions made by DRC relevant task force, the average world economic growth in the next ten years will drop to 2.9%, distinctly lower than the 3.6% average growth in the five years prior to the financial crisis and the 3.1%-3.2% growth in the 20 years prior to the crisis.

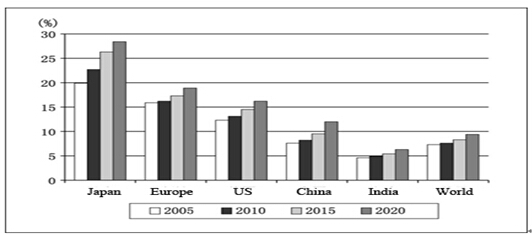

Low world economic growth in the future is caused by various reasons. The first is the impact of the international financial crisis. Developed countries generally face such structural problems as high debt, high deficit, high unemployment and low saving. It will take a long period of time for the United States and Europe to get out of the difficulty, and it is no easy job for their governments, enterprises and households to renovate balance sheets through "de-leverage"measures. The second is the fact that the world economy is at the downturn stage of the Kondratieff Cycle. The new round of industrial revolution is still brewing and unlikely to become the major driving force for world economic growth in the next five years. The third is the rapid population aging in developed countries and China (illustrated as below). The total dependency ratio of global population will start to rise since 2015, which will exert a negative influence over saving rate and investment rate.

Prospect of population aging in major economies (percentage of population aged above 65)

Source: The United Nations database, and figures on 2015 and 2020 are predictive mean value. Quoted from EU Economic Fundamentals and the Trend by Luo Yuze.

2. Emerging economies become the new engine of world economic growth

Developed countries take up a great share in the world economy and have been the major engine of global economic growth for a long time. In the next five years, as their economic growth slows down and share in global economy declines, their contribution to world economic growth will substantially decrease. Emerging economies will make more important contribution to the world economic growth and become the new engine.

Share of emerging economies in the world economy continues to increase. Regarding economic aggregate, from 2000 to 2011, share of G7 that represents developed countries in the world decreased from 66% to 48%, while that of E24 increased from 16% to 29%, approaching two thirds of G7. As for increment of economic growth, from 2008 to 2011, global economic aggregate only grew by 6.4%, among which nearly 90% was contributed by developing countries. In the next five years, economic growth of developed countries will remain low in general, while developing economies will become the new locomotive of growth. As estimated by International Monetary Fund, from 2012 to 2017, share of EU in global GDP will drop from 23% to 20.2%, US from 22% to 21.3%, and Japan from 8.4% to 7.1%. According to the research report Global Trends 2030: Alternative Worlds newly released by US National Intelligence Council, GDP growth of China from 2000 to 2020 will account for 55% of global GDP growth. What need to be pointed out is that as economic globalization deepens, various economies will be further closely inter-dependent and emerging economies will inevitably be affected by low growth of the developed countries. Though growth of emerging economies will be higher than developed ones, it will slightly drop compared with previous records.

The role played respectively by emerging economies and developing countries in global trade and investment is getting increasingly important. Statistics of the World Trade Organization in Handbook of Statistic 2012 show that in terms of trade volume, from 2000 to 2011, share of G7 in global import dropped from nearly 50% to 37%, while E24 increased from 16% to 28%. In 2011, share of developing countries in global finished goods export rose to 40.4%. With respect to cross-border investment, from 2000 to 2011, share of G7 in global foreign direct investment stocks fell from nearly 72% to 53%, while E24 climbed from 3% to 8%. As for investment flow, in 2011, share of cross-border investment by developed countries in the world declined from 84% in 2007 to 73%, while that of foreign investment made by developing countries increased from 13% to 23%. With regard to investment influx, in 2012, FDI received by developing countries reached USD680 billion, surpassing the developed world for the first time in history by a big margin of USD130 billion.

…

If you need the full text, please leave a message on the website.