-

News >Bizchina

Getting a handle on flow of hot money

2010-08-11 09:03

They have been blamed for pushing up housing prices to unaffordable levels and fueling a mining industry that is fraught with catastrophe. Yet, the image of investors from Wenzhou - one of the richest cities in China - could be about to change.With policymakers attempting to better direct the flow of hot money, entrepreneurs from this famed East China metropolis are turning their attention to more sectors.

State-owned enterprises (SOEs) have for decades dominated infrastructure and clean energy projects, as well as the health, education and financial services sectors. However, government regulations issued in the last few months have opened the door to more private input.

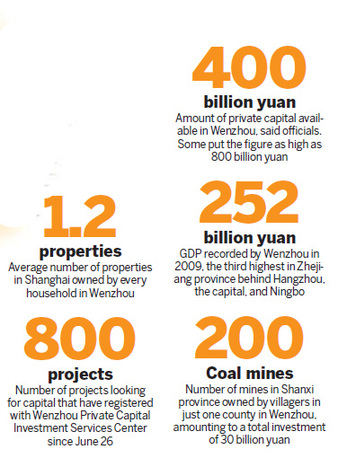

Investors from Wenzhou, which sits on Zhejiang province's southeast coast and boasts about 400 billion yuan ($58 billion) in private capital, have been quick to get on board and are already drawing up ambitious plans.

One of them is Wu Lei, 58, who has been involved in advertising and property development for two decades. He is now planning to bid for a water treatment project in Heilongjiang province.

"We're all ready and poised for take-off," said Zhou Dewen, director of the Wenzhou Small and Medium-sized Enterprises' Development Association. "All we're waiting for is to see how the new policies are implemented by the ministries and provincial government."

Although some remain cautious, the government has assured that guiding private investment into public sectors is a priority for China's future economic reforms.

"We wouldn't be pushing up the prices of coal or property if there were better channels for us to invest," said Chen Xiaowu, a shareholder in Zhongqing Hengsheng Investment in Wenzhou, who said his company is considering to move into financial services. "The policy will benefit everyone if it is well implemented."

Following two notices about the policy in May, the State Council met on June 30 and released a statement emphasizing the need to "speed up reforms in sectors dominated by SOEs and encourage private capital to enter through mergers and acquisitions."

Following two notices about the policy in May, the State Council met on June 30 and released a statement emphasizing the need to "speed up reforms in sectors dominated by SOEs and encourage private capital to enter through mergers and acquisitions."A report issued last month specified the ministries responsible for implementing the policy in various sectors.

"The gates are now open," said Chen, "but without detailed rules on how to enter and operate in each sector, most private investors will have to wait outside."

Developing private capital will help China's economy to become more market-oriented, say analysts. Yet, accomplishing this goal will not be easy.

Speaking about the financial sector, the boss of a credit company in Wenzhou who did not want to be identified said there are many rules defining private investment that do not fit with the new policy and urgently need changing.

However, Huang Fajing, board member of Rifeng Group, insisted the revised rules will level the playing field between private businesses and SOEs.

Making money

Wenzhou has a long history of manufacturing - shoes, leather, embroidery and blue china - and during the Southern Song Dynasty (1127-1279) was nicknamed "Little Hangzhou".

It was among the first 14 coastal cities opened to the outside world when China launched its ambitious reforms more than 30 years ago, prompting many residents to start small businesses with money from friends and relatives. The model is today regarded as the first example of capital investment in China.