G20 should push forward intl financial regulation

Updated: 2013-09-06 21:24

(Xinhua)

|

|||||||||

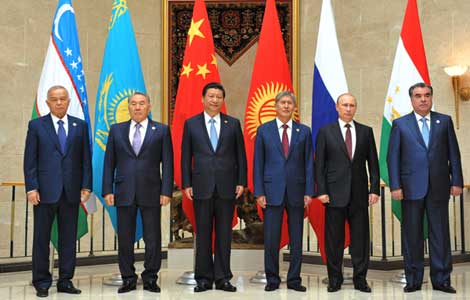

PARIS - Financial regulatory reform is one of the major priorities of the ongoing G20 summit in Russia's St Petersburg, due to its significance to global economic stability and sustainable growth.

The group should seek to increase the input of emerging economies and developing countries on the international financial system and push the reform forward based on equity.

Since the start of this year, the anticipated US exit from its quantitative easing (QE) program has frequently triggered turbulence on the global capital market against the backdrop of an international financial mechanism with the US dollar as the core.

What's more, some emerging markets were exposed to shifting capital flows, currency devaluation, and slow economic growth.

Statistics show some emerging economies' currency exchange rates against the US dollar, including the Brazilian real, Indian rupee and Thai baht, have hit the lowest point in recent years, which has brought considerable risk for economic stability.

Experts say the difficulty now facing emerging economies is connected to the US dollar, which is unable to appropriately play the role of major international currency within the current monetary system.

The US dollar's circulation depends on US monetary policy, and the latter is decided by its domestic demand, which means the adjustment of monetary policy takes the US interest as priority, so emerging markets will be inevitably subject to a "US dollar trap."

Therefore, the G20 members should take the opportunity to push forward international financial regulation.

Firstly, they should promote ratification of the 2010 IMF Quota and Governance Reform, a package which includes a shift in quotas to dynamic emerging markets and under-represented countries.

Secondly, they should further step up supervision on international financial markets to make the financial system truly reliable.

Thirdly, they should reform the basket of currencies for special drawing rights, to enhance the connection among international and regional financial cooperation mechanisms and establish a firewall against financial risks.

It is impossible to complete financial reform overnight, so emerging economies will need solidarity to resist external risks.

Related Stories

Global opinion leaders praise Xi's G20 speech 2013-09-06 16:26

Obama, Putin meet for G20 at St petersburg 2013-09-06 15:07

China expects further co-op at G20 summit 2013-09-06 13:43

World leaders pressure Obama over Syria at G20 summit 2013-09-06 10:21

Schedule