Society

Tide yet to turn for Chinese yachting

By Wang Chao (China Daily)

Updated: 2010-08-21 10:53

|

Large Medium Small |

|

|

|

A vessel looks for moorage on Monday in the busy Qingdao Olympic Marina in East China's Shandong province, which is home to more than 300 yachts. [Cui Meng / China Daily] |

QINGDAO, Shandong - Dong Yongquan has been under intense pressure ever since the Beijing Olympic Games ended in 2008. As the president of Qingdao International Yacht Club, he is running the 15.5-hectare harbor built for Olympic yachting events - and is supposed to turn a profit.

"The harbor is eating up 50,000 yuan (about $7,350) every day in maintenance costs and if I don't attract enough members, I can lose millions every year," Dong said.

"To achieve this may take another five years, given the condition of the yacht business in China."

Dong has a problem other maritime clubs in China face: not enough rich people going into leisure yachting, although money is not an issue.

Yachting magazine editor Wu Chenguang said for most of the new rich, "cars and villas are still their first choice and it is difficult to change this mindset overnight".

"If the yachting industry in Europe is generally into Mercedes-Benzes, we are still in the level of Chery QQ," said Wu. Chery QQ refers to a low-cost car made by a Chinese carmaker.

The history of leisure boating in Western countries indicates that when per capita income is about $3,000, the industry starts to develop. When this figure reaches $6,000, it starts to boom.

"With China's per capita income at $3,700, people are just beginning to know boats and yachts," Wu said.

People took to yachting in Europe more than 100 years ago and in Denmark now, there is a boat or yacht for one out of every 15 people. In New Zealand, the ratio is even higher, one in six.

While the number of Chinese yacht owners is still quite low, several hundred companies produce boats domestically. And about 30 percent of them, mostly in the Pearl River Delta, make parts for European and American companies.

Wu estimated that there are about 100 companies capable of manufacturing mid- to high-level yachts in China.

"Some companies are still producing fiber reinforced plastic, a material needed to build mid- to low-end yachts for foreign companies." Wu said. "It requires little technology but generates serious pollution."

Some companies, however, are not satisfied in doing assembly work; Qingdao Nauticstar Marine Co Ltd is one of them.

General manager Hou Jie told China Daily that its luxury series are "the best" in China.

"We incorporate Chinese elements such as wood carving and enamel into the design so that we can form our own style in the international market," she said.

Hou dubbed these yachts "son of dragon" and sells them in a range between 6.8 million yuan and 10 million yuan ($1 million to $1.47 million) - equivalent to a mid-level yacht imported from Europe.

Last year, sales reached 100 million yuan, more than double the number in 2007, with 60 percent overseas customers.

"We now have distributors in 22 countries in Europe, mostly in Mediterranean countries," Hou said.

However, compared with European counterparts such as Sunseeker, with an annual output value of more than 1 billion euros ($1.28 billion), Nauticstar is far behind, as are most manufacturers in China.

Most domestic yachts are produced in coastal cities such as Tianjin, Dalian, Qingdao, Shanghai and Shenzhen, where there are berths.

"The domestic yacht business began in 2004, when yacht harbor infrastructure became available in some coastal cities," Dong said.

That is when many provinces began placing the yacht manufacturing industry on their radar.

Last year, the southern province of Guangdong put yacht manufacturing in its annual investment plan while in the northern city of Tianjin, two yacht manufacturing proposals became part of its blueprint at the end of last year.

At the 2009 Qingdao yacht exhibition held in the eastern port city in Shandong province, the number of deals closed was 50 percent more than the previous year's show, said He Xiaoyan, who was in charge of the exhibition.

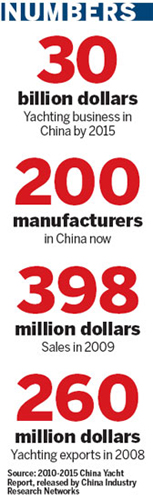

The 2010-15 China Yacht Report, released by China Industry Research Networks, says the market has the potential to reach $30 billion over the next five years.

But the goal is not expected to be easy to achieve. Analysts say that, unlike cars, most high-end yachts are designed according to customer needs.

"But the problem is we don't have enough yacht experts in China, and our universities don't even have yacht design as a major," Hou said.

Since design and decoration are essential, many Chinese companies have to spend millions of dollars to hire experts from Europe and the US.

At the same time, complicated approval processes for yachting have put off many potential buyers. For example, owners have to apply to a local Maritime Safety Administration before they sail. If they want to sail to another country, the procedures are even more complicated.

Taxes levied on imported yachts - 43.6 percent - also deter many people.

"Lack of infrastructure is another big problem," Dong said. "In the south of France, the number of yacht berths is very high while in China, it is still hard to find a high-quality yacht berth."