|

CHINA> Focus

|

|

Blocks on the road to Riches

By Dan Chinoy (China Daily)

Updated: 2009-11-13 09:36 Ten years ago, Lu Xuetao's livelihood depended entirely on two pigs and a handful of chickens. A poor farmer in Hebei's Yixian county, just two hours from Beijing, he lived virtually untouched by China's dramatic economic growth, rising standards of living and rapidly expanding opportunities.

That all changed in 1999 when a small organization called Funding the Poor Cooperative (FPC) offered him a loan of 1,000 yuan ($140). Lu used the money to buy a new pig and paid the loan back easily. It was a vital springboard and, after a decade of help from FPC, his farm has expanded to almost 80 pigs and more chickens than he can count. His annual income has also soared to 30,000 yuan. "I couldn't have done it without the loans. I just wouldn't have had any other options," said Lu, who in his collared shirt, glasses and faux leather shoes looks more like a computer programmer than a Chinese farmer. This, advocates say, is the promise of microfinance in China: opportunities for those largely forgotten by the country's economic development.

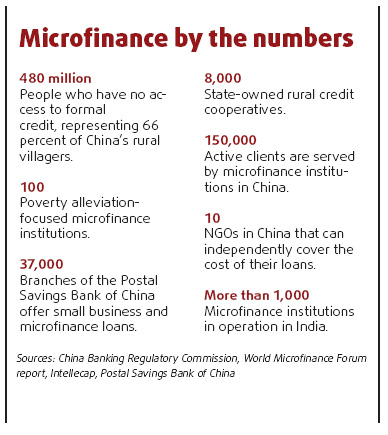

But despite almost 15 years of research, pilot projects, advocacy by non-governmental organizations (NGOs) and the State Council's renewed focus on poverty reduction, stories like Lu's are still rare in China. As Yunus joined China's microfinance experts in Beijing for a major conference last month, it was clear the sector faced a daunting array of problems that have stymied its development, including inadequate or overly restrictive government regulations, complex logistical challenges, poor risk management, a lack of expertise and insufficient funding.

In contrast, there are more than 1,000 such microfinance institutions in India, according to Intellecap, an India-based social investment consultancy, and that does not include the millions of informal "self-help groups" of 10 to 15 women who receive and distribute small loans from the country's 500 or so formal banks. Grameen Bank alone has nearly 8 million customers worldwide. "The development of microfinance in China lags far, far behind the rest of the world," said Bai Chengyu, chairman of the China Association of Microfinance, to which most microfinance organizations in China belong. When Du Xiaoshan, a poverty alleviation researcher for the Chinese Academy of Social Sciences, founded FPC in 1993, things looked more promising.

|

|||||||||