Top Bush aides oppose bills pressuring China

(Agencies/chinadaily.com.cn)Updated: 2007-08-01 08:42

WASHINGTON - US Treasury Secretary Henry Paulson and other top Bush administration officials warned on Tuesday of risks to the US and global economies if Congress passes legislation aimed at punishing China for its currency policy.

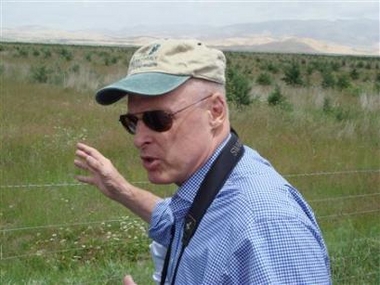

US Treasury Secretary Henry Paulson views a reforestation area aimed at combating the advancement of desert near Qinghai Lake in western China July 30, 2007. [AP]  |

Treasury Secretary Henry Paulson, Commerce Secretary Carlos Gutierrez and US Trade Representative Susan Schwab argued in a letter to congressional leaders that two Senate bills could undermine the administration's efforts to get China to address issues that have contributed to a soaring trade deficit.

"At a time when US exports are growing globally, such legislation also exposes the United States to the risk of 'mirror legislation' abroad and could trigger a global cycle of protectionist legislation," the three top officials said in a joint letter to senior senators.

One senator said it was incorrect to raise the threat of retaliation by China as a reason to oppose the legislation.

"If we manipulated our currency, then China should go after us. But we don't," said Sen. Charles Schumer, D-N.Y.

Sen. Max Baucus, D-Mont., disputed the administration's contention that the current system for policing misaligned currencies was working. He said his proposal would provide the administration with "a new approach, new tools and new incentives" to crack down on nations that were undervaluing their currencies.

"We recognize that many Americans are concerned that China's currency is undervalued and that the pace of economic reform is too slow, to the detriment of American businesses and workers. We share this concern," the Bush officials said. "However, these bills will not accomplish our shared goal of persuading China to implement economic reforms and move more quickly to a market-determined exchange rate."

Paulson was scheduled to meet Chinese President Hu Jintao in Beijing on Wednesday as he wraps up a three-day trip designed to defuse congressional demands for sanctions against China. The administration hopes to show that China is moving more quickly to implement reforms as part of an effort to narrow last year's $233 billion trade deficit with China, the largest ever recorded with a single country.

The Senate Banking Committee is scheduled Wednesday to take up legislation sponsored by Committee Chairman Christopher Dodd, D-Conn., and Sen. Richard Shelby of Alabama, the top Republican on the panel.

Last week, the Senate Finance Committee approved by a 20-1 vote a measure sponsored by the leaders of that panel that would propose various punishments for countries with a "fundamentally misaligned currency."

The penalties in the Finance Committee bill, sponsored by Baucus and Charles Grassley, R-Iowa, would include using the amount that the currency is undervalued to determine tariffs imposed in cases where countries are found to be selling products in the US market at below fair value.

The Finance measure is also sponsored by Schumer and Lindsey Graham, R-S.C., who last year were pushing a more draconian bill that would have imposed 27.5 percent tariffs on all Chinese imports if China did not move more quickly to revalue its currency.

American manufacturers contend the Chinese currency is undervalued by as much as 40 percent, giving that country a tremendous competitive advantage against US products.

The administration officials argued in their letter that the best approach for success was through continued use of the strategic economic dialogue which requires the two countries to hold two meetings a year to discuss economic issues. These high-level talks started last year in Beijing with the second session held in Washington in May.

"The best way to achieve results in through continued intensive dialogue and engagement with China bilaterally and through multilateral institutions," the three officials said.

Certain provisions of both Senate committee bills "appear to raise serious concerns under international trade remedies rules and could invite WTO-sanctioned retaliation against US goods and services," they warned.

|

||

|

||

|

|