Local debts surge to nearly $3t

Updated: 2013-12-31 07:43

Lu cited the central government's "very low" ratio of debt to GDP, which stands at 21 percent.

As almost all government debt is denominated in China's own currency and held domestically, "the People's Bank of China can prevent a public debt crisis with its unlimited capability for liquidity supply", Lu said.

Lu added that China is protected by national savings that include $3.5 trillion in foreign exchange reserves. Further, its central and local governments have solid assets, and the country still enjoys high economic and fiscal revenue growth.

Song Li, a local government researcher with the Academy of Macroeconomic Research under the National Development and Reform Commission, said the growth of the debt is in line with the development of the country's infrastructure and other construction.

"China's urbanization requires huge amounts of financing in infrastructure and other areas. So it is natural to see the rapid rise of debt. Unlike debts in Western countries, which are consumption-oriented, most of China's debts were transformed into property and could yield stable returns," he said.

The NAO's report showed that of all the local government debts, the largest portion, or 32.4 percent, was invested in municipal construction. The second-largest portion, or 22.9 percent, was invested in transportation.

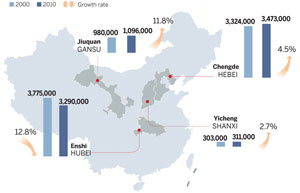

The result also revealed that China's prefectural level governments had raised the largest debts, or 27 percent of the local debt. County-level governments accounted for the second-largest amount, or 22.1 percent.

There are also risks. The result revealed that two provinces, 31 prefectures and 29 counties had repaid more than 20 percent of their debts by raising new debt in 2012.

Also, 37.23 percent of debt repayment involved land sale revenue, a level that was deemed too high.

Many experts have suggested China should boost its municipal bond market to give local governments greater scope for financing, a method that's regarded more transparent and better regulated.

At present, only 10.3 percent of local government debt involves bond issues, the NAO said.

Qi Bin, director of the research center under the China Securities Regulatory Commission, said municipal bonds and asset securitization will be the two major standard methods for future borrowing.

A big share of the debt stems from spending on new airports and other public works as part of the stimulus package that helped China rebound quickly from the 2008 financial crisis.

While Western governments borrowed directly to pay for their stimulus programs, China's debt was concealed temporarily on the books of State banks.

Analysts have warned that the rapid increase in lending could lead to a rise in unpaid loans.

Local governments also borrow to pay for schools and other social programs that are mandated - but not paid for - by the central government.

The total debt burden was obscured because local governments created separate investment agencies to pay for the construction of highways and other infrastructure. Some have run into trouble raising revenues to repay lenders.

Monday's audit report also cited problems including high debts for local industry, heavy reliance by local leaders on land sales to raise revenue and improper activities surrounding some government debt.

Auditors found some 13.5 billion yuan that had been improperly invested in stocks and real estate or spent on unauthorized construction, the report said. It said 69 people were implicated but gave no other details.

Agencies contributed to this story.