Boomtime buys lead to bust

Updated: 2011-12-14 10:37

By Zhou Siyu (China Daily)

|

|||||||||||

Two-thirds of shipping lines report deficits, shipyards fight for orders

BEIJING - For the world shipping industry, this year has been a grand hangover after a bender in 2010.

|

|

|

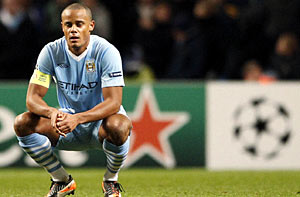

Straddle carriers move shipping containers at the Port of Brisbane in Australia. Weak demand, too many vessels and rising fuel costs are harming the shipping industry around the world, with many companies reporting losses.[Photo/Bloomberg] |

Industry data show that two-thirds of the world's shipping companies reported deficits. Meanwhile, shipyards fought for diminishing orders, and ports - while still making profits - were busy with further investments.

There are many causes of the industry's woes, especially the fragile global economic recovery.

High unemployment rates and a weak housing market have caused US consumers to tighten their purse strings.

European consumers have also watched their spending amid the region's debt crisis.

Even emerging economies cannot be relied on, as governments battle against surging inflation rates.

Weak demand, combined with an excess supply of vessels and rising fuel costs, worsened the situation.

Analysts said that too many vessels had been ordered during the optimistic years before the 2008 global downturn.

"The shipping industry as a whole has made a mistake by ordering too many vessels," said Nils Andersen, partner and group chief executive officer of the Copenhagen-based AP Moller-Maersk Group, the world's largest container ship operator by capacity.

As a consequence, freight rates were depressed. Container rates declined to about $500 each on the Asia-Europe route, the major route for world trade, less than half of the peak last year.

The Baltic Dry Index (BDI), a measure of shipping rates for bulk goods such as coal, iron ore and grain, peaked at 2,200 in October, having an average of about 1,600 for the year.

That's a far cry from the level of 12,000 that was reached in 2008.

Among the three large shipping sectors, containers and product tankers are more likely to recover, said Torben Skaanild, secretary-general and chief executive officer of the Baltic and International Maritime Council (BIMCO), the world's largest association of shipowners.

"The product tanker sector has left an excessive inflow of tonnage behind and container shipping is likely to see strong demand once the wheels start turning," he said.

For the BDI, "we foresee freight rates to hover around current levels throughout the remaining part of the year and well into 2012", Skaanild said.

Difficult market conditions were expected to persist "until 2014 or even longer", said Yudhishthir Khatau, BIMCO president and board chairman.

Amid a dull market, shipping lines ordered new fleets of larger vessels as a way to survive and become better competitors, especially with comparatively low vessel prices.

In February, Maersk Line, the container division of AP-Moller Maersk Group, ordered 20 of the largest-ever container carriers. Scheduled for delivery in 2013, the vessels are designed to carry 18,000 containers each.

The new ships would be deployed on the China-Europe route, and China's robust trade growth was expected to shore up the shipping business.

"China is the biggest container shipping market and it is very important for us. In a way, these new ships are specifically planned for China," said Soren Karas, vice-president of Maersk Line North Asia Region.

During the first 11 months of this year, China's total trade rose 23.6 percent year-on-year to $3.31 trillion. Exports surged 21.1 percent to $1.72 trillion while imports increased 26.4 percent to $1.59 trillion, data from the General Administration of Customs show.

"China needs to establish a larger domestic market in the future to cushion itself from external shocks like the current crisis. Until then, Chinese imports of dry bulk commodities remain vital to an oversupplied market," said Skaanild.

"But during the current crisis, China has stayed buoyant and provided strong world trade to the benefit of the shipping industry," he added.

Related Stories

Shaping up, shipping out 2011-10-21 09:02

Shaping up, shipping out 2011-10-21 09:02

Italian ship attacked by pirates off Somalia 2011-10-11 05:50

Crucial shipping hub 2011-09-16 08:03

COSCO reports H1 loss of $432 million 2011-08-27 09:33

More Chinese to travel overseas by cruise 2011-08-27 10:54

- US markets 'still attractive' for Chinese IPOs

- Anshan Steel in supply agreement with Maersk

- IPOs: Who vouches for the sponsors?

- China to maintain prudent monetary policy

- Lower taxes to aid economic growth

- China's housing prices to decline in 2012

- Foreign trade target 'arduous' next year

- Govt to act as export growth slows