InfoGraphic

More monthly deficits 'likely'

By Ding Qingfen (China Daily)

Updated: 2011-03-11 09:04

|

Large Medium Small |

Trade figures may reduce pressure for yuan appreciation, experts say

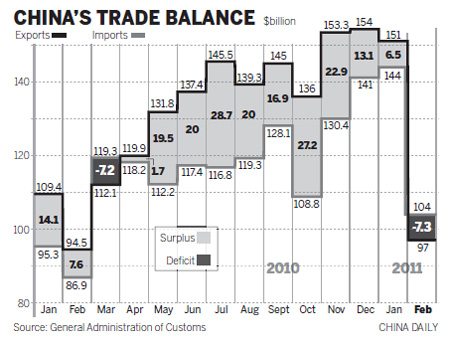

BEIJING - China is "highly likely" to see more trade deficits in the coming months after it reported a surprise February deficit, the biggest in 7 years, due to slowing overseas demand and rising commodity prices, economists said.

The General Administration of Customs (GAC) announced on Thursday a deficit of $7.3 billion in February, the first since last March's deficit of $7.2 billion.

The deficit, some economists believe, could help reduce pressure to appreciate the yuan.

"It is absolutely good news for China, at least in the short term, as calls by some countries for yuan appreciation are getting stronger," said Zhou Shijian, senior researcher at the Center for US-China Relations at Tsinghua University.

Exports grew 2.4 percent in February, from a year earlier, to $96.74 billion, while imports surged 19.4 percent to $104.04 billion.

The GAC cited the Spring Festival as a major factor, as many exporters ceased production during the holiday.

The February slump contrasted sharply with January, when exports grew by 37.7 percent and imports surged by 51 percent.

Song Hong, head of the section of international trade with the Chinese Academy of Social Sciences, attributed the deficit to the "sharp rise in commodity prices".

Meanwhile, exports of textiles, mechanical and electrical goods, a large section of the total exports, registered declines.

"The increasing cost of labor and raw materials, along with the rising yuan, are major concerns for exporters," said Ding Mingquan, president of Fujian Jinjiang Aojin Knitting & Garments Co Ltd.

"These combined factors have eroded up to 4 percent of our gross profit," he said. His swimsuit factory, in Jinjiang, Fujian province, exports nearly 95 percent of its products to European countries and the United States.

Wang Tao, head of China Economic Research with UBS Securities, said China's exports will bounce back in a few months before slowing down with decreasing demand for made-in-China goods.

"China's trade surplus will shrink this year, and in some months deficits will be registered as various commodity prices, including iron ore, grain and crude oil, increase," Song said.

During the first two months of this year, imports of iron ore jumped by 22.6 percent to 120 million tons and soybean imports grew by 6.1 percent to 7.45 million tons, year-on-year. But their prices, on average per ton, surged during this period by 62.6 percent for iron ore and 22.7 percent for soybean.

"As commodity prices rise, it is likely we will see more deficits in the months ahead," said Zhang Xiaoji, senior researcher with the Development Research Center of the State Council.

The Ministry of Commerce has set a target this year to expand imports and stabilize exports.

China's trade surplus decreased 34 percent to $196.1 billion in 2009, and last year, the surplus further fell by 6.4 percent, to $183.1 billion.

|

|||||||

Dong Xian'an, chief economist at Peking First Advisory, a private consultancy, predicted the trade deficit will last for "another two months, thanks to increased purchasing by the government of a wide range of goods, including high-tech equipment, aerospace and agricultural goods, since December."

"The monthly deficit makes it possible for China to slow its currency appreciation," said Dong.

Since June's foreign exchange rate reform, the yuan has gained 3.5 percent against the dollar. But some countries, including the US, continue to demand a faster rate of appreciation.

The US Treasury Secretary Timothy Geithner reiterated on March 3 that the yuan is "substantially undervalued", putting other countries at a competitive disadvantage.

Wang Ying and Zhou Siyu contributed to this story.

| 分享按钮 |