Top Biz News

Dreaming of their own homes

(chinadaily.com.cn)

Updated: 2010-02-26 15:31

|

Large Medium Small |

Editor's Note:

In China, young couples hope to live in a flat or a house of their own, as it is seen as a first step in starting a family. However, as housing prices in major cities soared in past years, this dream has become hard to fulfill.

For cooling the overheated housing market, the Chinese government has rolled out several measures since December 2009. They include building low-rent homes and affordable houses, raising down payments for second-home buyers and strengthening real estate project loan risk management. The central bank also raised the deposit reserve requirement ratio to limit liquidity.

Heeding the government's moves, commercial banks also tightened their mortgage loan policies. Most banks cut or even cancelled the discounts on interest of loans for first-home buyers.

In January of 2010, house trading volume in major cities has started to decline. Some homebuyers plan to wait and see. However, data shows housing prices still keeping firm, with a 9.5 percent increase in January. What's wrong with housing prices? While we are wondering whether the government's measures could curb rising home prices, experts say the property market still needs time to react, especially in terms of prices. How the policies were implemented is also important.

1. Do you have a plan to purchase a home in China?

2. Do you think government measures will cool down house prices sooner or later?

3. Do you think China will announce more policies to curb real estate bubbles during the upcoming two sessions?

4. Do you hope so?

5. What's your suggestion for cooling down home prices?

Take our survey

...................................................................................................

Crazy housing price! Where is my home?

Property prices skyrocketing

2010-01-15

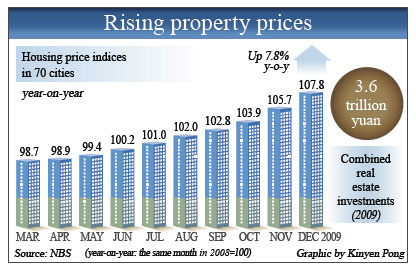

Property prices in China's 70 major cities climbed 7.8 percent in December from a year earlier, the fastest pace in 18 months, the National Development and Reform Commission (NDRC) said on Jan 14.

It is also the seventh consecutive price increase since July 2009, and the growth rate is 2.1 percentage points higher than November, according to the NDRC. Except for Tangshan in Hebei province, the other 69 cities all saw a year-on-year price increase for new properties, led by Guangzhou, Shenzhen, Haikou and Beijing. [Full Story]

Soaring house prices, headache for single Chinese

Looking up at a new building for sale, Jin Jian, a fitness trainer in Harbin, turned and left with a sigh.

With half of his 4,000-yuan monthly income spent on rent and living expenses, Jin needed to save for at least 20 years to own a 60-square-meter apartment in Harbin, the capital of northeast China's Heilongjiang Province.

Many Chinese born in the eighties, like Jin, are struggling as a consequence of the country's bullish property market. [Full Story]

Big cities small on happiness

Happiness runs lowest among China's most developed metropolises, including Beijing, Shanghai and Shenzhen, a survey showed, which also cited skyrocketing property price as a possible reason. [Full Story]

...................................................................................................

Govt efforts on controlling housing price

Tightening land purchase rules

2009-12-19

Five ministries, including the Ministry of Finance and the central bank, announced on Dec 17, 2009 a new policy that sets the down-payment requirement for land purchases at 50 percent of the total price.

In addition, property developers must make a full payment for land purchased from the government within one year of the sale agreement. Developers will not be allowed to buy additional land if they fail to meet the requirement. [Full Story]

Crackdown on land hoarding

The central government will crack down on the hoarding of undeveloped land in an effort to tackle rising property costs, officials from the Ministry of Land and Resources said.

Zhu Liuhua, the ministry's director of farmland protection, said local governments would be penalized if land is left idle two years after it was approved for use by the central government.[Full Story]

New rules on property market in 2010

2010-01-11

The General Office of the State Council, China's cabinet, issued a notice on Jan 10 that required central governmental departments and local governments to strengthen management, stabilize market expectations and facilitate stable and sound development of the real estate market.

It listed 11 specific measures which should be taken in five aspects -- increasing supply of low-cost houses for low-income families and common residential houses, encouraging reasonable house buying while restraining purchases for speculation and investment, strengthening real estate project loan risk management and market supervision, speeding up construction of housing projects for low-income households, and specifying responsibilities of local governments. [Full Story]

Top bidders stripped of land contracts

2010-02-02

The Beijing municipal government announced on Feb 1 that it has torn up a commercial residential land contract that set the record last year as the most expensive residential land in Beijing.

According to the official announcement, the municipal bureau withdrew the contract with Dalong estate after the agency failed to sign a State-owned land transfer contract within the agreed date, along with another land development compensation contract. The 200 million yuan of cash security would not be refunded. [Full Story]

Dalong is not alone. Authorities in the eastern city of Nanjing said on February 3 they had revoked the rights of two property developers to buy a residential plot they won at an auction two years ago. [Full Story]

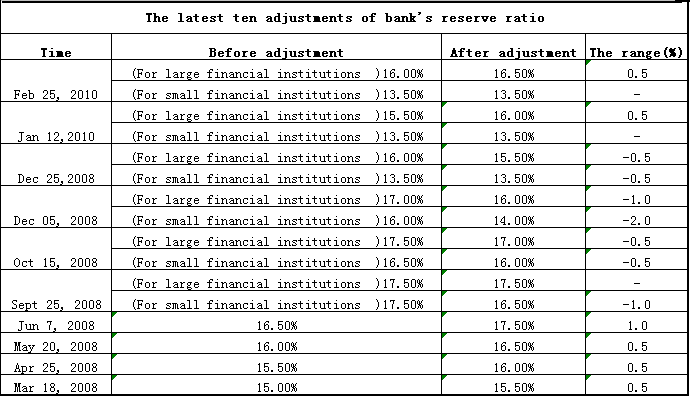

Bank reserve ratio raised to curb lending

The People's Bank of China, the country's central bank, announced on Feb 12 it will raise the deposit reserve requirement ratio for Chinese financial institutions by 0.5 percentage points from February 25 this year. The rise is the second for the deposit ratio this year. [Full Story]

The central bank on Jan 12 raised the reserve requirement ratio - the proportion of deposits that banks must hold in reserve - in a clear sign that it was determined to drain excessive liquidity in the market and curb lending. It was the first time that the central bank raised the ratio since June 2008.

The move is meant to stabilize loan growth but keep overall policy pro-growth, Reuters quoted a central bank official as saying. [Full Story]

Commercial banks reactions: Tighten mortgage loans

Lending curbs by banks to cool down fiery property mart

2010-01-26

Heeding the government's call to rein in runaway property prices, banks are looking to tighten lending by canceling mortgage interest-rate discounts to first-time buyers.

Major banks are expected to take the lead in this initiative, thereby setting a precedent for mortgage lenders in other cities, especially Shanghai, where the property market has been on the boil for the past six months. [Full Story]

Bank of China cuts discounts on mortgage rates

Bank of China, the nation's third largest lender by market value, said on Feb 3 that it has cut the discount on mortgage rates for individual borrowers to improve its loan structure.

The bank, however, did not say to what extent it intends to scale back the preferential interest rates, but said it would decide permissible rate levels based on the credit history of clients.

Reports indicate that the bank has cut the mortgage rate discount for first-home buyers to 15 percent from 30 percent and has suspended offering mortgage loans to buyers of second-hand homes through real estate agencies. [Full Story]

ICBC to curb property loans

2010-02-09

The Industrial and Commercial Bank of China said Feb 8 it would apply stricter approval rules to property lending this year as part of an effort to balance its loan structure and stem rising credit risks.

The world's largest bank by market capitalization will not issue new loans to developers who seek to speculate on rising property prices through "hoarding land" or "putting off home sales" and may also call back earlier credit to such borrowers, the lender said at its 2010 work conference. [Full Story]