Top Biz News

Mainland equities hit two-week high

(China Daily/Agencies)

Updated: 2009-12-08 08:00

Mainland stocks rose to a two-week high, led by developers and consumer-staple producers, after the government pledged to maintain a "moderately" loose monetary policy and Kweichow Moutai Co raised product prices.

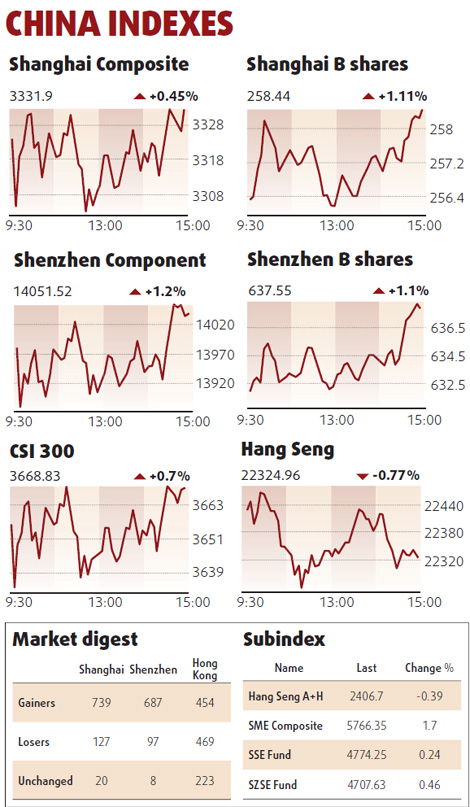

The Shanghai Composite Index rose 14.85, or 0.45 percent, to 3331.9 at the close, the highest since Nov 23. The gauge swung between gains and losses at least 15 times. The CSI 300 Index added 0.7 percent to 3668.83.

China Vanke Co, the nation's biggest listed property developer, climbed 2.7 percent to 12.29 yuan. Poly Real Estate, the No 2, advanced 2.2 percent to 26.09 yuan.

The government will ensure policy continuity, boost consumer spending and adjust growth models, said the annual central economic work conference between Dec 5 and yesterday in Beijing.

| ||||

Wuliangye Yibin Co, the second largest, climbed 2.4 percent to 29.65 yuan. Sichuan Swellfun Co, the Chinese liquor maker that's a partner of Diageo Plc, added 1.8 percent to 20.19 yuan.

"We like consumer stocks because the industry will get government support and deliver stable growth over the next few years," said Zhao Zifeng, who helps oversee about $10.2 billion at China International Fund Management Co in Shanghai.

Hang Seng falls

Hong Kong stocks fell, led by commodity producers on lower metal prices, while companies relying on exports declined after the Hong Kong SAR government said sales overseas were "very weak".

Hong Kong isn't likely to see a "V-shaped" rebound in exports, the government's chief economist Helen Chan said.

The Hang Seng Index fell 0.77 percent to close at 22324.96.

The gauge has surged 97 percent from this year's low on March 9.

It rose to an intra-day high for the year of 23099.57 on Nov 18. Shares on the gauge are priced at an average 17.6 times estimated profit, up from 10.6 times at the start of 2009, according to data compiled by Bloomberg.