Top Biz News

Shanghai copper futures inch up

(China Daily/agencies)

Updated: 2009-12-04 08:05

With the international impact of Dubai's shock debt announcement last week seemingly largely contained to the emirate and a handful of large creditors, investors were free to focus on the eighth straight decline in US job losses in November, and a bullish outlook by the Federal Reserve.

"The Dubai problem was not as bad as people had expected and that's a relief for the market," said Ciaran Moore at Halifax Investments in Sydney.

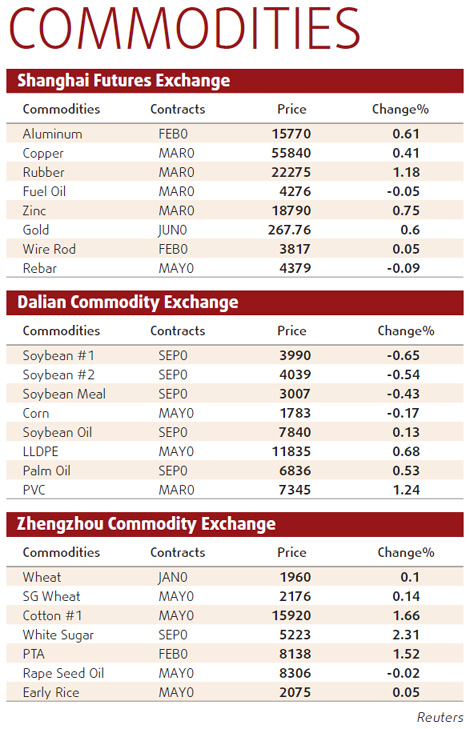

Shanghai's benchmark third-month copper rose 370 yuan to 55,680 yuan a ton at the close, after rising as high as 55,850 yuan, its best level since Sept 12, 2008.

The most active fourth-month hit a high of 56,170 yuan, also the loftiest since Sept 12 last year, before cutting gains to 55,930 yuan.

On the London Metal Exchange, three-month copper edged up $5 to $7,130 a ton by 0713 GMT. It touched a high of $7,160, near Wednesday's peak of $7,170, the best since late September 2008.

A softer dollar against a basket of currencies, which makes dollar-priced commodities cheaper for local currency holders, also worked in copper's favor.

The yen and the dollar fell yesterday after Bank of America said it would repay $45 billion of taxpayer bailout funds, boosting investor confidence and trimming safety bids in those currencies.

Copper has risen more than 130 percent this year, on track for its biggest annual increase since at least 1978. But it is still far off a record $8,940 struck in July last year, before the collapse of global markets in the last quarter.

| ||||

Chile, the world's biggest copper producer, expects copper prices to stay at "good levels" in coming months despite rising inventories, its mining minister said on Wednesday.

"Even though inventories are rising in the near term, the perception is that with the global economy on a recovery path, in two years' time you may well see some deficits in metals, especially copper," said a metals trader in Hong Kong.

"That's why prices now get to reflect some premium."

Copper stocks on LME warehouses stand at 443,000 tons, the highest since late April.