Top Biz News

Equities edge up on growth numbers

(China Daily/Agencies)

Updated: 2009-12-02 08:04

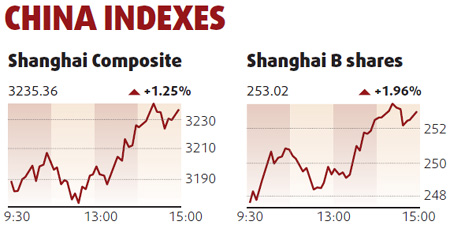

Mainland stocks rose for a second day, led by materials producers and retailers, after the nation's manufacturing grew at the fastest pace since April 2004 and the government said it will extend efforts to boost consumption.

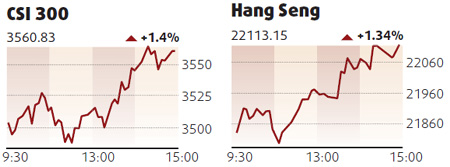

The Shanghai Composite Index rose 40.06, or 1.25 percent, to 3235.36 at the close. The gauge surged 3.2 percent on Monday after the government pledged to maintain stimulus policies next year. The CSI 300 Index added 1.4 percent to 3560.83.

"We are still confident that China's economy is on a solid track," said Nina Wu, who co-manages a $991-million Greater China fund at Hamon Asset Management Ltd.

"In the near term, we may still see some volatility in the market."

The purchasing managers' index (PMI) released yesterday by HSBC Holdings Plc rose to a seasonally adjusted 55.7 from 55.4. The government's PMI, also released yesterday, held at an 18-month high.

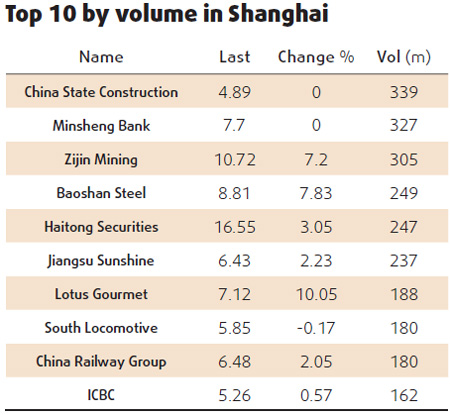

Baoshan Steel rallied 7.8 percent to 8.81 yuan. Angang Steel Co gained 3.8 percent to 14.92 yuan.

Anhui Conch, the biggest construction-materials producer, added 5.7 percent to 46.25 yuan. Tangshan Jidong Cement Co climbed 6.2 percent to 19.16 yuan.

Hang Seng rises

The Hang Seng Index climbed 1.34 percent to 22113.15 at the close, adding to 3.3 percent advance on Monday. The gauge tumbled 5.9 percent last week, the most since the week ended March 6, as Dubai World sought to delay repayment on some of its debt.

Shares in the benchmark Hang Seng Index trade at 17.4 times estimated earnings, up from 10.6 times at the beginning of the year, according to data compiled by Bloomberg.

The Hang Seng China Enterprises Index climbed 1.9 percent to 13229.36.