|

|

Dealers are cutting prices and offering incentives as retail sales began to slow in February, but had a limited affect as potential buyers wait for even bigger incentives. [China Daily] |

Average vehicle prices in the major cities, monitored by the National Development and Reform Committee, fell from February, but price cuts had a limited affect as potential buyers wait for even bigger incentives.

Dealers are expected to have difficult time in the second quarter.

But there are exceptions. The Tiguan, an SUV launched by Shanghai Volkswagen in March, is being sold at an average price 15 percent higher than the manufacturer's suggested retail price.

The "skimming" sales strategy - which raises the retail price of a model by limiting its supply - has been used by Honda with the CR-V for years and now Shanghai Volkswagen is trying to follow suit.

Though bringing bigger profits, it risks compromising brand perception and losing customers, particularly in the presence of some strong competitive models. Specifically the Hyundai iX35, which hit the market at the same time with a lower price, is projected to gain more market share than the Tiguan.

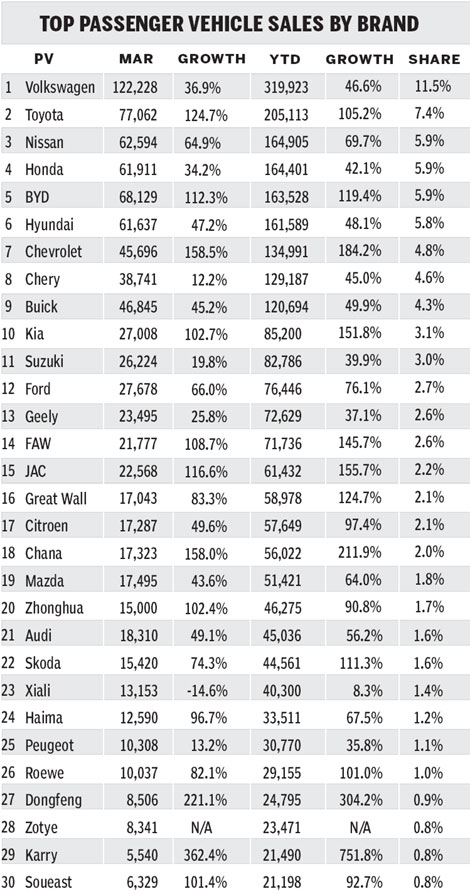

Korean brands

Korean brands have been developing rapidly of late, mainly due to their good market positioning and timely introduction of new global models.

Latecomers to a market dominated by German, US and Japanese players, Hyundai and Kia struggled in their first few years, underestimating the huge demand of the China market and not positioned well with aging models that were uncompetitive even at low prices.

The Korean brands adjusted their strategy by rolling out of a series of new models, including the Elantra Yuedong, Forte and Sportage.

|

|||||||

But there are still challenges ahead for Hyundai and Kia. A weak performance in the mid-size car segment is an important factor preventing them from improving their brand's perception. Hyundai hopes the next Sonata, which will probably be named the i40 in China, will attract more product buyers than price buyers.

The multiple generation strategy with more than one generation of a model on the market at the same time - such as the Elantra, Tuscon, the forthcoming new Accent and Sportage - clearly differentiates the customer groups, but leaves limited room for price incentives.

It also requires new products to be rolled out much faster to avoid a drop in market share when the old models are phased out.

Going forward, the price advantage of the Korean brands is expected to be much weaker, given the rapid growth of Chinese brands and the introduction of low-cost models by the US and Japanese players. But it does seem they have anticipated this, and are now hoping to compete more on quality and design, thus ensuring they remain firmly in the game.

The author is a senior market analyst at JD Power Consulting (Shanghai) Co Ltd

| Press Preview: April 23 - April 24 |

| Industry Preview: April 25 - April 26 |

| Public Show: April 27 - May 2 |

| Auto Components and Parts: April 23 - April 27 |

|

Venue for Passenger Cars and |

|

The New China International Exhibition Center |

|

Venue for Auto Components and Parts: |

Geely's Emgrand GE debuts at the Auto China 2010 in Beijing April 23, 2010. Emgrand is a sub brand of China's Geely.

Lamborghini Murcielago LP 670-4 Superveloce at the 2010 Beijing International Automotive Exhibition in Beijing on April 24, 2010.