Money

Chinese stocks decline to hit six-week low

By Irene Shen (China Daily)

Updated: 2010-11-24 09:48

|

Large Medium Small |

SHANGHAI - China's stocks fell, with the benchmark index dropping to a six-week low, on concern the government will intensify steps to tame inflation.

Indexes tracking materials and energy producers slumped more than 2 percent after People's Daily said the government should intervene in prices where necessary.

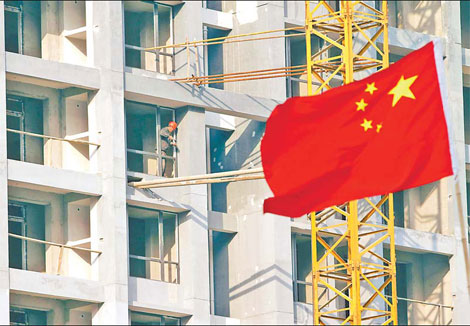

Poly Real Estate Group Co retreated 2.61 percent after Credit Suisse Group AG said property companies will underperform on lower home prices and volumes.

The Shanghai Composite Index fell 1.94 percent to 2828.28 on Tuesday, the lowest since Oct 11.

The gauge has lost more than 10 percent since reaching an almost seven-month high on Nov 8 on concern that accelerated monetary tightening will crimp economic growth. The CSI 300 Index retreated 2.04 percent to 3107.18.

Agricultural Bank of China Ltd fell 1.13 percent as the benchmark money-market rate rose on speculation policymakers will boost borrowing costs. China Construction Bank Corp fell 1.5 percent, the sixth decline in seven days. Policymakers four days ago boosted the amount of money that lenders must set aside for the fifth time this year.

Jiangxi Copper Co fell 5.34 percent on Tuesday. Aluminum Corp of China dropped 4.14 percent.

Accelerating food inflation in China may be the "worst enemy" of metal prices because it will encourage the government to increase interest rates, slowing industrial production growth, Citigroup Inc said in a report.

| |||||||

"When food prices rise 10 to 15 percent every year, it does. For them, the 'supper-cycle' is a lot closer to home than the 'super-cycle'. "

Energy producers retreated 2.2 percent on the CSI 300. PetroChina Co slid 2.86 percent, the biggest contributor to losses on the Shanghai Composite and closed at its lowest close since Oct 11. China Shenhua Energy Co fell 2.25 percent on Tuesday.

"The market will seek support at a lower level in the short term as we are in the midst of very severe tightening," Luo Jianhui, a fund manager at China International Fund Management Co, said at a briefing on Tuesday. "China's economy may bottom out in the second quarter next year."

Poly Real Estate declined 2.61 percent, capping a 31 percent plunge this year. China Vanke Co sank 2.1 percent on Tuesday, the lowest close since Sept 29.

In addition to expected declines in property prices, government controls on trust financing for developers will further squeeze their balance sheets in the "next few months", Credit Suisse analysts led by Jinsong Du said in a report.

Government lending restrictions have helped drag the Shanghai Composite down 14 percent this year after surging 80 percent in 2009.

Policymakers suspended mortgages for third home purchases and pledged to speed up trials of property taxes to curb gains in housing prices.

Bloomberg News