Economy

Wen: Don't blame yuan for deficit

By Wu Jiao, Qin Jize and Cheng Guangjin (China Daily)

Updated: 2010-09-24 09:17

|

Large Medium Small |

|

|

|

Premier Wen Jiabao and UN Secretary-General Ban Ki-moon attend a ceremony on Wednesday to launch a $40-billion global strategy to save the lives of 16 million women and children during the next five years as part of efforts to reduce global poverty, hunger and disease. [Xinhua]

|

Premier urges US to lift restrictions on exports; says business ties linked

NEW YORK - The value of China's currency is not the main reason for the United States' trade deficit with China or its high rate of unemployment, Premier Wen Jiabao said in advance of a meeting with US President Barack Obama.

Wen repeated his stance on several occasions during his trip to New York against the backdrop of the trade issue growing into a major political dispute between the two nations.

While meeting 21 high-profile representatives from academia and the business and financial sectors on Wednesday, Wen said Beijing and Washington should take a positive attitude when discussing large-scale fiscal and trade cooperation on the basis of equality, mutual trust and mutual benefit.

Wen made the remarks after some US politicians claimed China's currency had been intentionally undervalued to bolster the country's exports.

Some US lawmakers are pushing for a bill that will punish China if Beijing does not do more to allow the yuan to rise.

Obama said on Monday that China had not done enough to raise the value of the yuan and claimed that the currency "is valued lower than market conditions would say it should be".

Yet Wen said China has never pursued a surplus in trade and is not ready for a drastic yuan re-evaluation.

He added that a 20 percent appreciation of the yuan - something being demanded by some US lawmakers - would cause many bankruptcies in the Chinese export sector, where firms operate on thin margins.

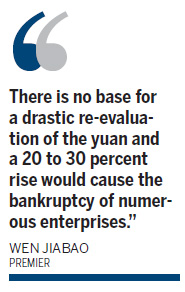

"There is no base for a drastic re-evaluation of the yuan and a 20 to 30 percent rise would cause the bankruptcy of numerous enterprises and severe unemployment. Many migrant workers would have to return to the countryside. China would suffer major social upheaval," Wen said at an evening banquet on Wednesday.

According to Wen, China's trade surplus dropped by 34 percent in 2009 from the 2008 level and was down 42.5 percent during the first half of 2010 on a year-on-year basis.

Wen called on the US to lift restrictions on the sale of certain goods to China in a bid to promote trade.

The Chinese government is also committed to boosting domestic consumption to help rebalance trade, he added.

Wen also explained that the high jobless rate in the United States is not the fault of China's trade surplus.

China's exports are largely comprised of labor-intensive and low value-added manufacturing items. He said the US has not produced such products for a long time, so the fact that China is producing them now should have no impact on US unemployment.

"If the US doesn't import them from China, it will import them from somewhere else," he said.

Wen called for improved ties between China and the US, saying that business interests in both countries were "inextricably connected".

Stephen Roach, president of Mogan Stanley Asia and a professor at Yale, agreed that pressing China to raise the value of its currency will not solve the trade imbalance. Instead, he suggested that China introduce positive domestic consumption policies and expand its social security network.

|

||||

"The US itself invests and consumes much more than it produces," said Chen Baosen, a researcher with the Institute of American Studies at the Chinese Academy of Social Sciences. "As long as it demands more than it supplies, it needs to import and borrow money from other countries."

Chen said the situation in the US is being made worse by the fact that it has placed so many restrictions on its exports to China of such things as high-tech products.

"These are what we need greatly and in large quantities but the US refuses to export them to us because of political distrust," Chen said. "So, other countries, like those in Europe, have filled the gap and export them to China instead.

"The Obama administration is using the trade deficit as a card to play in winning the upcoming mid-term election and to press China on certain bilateral issues."

Niu Xinchun, a US studies specialist at the China Institutes of Contemporary International Relations, agreed and said the US government is unlikely to take tough measures against China on the yuan issue because such a move will harm both countries' economies.