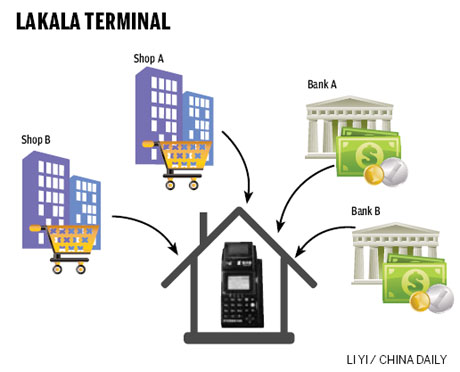

InfoGraphic

No more lining up to pay bills?

By Chen Limin (China Daily)

Updated: 2010-05-28 09:15

|

Large Medium Small |

|

|

|

An employee in a convenience store in Suzhou, Jiangsu province, demonstrates how to use a Lakala terminal. [China Daily] |

New home-based technology may make queuing a thing of the past

BEIJING: Forget lining up at banks, the phone company or other retail outlets to pay your bills. In China, the future of paying your bills easily from the comfort of your own home may well have arrived.

Enter the Mini Lakala home payment machine.

The Mini Lakala uses a basic phone line to connect to Beijing Lakala Billing Service Co Ltd (Lakala) and retails for a one-time fee of 399 yuan.

The Mini Lakala is the brainchild of 41-year-old entrepreneur Sun Taoran, founder of Lakala, China's largest offline e-payment service company.

Started in the year of 2005, the company is often referred to as an offline version of Alipay, China's leading online payment service both by user and total transaction volume.

Alipay enables individuals and businesses to securely, easily and quickly send and receive payments online.

Lakala's Sun believes his company product is the future.

"We are providing a better e-commerce experience," he said.

Many people steer clear of online shopping because they are not used to the complicated process of making payments online, including applying for a bank card, registering an Alipay account and topping up the account with cash. But with Lakala the whole process has been shortened considerably.

For those not keen on having a Mini Lakala at home, Lakala also offers store-based payment terminals, where a simple debit card can be used to pay all types of bills.

Sun came up with the idea after seeing the quick development of the bank card business, yet the average user didn't find it easier to complete related services in banks. Hindrances included few bank branches and long queues.

Sun, an entrepreneur now running his third company, thought that a machine that enabled users to complete different financial services right in their home could resolve many of the headaches credit card users face.

Lakala terminals are for the most part located in convenience stores and supermarkets. The company has now over 40,000 terminals across 88 cities.

"We hope that people can complete related services within a hundred steps (of their homes) with Lakala," said Sun, adding that the company is going to more than double its terminals by 2012.

The company, which is venture capital-funded, generates its revenues from service fees charged to payment receivers, such as banks, telecom carriers and e-business sellers.

In April, about 6 million transactions were made on the terminals, a month-on-month increase of 10 percent, Sun said

He hopes to break even next quarter.

According to domestic research firm Analysys International, China's offline payment market reached 110 billion yuan ($16.1 billion) last year, a year-on-year increase of 547 percent.

"The market is on a fast track to growth at the moment with more payment terminals quickly spreading to second- and third-tier cities," said Analysys' Cao Yu.

Lakala had a 63.7 percent share of the market in the first quarter of this year, while the remainder was shared by regional rivals, such as different subsidiaries of inter-bank credit card organization China UnionPay Co Ltd, which took up 15.4 percent.

UnionPay helps to settle payments among different banks and all payments done through Lakala go through the UnionPay system before reaching specific banks.

While Lakala is a leading player in the market, it is not without challengers.

Analysts said that UnionPay might grab a larger share of the market with its resources in the financial services sector, even though its subsidiaries are regional and lack the market scale of Lakala.

Sun said the two cooperate more than they compete, but his firm is headed in different directions to further boost its market share. "We have to be more than a simple payment tool, but one that can create business deals."

The company is upgrading its terminals, which have more services, in convenience stores in order to invite more people pay on the spot with a Lakala terminal.