Top Biz News

Supply concerns lift copper prices

(China Daily)

Updated: 2009-12-25 08:02

|

Large Medium Small |

Smelters are caving into demands for lower treatment charges from miners - Japanese and Chinese copper smelters have agreed to a 38 percent cut in 2010 fees with Freeport-McMoRan - illustrating that the market for concentrate is looking tight.

That tightness could be exacerbated if miners at one of the world's biggest copper mines, Codelco's Chuquicamata in Chile, reject a final pay deal. Earlier this week, unions voted down an initial offer.

Negotiations will resume and a vote on a final offer is expected before the contract expires on Dec 31. If rejected, a strike could come as early as the first week of January.

However, labor disputes in Chile are usually brief affairs, and a strike at Chuquicamata would have to last a considerable time to eat into copper stockpiles held by Codelco and on the London Metal Exchange (LME).

"This is end-of-year optimism confronting fundamentals and it's the optimism that is carrying the day," Jonathan Barratt, managing director of Commodity Broking Services, said.

"I worry that stimulus packages are rolling off. Inventories don't seem to be falling and I am worried about property markets and sovereign debt - we are watching those as a pre-indicator for a fall in copper."

But on the last day of trading before Western markets close for Christmas, investors said "Bah-humbug" to worries about demand in 2010.

| ||||

Three-month copper on the LME rallied $110 to $7,110 a ton in early trade, off a 15-month peak of $7,170 struck early in December.

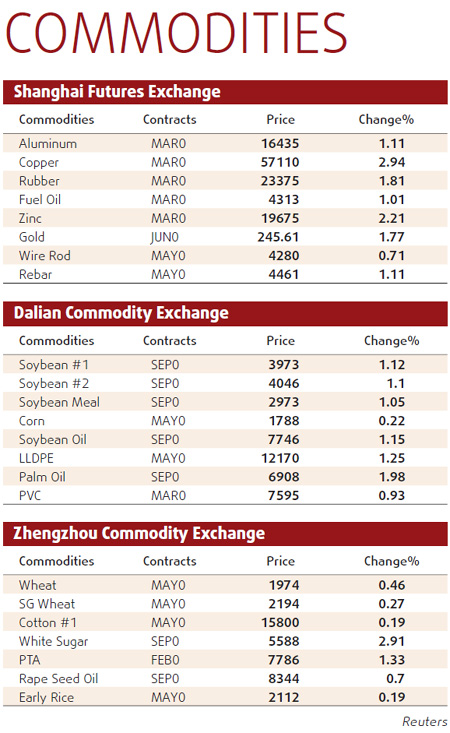

Shanghai's benchmark third-month copper futures contract ended up 2.7 percent, its biggest one-day rise in three months, at 57,110 yuan ($8,363) a ton.

It hit a peak of 57,150 yuan earlier in the day, the highest since early September last year.

While the LME is shut today and Monday, Shanghai will keep trading.

"Copper prices have been consolidating around the current levels for a while now. If LME can break above the key resistance at $7,200, we may see a serious rally," said Zhu Yanzhong, an analyst at Jinrui Futures.