Top Biz News

Markets bet on climbing yuan

(China Daily/Agencies)

Updated: 2009-11-18 07:58

Outside pressure has been building on the Chinese authorities to let the yuan rise after more than a year of it being nearly frozen in place against the weakened dollar, with the head of the International Monetary Fund the latest to weigh in.

Obama has promised to raise the issue of the yuan's exchange rate during his talks in Beijing this week, putting the spotlight on a major bone of contention, which has the potential to shake currency markets and diplomatic ties alike.

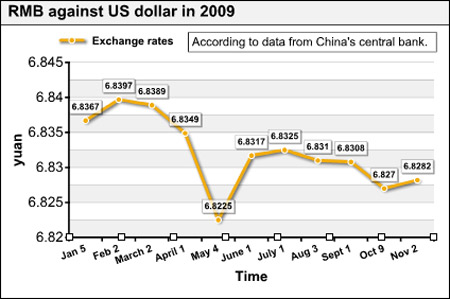

Twelve-month yuan rise implied by benchmark one-year dollar/yuan non-deliverable forwards (NDFs) remained high at 3.38 percent measured from the Chinese central bank's daily mid-point of 6.8272, though down from 3.76 percent implied at Friday's close.

The one-year NDFs were quoted at 6.6040 bid late on Monday compared with Friday's close of 6.5800.

"With Obama in China this week, the markets are speculating that China may have 'presents' for him. That has caused a little bit of flurry in the yuan options market," said a dealer in Singapore.

Market expectations for yuan appreciation have steadily increased since early September, when investors priced in less than 1 percent gains against the dollar in the next 12 months.

Bets on the yuan's rise propped up other Asian currencies, suggesting authorities in the region would be less worried about their exporters losing out to Chinese rivals.

China's Ministry of Commerce on Monday rejected calls for the yuan to appreciate.

The tone of Yao's comments seem contrasted with a Chinese central bank statement last week.

War of words

China's central bank last week tweaked its description of how it manages the currency, sparking speculation that it might be willing to give the yuan some room to run.

Over the weekend, Sino-US discord surfaced at a summit of the Asia Pacific Economic Cooperation (APEC) forum in Singapore when a reference to "market-oriented exchange rates" was cut from a communique issued at the end of two days of talks. An APEC delegation official said Washington and Beijing could not agree on the wording.

"It's a misunderstanding to believe that yuan policy will be decided mainly by a war of words between China and its trade partners, including the US," said a US bank dealer trading in the Chinese market.

"The prospects of yuan appreciation will mainly be decided by China's economic reality," he said. "If China's exports recover decently and global commodity prices continue to rise to threaten China with imported inflation, China will allow the yuan to appreciate anyway - with or without currency disputes."

The dealer and several others said they maintained their forecast for the yuan to resume slow but steady climb early next year - at an annual rate of around 6 percent, though it was possible the yuan might be held steady for the rest of this year.

Across the region, dollar selling in rupee NDFs continued on Monday in India and also spilled into the spot market, with dealers citing the weak dollar and continued expectations of yuan appreciation.

In South Korea, the won touched a fresh near 14-month high against the dollar as dealers said investors believed the currency dispute between China and the US might continue supporting Asian currencies.