|

BIZCHINA> Money Market

|

|

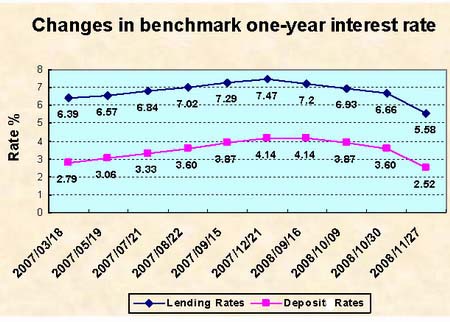

China slashes interest rate by 1.08 percentage points to boost growth

By Xin Zhiming (China Daily)

Updated: 2008-11-26 16:52  It has also cut the proportion of money commercial bank must hold in reserves by 1 percentage point for big banks and 2 percentage points for smaller ones. The central bank said in a statement the move is aimed to "bring out the role of monetary policy in supporting economic growth". It was the fourth cut this year, as the economy slowed to 9 percent in the third quarter of this year, against 11.9 percent for last year. The move sends a strong signal that the central policymakers have reached a consensus on adopting forceful policies to prevent any economic hard-landing, analysts said.  (For more biz stories, please visit Industries)

|