Investment is a two-way street

Updated: 2011-12-09 08:10

By Fu Jing (China Daily)

|

|||||||||||

Worldwide, China has made more than $300 billion worth of non-financial investments overseas by the end of 2010, setting up more than 16,000 business establishments in 178 countries and regions with total assets topping $1 trillion, according to the Ministry of Commerce.

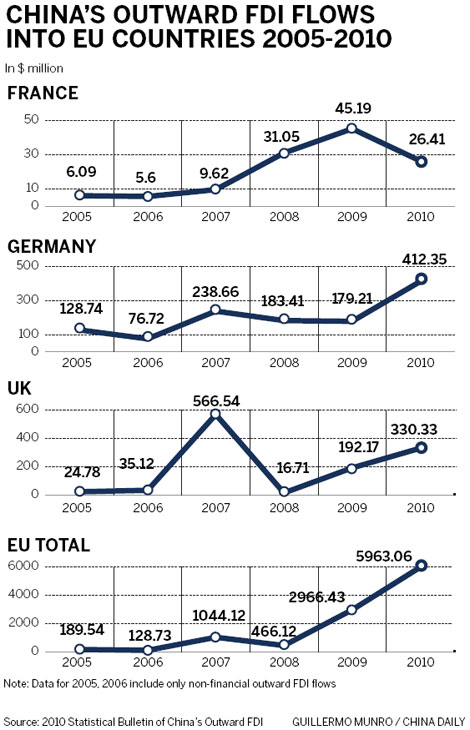

China has started to invest more actively in Europe. By the end of 2010, nearly 1,600 Chinese businesses were making direct investments in Europe with a total portfolio of $12.5 billion, according to the Ministry of Commerce.

The investments have covered a wide range of sectors, including manufacturing, finance, commercial services, retail, wholesale and leasing. Chinese investment can now be found in all 27 EU member states.

Song Zhe, the Chinese ambassador to the EU, said while growing investment in Europe generates revenue for Chinese companies, Europe also benefits from this growth.

Many European companies have been reinvigorated through mergers, acquisitions and restructuring. Take Geely's acquisition of Volvo. Under its new global development strategy, Volvo has managed to refurbish its brand by inheriting high-quality manufacturing and advanced safety technology.

At the same time, by setting up production and R&D centers in China, the company is successfully lowering its supply costs and increasing competitiveness and market share. "Volvo's production base in Belgium's Ghent is very busy meeting sales demand," Song said.

Furthermore, Chinese investment generates new jobs in Europe. By the end of 2010, Chinese companies had employed 37,700 European workers. China National BlueStar, a subsidiary of ChemChina, employs nearly 3,000 employees in its three branches in France and the United Kingdom.

During this period of financial crisis, Chinese investment also offers some relief for Europe's struggling economies, Song said. For instance, although the China Ocean Shipping (Group) Company (COSCO) faced some difficulties during the financial crisis, it did not give up on its project at the Piraeus container port in Greece, providing hope to the Greek shipping industry during its toughest time.

Despite the rapid expansion of Chinese companies investing overseas, the country is still new to this area and needs to learn and develop through experience.

Song said many Chinese companies at the lower end of the value chain lack transnational operational experience or qualified administrative personnel to properly handle cross-cultural barriers and overseas business risks.

He urged the European side to facilitate a smooth flow of Chinese investment. "In Europe, the sovereign debt crisis is laying out a breeding ground for protectionism," he said.

Song also said inconsistencies in laws and policies among some member states had made the gaining of visas, work permits and residency permits more complex. In addition, some Europeans still view China with suspicion and propose background investigations into Chinese investment simply because of groundless suspicion or uncertainty.

Recently, European authorities have blocked several cases of Chinese investment. This has left many Chinese business people with the impression that the European investment environment is deteriorating, causing them to postpone or even cancel plans to invest there.

"Actions like this from the European side could seriously obstruct investment flow from China," Song warned. "This is not the scenario we want to see."

Related Stories

Role of WTO key to EU and China 2011-12-09 08:10

Leaders of China, EU urge better relations 2011-11-30 08:15

China surpasses US as EU's top trade partner: MOC 2011-10-16 16:46

EU, China should look beyond trade irritants 2011-09-17 15:34

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%