Hainan expands tax incentives for top talent

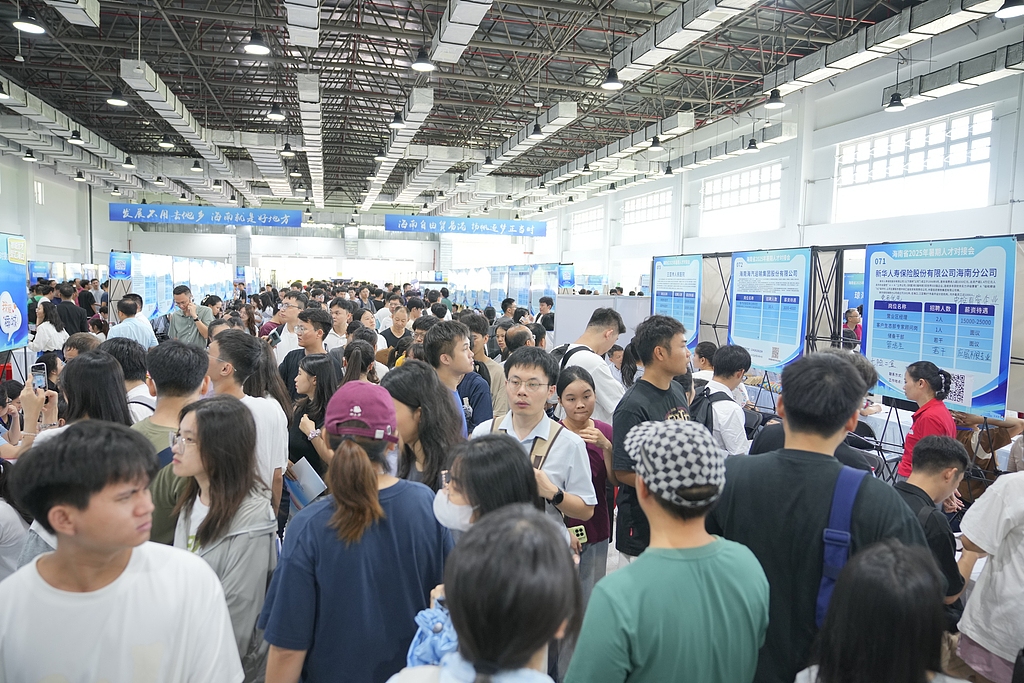

Hainan province has updated its income tax policy for high-end and in-demand talent to boost participation in the island's Free Trade Port construction, provincial authorities said on Tuesday.

Between its launch in 2020 and the end of 2024, the 15 percent tax cap drew 930,000 professionals, of whom 39,000 have benefited thus far, according to Liao Zengliang, deputy director of the CPC Hainan Provincial Committee's reform office. The policy has particularly boosted modern services and high-tech industries.

The Ministry of Finance and the State Tax Administration extended the policy through 2027 in January.

The updated rules address operational challenges while tightening oversight, explained Zhou Zheng, deputy director of Hainan's Department of Finance.

"Talent may now count 'reasonable' off-island work trips, vacations, and training toward the required 183-day annual stay but must physically reside in Hainan for at least 90 days," said Zhou. "The change accommodates businesses reliant on China's mainland or global markets, especially after the island-wide special customs operations taking place on Dec 18."

The policy now includes aerospace, shipping, and offshore oil exploration, Zhou added.

Application processes remain streamlined, with most approvals automated via tax agency systems, said Zhao Wei of the Hainan Human Resources Bureau.

The tax department uses SMS, app alerts, and hotlines to guide applicants, said Chen Jie, deputy chief of Hainan's tax bureau.

The update aims to balance talent attraction with risk control as Hainan prepares for greater post-special customs operations openness, officials said. Supporting guidelines and outreach campaigns will follow to maximize policy impact.

- Xizang city transforms into conservation model

- Hainan expands tax incentives for top talent

- School canteen staff jailed for meat theft in Sichuan

- Zhangjiajie hosts daring slackline competition

- Summer wellness tourism flourishes in Yichun, Northeast China

- Thailand extradites man who illegally collected public deposits in China