Experts: French fast fashion bill counterproductive

The approval of a recent bill by France's lower house of Parliament that seeks to penalize fast fashion companies is a blatant attempt at anti-globalization and will eventually harm the interests of its own consumers as well as a highly globalized industry, experts said on Monday.

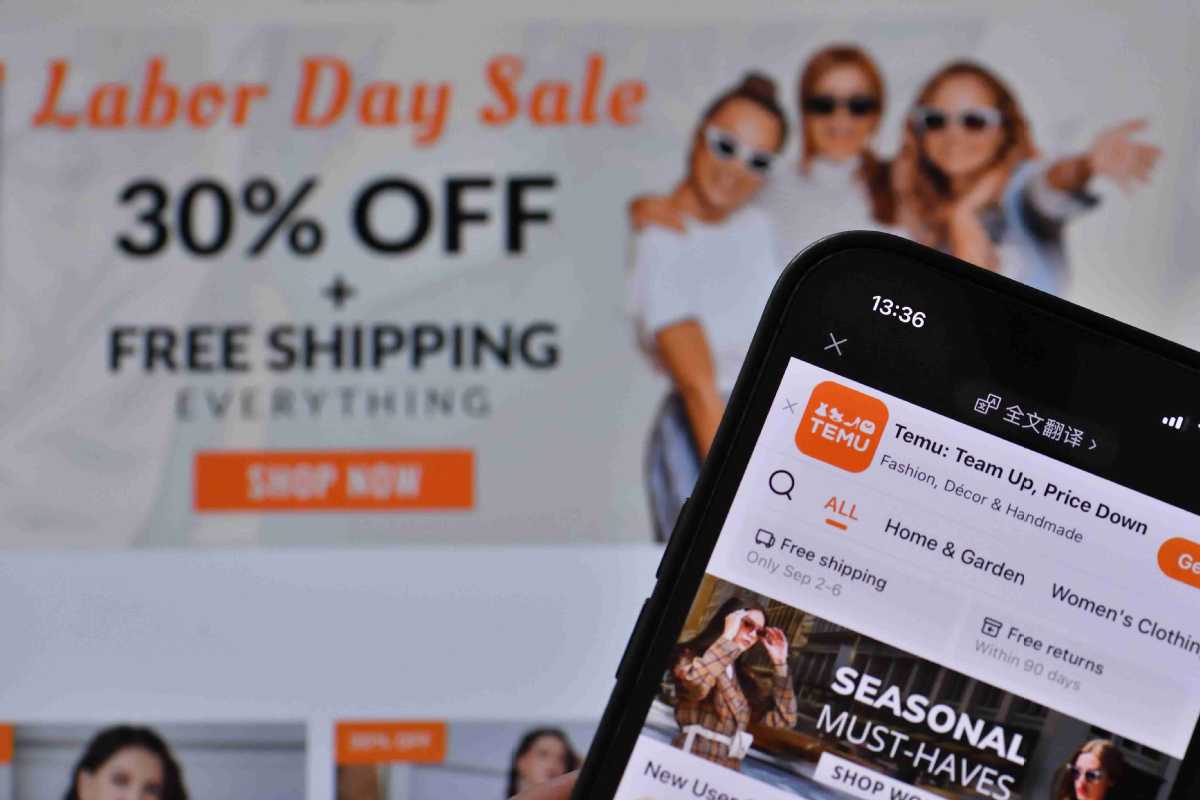

The comments came after French lawmakers last month approved the proposal that will slap penalties on products sold by fast fashion companies, including China's Shein and Temu, to offset a so-called environmental impact.

The bill will see incremental fines of up to 10 euros ($10.83) attached to each such garment by 2030, as well as a ban on the advertising of such products. The bill needs to be submitted to the Senate for approval before it is officially passed.

"The bill is more like a crackdown on China's fast fashion industry as well as supply chain that have risen rapidly and are attracting attention," said Wang Peng, a researcher at the Beijing Academy of Social sciences.

Wang said China has made great strides in recent years and built a resilient, agile and efficient supply chain that makes products which are more diverse, cost-effective and quick to market.

"Scaling up orders based on demand thanks to ultra-flexible supply chains has driven the popularity of fashion retailers Shein and Temu in many markets," he said.

"The bill is to leverage power to intervene in the fast fashion sector that is highly globalized and based on market dynamics. It will hurt the interests of its own consumers and industries," he added.

China has maintained its position as a leading supplier of garments to France for years and has quickly risen to outpace European stalwarts like H&M, Primark and Zara by appealing to fashion-conscious consumers.

George Yip, emeritus professor at Imperial College London and distinguished visiting professor at Northeastern University in Boston, said in an earlier interview with China Daily that the development is "inevitable" because the essence of fast fashion is to see what the trend is, respond to it quickly in terms of manufacturing and getting the distribution out.

Audrey Millet, an expert on French fashion history and a scholar at the University of Oslo in Norway, said in a media interview that the bill comes ahead of elections to the European Parliament and is contrary to the WTO principles of free competition and free trade.

"Ultimately, the fines imposed on brands will end up being borne by consumers, because brands will have to raise prices to pay for fines, but consumers should not be the ones penalized to fund environmental and societal causes," Millet said.

Market consultancy Boston Consulting Group said in a report that agile supply chains can enable fashion companies to balance supply and demand, thereby reducing inventory costs, improving capital efficiency, increasing revenue, and sharing benefits with customers by reducing product prices.

Shein said in a statement that unlike traditional garment manufacturing practices still employed by other companies, its flexible, on-demand supply model is able to greatly reduce the issue of inventory wastage because each product is produced and tested in small batches of only 100 to 200 pieces.

This on-demand, agile supply chain has kept the company's unsold inventory levels in the low single digits, compared to 40 percent for traditional businesses, the company said.

While the current narrative would have consumers believe that China is the exclusive winner in this commerce, the reality is that it is two-way and symbiotic, industry experts added.

This year marks the 60th anniversary of the establishment of diplomatic relations between China and France.

While products from China’s clothing and textile supply chain are rapidly gaining in popularity in European markets such as France, market consultancy Daxue Consulting said that the sales of French branded goods, perfumes, cosmetics and other luxury fashion brands and products are also rising in China.

For instance, China stands as a major market for French cosmetics, ranking third after Europe and the United States in terms of export. In 2022, the total value of French cosmetics exports to China reached $1.8 billion, with China being the largest lipstick market for France, it said.

chengyu@chinadaily.com.cn